CBRT Lifts End-Year Inflation Forecast to 38%

Bottom Line: Central Bank of Turkiye (CBRT) released the second quarterly inflation report of the year on May 9, and lifted end-year inflation prediction from 36% to 38% citing that the rebalancing process for demand will be more delayed compared to what was projected that in the first inflation report in 2024. According to the report, the disinflation process, which is expected to start in June, is projected to continue with a stronger pace in H2 2024. We feel upside risks remain strong which would likely continue drive the inflation in H1 of 2024. We foresee favourable base effects, additional macro prudential measures and tightened monetary and fiscal policies will likely start relieving the pressure on the inflation, likely after July.

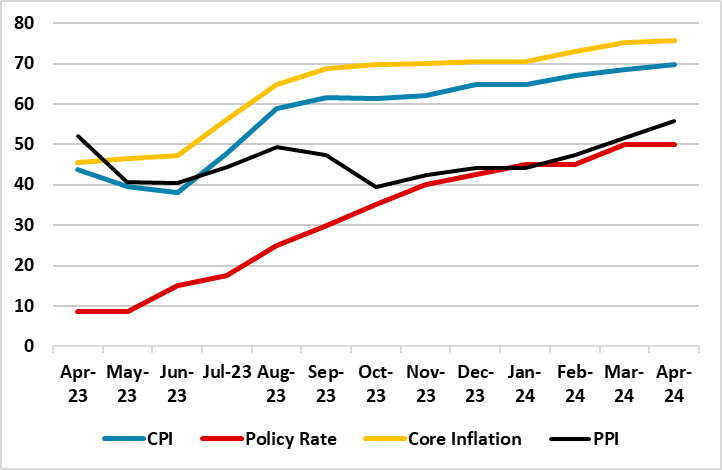

Figure 1: CPI, PPI, Core Inflation (YoY, % Change) and Policy Rate (%), April 2023 – April 2024

Source: Continuum Economics

CBRT released the second quarterly inflation report of the year on May 9 (here), and increased its year-end inflation forecast to 38% from 36%. CBRT’s forecast for end-2025 remained unchanged at 14%, while inflation is seen falling to 9% by the end of 2026.

CBRT Governor Karahan stated on May 9 that annual inflation - which climbed to 69.8% in April - will peak this month at 75-76%, while disinflation trend is expected to start in June. Karahan added that CBRT would do whatever it takes to avoid any lasting deterioration in inflation as it maintains a tight monetary policy stance.

According to the mentioned report, indicators for Q1 2024 pointed to a strong course in domestic demand, while leading indicators for April suggested that domestic demand is not as strong as in the first quarter. The disinflation process, which is expected to start in June, is projected to continue with a stronger pace in H2 2024, said the report. The report highlighted that the improvement in the current account balance gained momentum in Q1 due to the narrowing of the foreign trade deficit and the strong outlook for the services balance.

We are of the view that there are strong signs that inflation will continue to stay high in the first half of 2024, as partly proved by the April CPI data. Despite aggressive monetary tightening, lagged impacts of the tightening cycle are still feeding through and we still see upside risks to the inflation outlook. We think hikes in salaries, stickiness in services inflation, high domestic demand, deterioration in pricing behaviour, geopolitical risks, strong inflation expectations and surges in public spending during the local elections continue to ignite general level of prices.

We think CBRT would have to closely watch the upcoming inflation figures in May and June before favourable base effects, additional macro prudential measures and tightened monetary and fiscal policies will likely start relieving the pressure on the inflation from mid-year.