South Africa’s Inflation Softened to 5.3% in March

Bottom Line: According to the inflation figures announced by Department of Statistics of South Africa (Stats SA) on April 17, the inflation softened to 5.3% YoY in March from a four-month high of 5.6% YoY due to lower food and non-alcoholic beverages (NAB), alcoholic beverages & tobacco, transportation, and restaurants & hotels prices, coupled with relatively less power cuts (load shedding). Despite the fall in March, inflation remained far from the 4.5% midpoint and the drop could likely be short-lived because of drought conditions, rising oil prices and renewed rand weakness. We continue to foresee South African Reserve Bank (SARB) will likely delay the rate cuts to Q3 until after the May 29 elections, if the Q2 CPI trajectory allows.

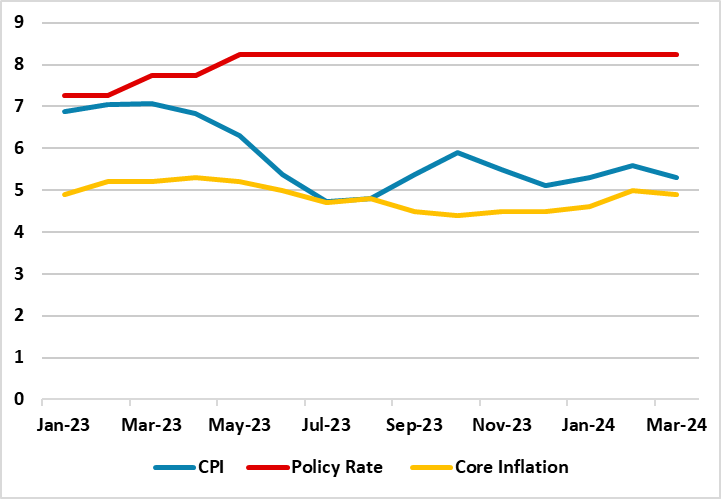

Figure 1: Policy Rate (%), CPI and Core Inflation (YoY, % Change), January 2023 – March 2024

Source: Continuum Economics

South Africa’s inflation fell to 5.6% YoY in March due to softening prices for food & NAB (5.1% YoY versus 6.1% YoY in February), alcoholic beverages & tobacco (4.5% YoY versus 4.8% YoY in February), transportation (5.3% YoY versus 5.4% YoY in February) and restaurants & hotels (5.7% YoY versus 6.6% YoY in February). Core inflation also decelerated to 4.9% in March from an eight-month high of 5.0% in February in annual terms. On a monthly basis, inflation was at 0.8% in March compared to 1.0% a month before.

On the other side of the coin, inflation in March was driven by higher miscellaneous goods & services, education, health and housing & utilities costs. The annual price growth in miscellaneous goods & services (8.5% YoY versus 8.4% YoY in February) and education (6.3% YoY versus 5.7% YoY in February) accelerated in March.

Despite South African load shedding became worse in February as the power cuts rose up to Stage 5 (led by the need to continue to do planned maintenance and excessive demand), the rising trend of the electricity blackouts became noticeable after the third week of February. Stages 2 and 3 load shedding was implemented broadly in March with the available generation capacity was largely sustained, which also lead to a deceleration in the inflation reading in March. (Note: Stage 4 was shortly implemented in the first week of March).

Despite inflation falling slightly in March, we think risks to the inflationary outlook remain strong while the drop could likely be short-lived because of drought conditions forcing up the price of some agricultural products like white corn, high oil prices, and renewed rand weakness. We think ongoing geopolitical tensions in the Middle East will likely contribute to the sticky inflation, particularly if the retaliation by Israel against Iran’s attack will be harsher than expected.

South African Reserve Bank Governor Kganyago reiterated on April 16 that he remains wary of inflation pressures and is ready to maintain tight monetary policy to ensure they are contained, signaling that SARB will be unwilling to adjust its policy stance until inflation retreats towards 4.5% in a sustainable manner and settles there. In this respect, and as we previously underlined, we expect SARB will likely keep the rates unchanged at 8.25% on the next MPC meeting on May 30. We envisage the first rate cut could happen either on July 18 or on September 19 while the elections outcome as a coalition with an uncertain fiscal and load shedding policy coupled with higher inflation and toughened logistical issues and power cuts could delay easing process further.