FOMC Preview for May 7: No change with future policy left data-dependent

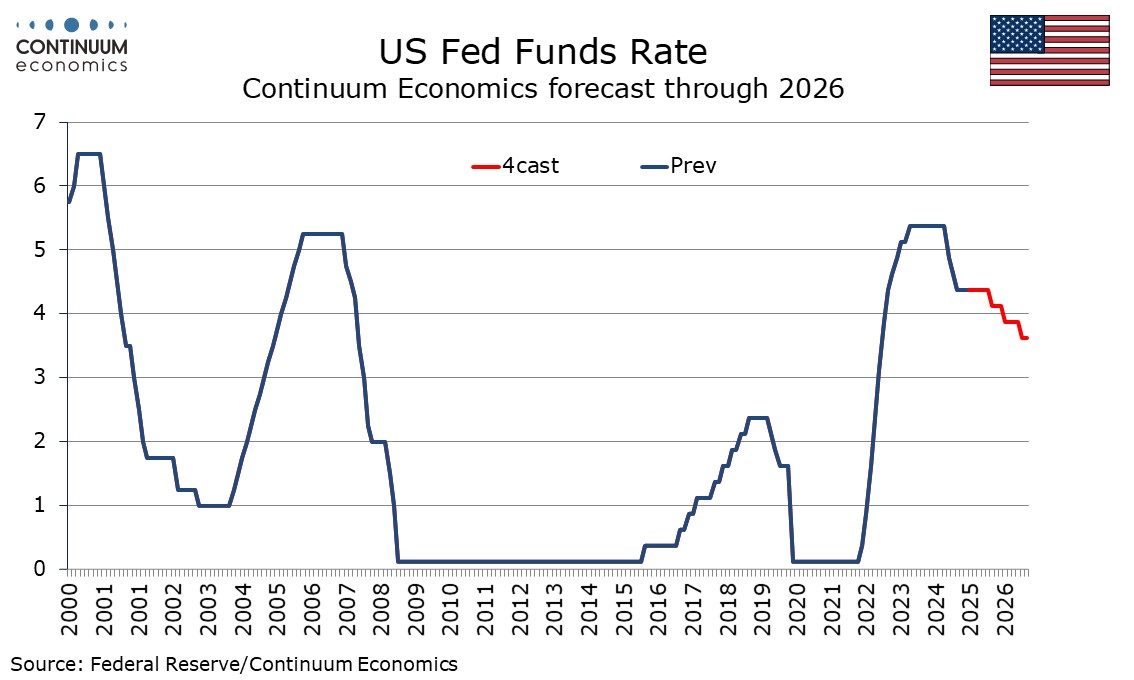

In the current exceptionally uncertain environment, the FOMC looks set to keep rates unchanged at 4.25-4.5% at its May 7 meeting, and give little away on future policy. This meeting will not see the dots updated. Chairman Powell however at the press conference is likely to signal that future meetings will be live and dependent on data, which is likely to sustain market hopes for easing. The possibility of easing however should not be seen as anything close to a commitment.

A decision to leave rates unchanged is unlikely to see any dissenting votes. In assessing the economy the FOMC will have to adjust its March 19 assessment that economic activity has continued to expand at a solid pace, given the marginal decline in Q1 GDP, but the statement is likely to signal that indicators of demand remained healthy, if at risk of a future slowing. The Fed will not need to adjust its March 19 view that unemployment has stabilized at a low level in recent months and labor market conditions remain solid. Its March 19 view that inflation remains somewhat elevated could be left as it was, though they could expand on it, noting easing inflationary pressures coming from wages but rising upside risks from tariffs. Elsewhere the statement needs no changes from March 19 apart from sticking to the reduced pace of quantitative tightening that was outlined on March 19. On March 19 the FOMC stated it was prepared to adjust policy as appropriate, giving no signal of a directional bias. Given growing downside risk to growth and growing upside risks to inflation, that is appropriate.

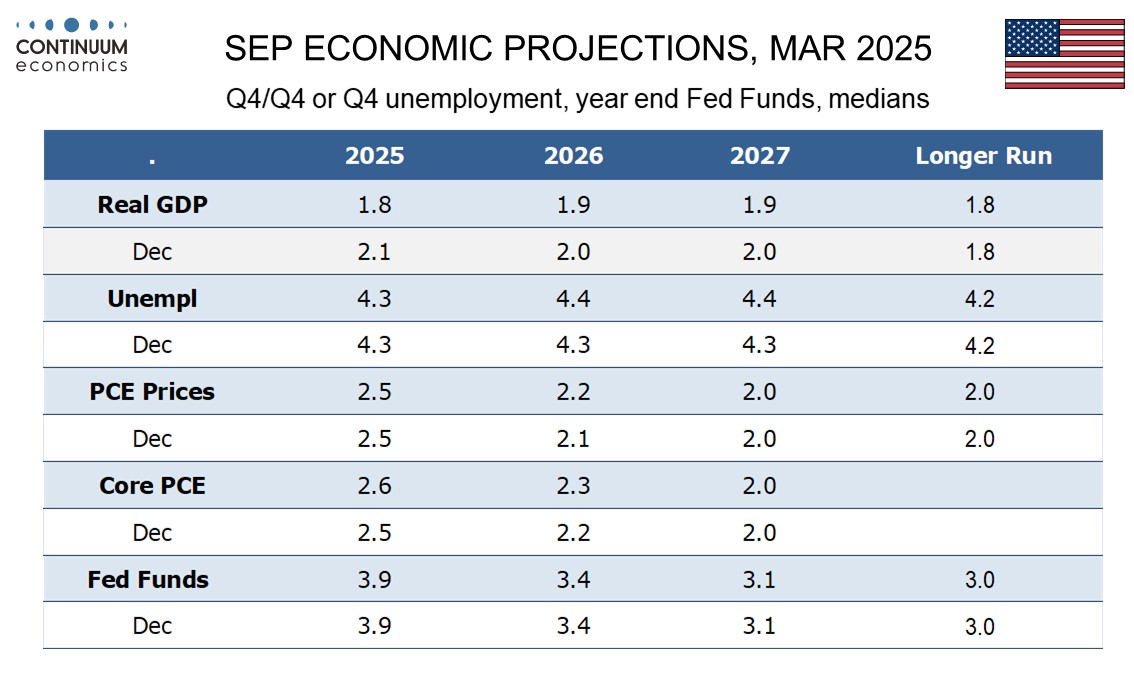

While the statement will give little away on the timing or direction of the next move, then Fed’s message has generally been that it can either keep policy restrictive if data remains firm or ease if data weakens. The bar to tightening looks high. While the Fed will need to see clear evidence of weakness in the data before easing, a lot can happen between now and the next meeting on June 18, with one non-farm payroll and two CPIs scheduled. Powell is unlikely to rule anything out, which will leave easing as a possibility at that meeting. However it is not our expectation unless we see a sharp slowing in activity combined with relief at incoming inflation data. The Fed dots will not be updated at this meeting but we doubt much has changed from those of March 19, other than the tariffs exceeding expectations and thus raising downside risk to activity and upside risks to inflation. In March the median dot for 2025 was two 25bps easings, but four participants saw only one, four saw none at all and only two saw three. Trump’s 90 day reciprocal tariff pause will not be over by then so uncertainty is likely to remain high in June, unless a large number of trade deals have been agreed by then. Our view is that the Fed will ease only once this year, in December, but risk is for more and sooner rather than nothing.