EUR, USD, JPY, CHF, AUD, NOK flows: USD remains under pressure, risk steadier for now

USD still under pressure, risk sentiment stabilising but danger of renewed weakness

Markets are showing greater stability overnight with a modest recovery in equities and a small decline in US yields, helped by the pause on tech tariffs announced at the weekend. However, U.S. Commerce Secretary Howard Lutnick said on Sunday that smartphones, computers and some other electronics, just exempted from steep tariffs on imports from China, would face separate new duties along with semiconductors within the next two months. The stability therefore to some extent reflects uncertainty, and seems unlikely to lead in a sustained recovery in risk appetite.

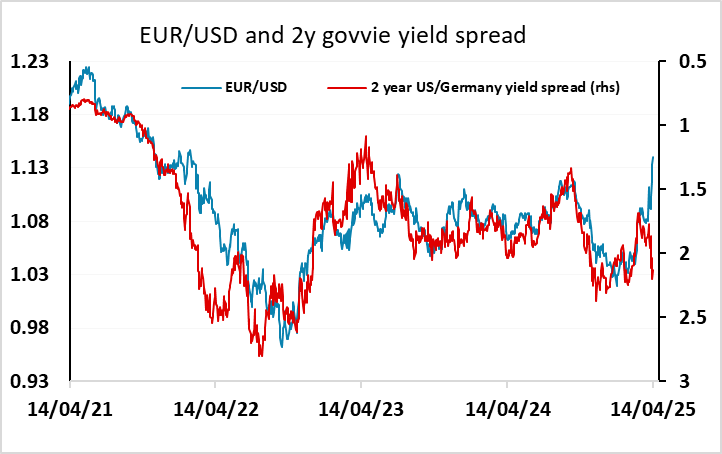

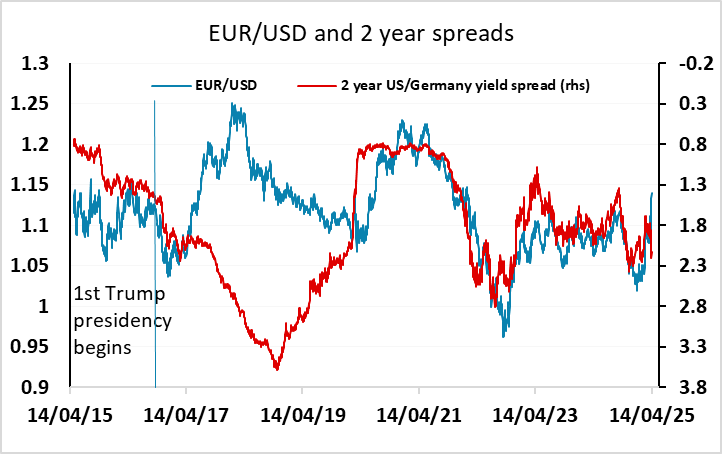

While risk sentiment has stabilised for now, the USD remains under pressure, with a very clear divergence from the correlation with yield spreads that has dominated the EUR/USD market landscape over the last few years. This break echoes Trump’s first term, which saw the USD decline sharply in the first half of his presidency, despite yield spread movements in its favour. There is therefore still scope for more USD weakness if policy uncertainty continues and confidence in the US remains fragile.

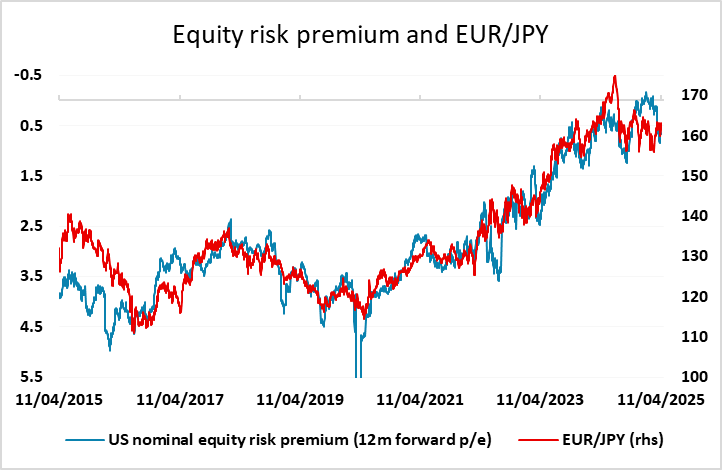

The stabilisation in risk sentiment has allowed a recovery in the AUD and CAD, but the strength of the CHF is so far undimmed as is the weakness of the NOK. CHF/NOK broke to all time highs on Friday and has so far retraced only modestly from that level. If we see a further calming in the markets and a decline in volatility there should be scope for the NOK to recover further, while other risk sensitive pairs like EUR/GBP may also see some decline. However, any recovery is likely to be slow and cautious. There is still nervousness about policy announcements, and despite the apparent stabilisation in equities, we suspect it will be hard for equities to hold current levels unless US yields fall back. Implied equity risk premia have fallen back on the rise in yields, and look too low given the uncertainties of the situation.