China Equities: A Tactical Play

China equities can see a tactical bounce of 5-10% in the coming months. Cheap valuations and underweight global fund positions means that the scale of pessimism only has to get less bad on the economy and China authorities attitude towards businesses. While we see a tactical opportunity, we do not see a strategic opportunity into 2025 given cyclical and structural headwinds.

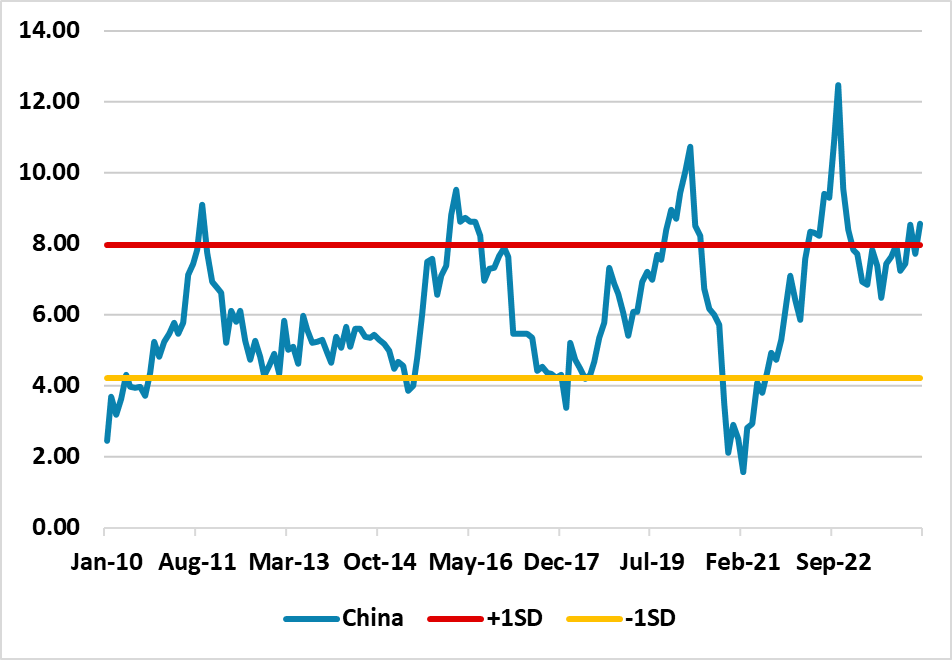

Figure 1: CAPE Yield-10yr Real Bond Yield (%)

Source: Continuum Economics

China’s equity market has started to recover in recent weeks, as ingrained pessimism has started to become less acute. Key points include

· Valuations. China equities are cheap versus 12mth forward P/E ratios and also versus 10yr nominal and real government bond yields (Figure 1). For the CAPE yield-10yr real bond yields, we have swung to more than 1 SD deviation and this cheapness has normally been followed by a rally. 10yr government bond yields in China are low in nominal terms for an EM economy and relative to China nominal GDP, but this reflects China authorities long-term encouragement of central government bonds. Near-term cheap equity valuation also means that the news flow has to get less bad rather than truly good.

· Circa 5% 2024. Q1 GDP growth, plus still to be implemented Yuan1trn of central government infrastructure investment suggests to the market that the 5% growth target is feasible. Though we are concerned that residential investment will be a negative drag on GDP and still mean 4.6% is achieved in 2024, the situation is getting less bad in this sector. Our 2024 GDP forecast is also not sufficiently far below 5% for a major disappointment on corporate earnings growth.

· Xi charm offensive. President Xi visit to France follows on German Chancellor Scholz meeting in Beijing, which has seen President Xi playing up the essential nature of China trade with the EU. Xi has also meet global CEO’s to encourage them to invest in China. Finally, China has not escalated tensions with Taiwan, partially as the new pro-China speaker in the Taiwan parliament can help to encourage a less hostile relationship with China.

· These all combine to mean that the pessimism towards the China equity market is softening and could continue to get less bad in the coming months. We can see a further 5-10% rally in the China CSI 300 index. Global investors are underweight China and will tactically likely reduce the scale of this underweight position.

Figure 2: China M2 Growth Yr/Yr (%)

Source: Datastream

However, we would not change the strategic underweight view on China in EM portfolios. Domestic China investors only tend to fuel prolonged equity rallies when money supply growth is strong and persistent, but lending conditions are restrained currently (Figure 2). We also remain concerned that real GDP will slow to 4.0% in 2025, given that net exports are also being hurt by supply chain reconfigurations multiyear and residential property will still be a modest drag in 2025 and beyond. Additionally, private investment is weak, which is a cause for concern on employment, income and consumption growth. Finally, the authorities want to undertake targeted not aggressive action. Consideration is also needed for the structural headwinds of stalling population growth and weak productivity. Nominal GDP will be just above 5%, which is terrible compared to pre 2020. This all means that corporate earnings expectations at 15% per annum in 2025 are too high and will likely disappoint. Thus we see only around a further 5-10% upside in 2025 for China equities. Tactical outperformance is unlikely to herald a new phase of strategic outperformance by China equities.