Russian Economy Grew by 2.9% YoY in September

Bottom Line: According to the preliminary figures announced by the Ministry of Economic Development, Russia's GDP expanded by 2.9% YoY in September driven by military spending and investments. Ministry of Economic Development significantly upgraded its GDP growth outlook to 3.9% from 2.8% for 2024, and to 2.5% from 2.3% for 2025. We still foresee Russian economy will expand by 3.5% and 1.7% YoY in 2024 and 2025, respectively, taking into account that aggressive monetary policy, sanctions, tight labor market conditions and higher price pressures remain restrictive, particularly in 2025.

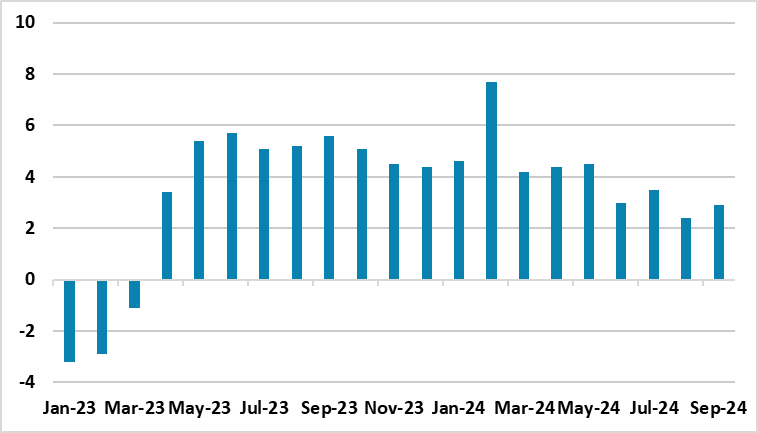

Figure 1: GDP Growth (%, Annual), January 2023 – September 2024

Source: Ministry of Economic Development

Russian economy continued its growth pattern in September, and grew by 2.9% YoY backed up by fiscal stimulus, strong military spending and investments. Despite this, the economy remains strained by sanctions, export controls, high inflation, and tight labor market conditions causing a slight deceleration in the growth rate particularly in Q3. (Note: Russia’s unemployment rate remained at a historically low level of 2.4% in September 2024 for the fourth consecutive month).

Seasonally adjusted MoM growth was 0.5% in September after hitting 0.4% in August. It appears YoY GDP growth had slowed in August mainly due to a 14.2% drop in agricultural output caused by delays with the harvest campaign in some regions, however agriculture grew slightly in September, by 0.2%. Ministry of Economic Development announced that overall GDP growth totaled almost 4% in 9M 2024 while president Putin also stated on October 29 that Russia's GDP is expected to increase by 3.9% by the end of 2024, which will be higher than the global average.

It is worth noting that Ministry of Economic Development significantly upgraded its GDP growth outlook to 3.9% from 2.8% for 2024, and to 2.5% from 2.3% for 2025. Minister Maxim Reshetnikov emphasized that "We now see the signs of the economic cool down start, and we will very attentively consider and analyze the situation on the basis of figures to appear."

When strong military spending and fiscal stimulus are considered, budget revenues remain significant in meeting the expenses as Western economic sanctions continue to hurt. Russia's draft 2025 budget allocates about one-third of total expenditure, or 6.3% of GDP, to the military, which is the highest level since the Cold War. (Note: Deputy Finance Minister Vladimir Kolychev recently noted that military spending has grown by 3.0-3.5% of GDP during the war years). Reuters reported on October 31 that the share of spending on defence will be double that of social spending for the first time, as military spending remains huge. Under current circumstances, a major tax reform is expected to generate additional revenues worth 1.7% of GDP in 2025.

Considering that economic growth is primarily driven by wartime activities and related subsidies, we think both Russian offensives in Ukraine and recent counter-offensives in Kursk region continue to pump up Russian military expenses, which could mean a higher-than-expected growth figure in 2024. We feel economic overheating to start contracting gradually in 2025 due to ongoing aggressive monetary tightening. We foresee Russian economy will expand by 3.5% and 1.7% YoY in 2024 and 2025, respectively, taking into account that CBR’s hawkish stance, sanctions, tight labor market conditions and higher price pressures would be restrictive, particularly in 2025. If Trump is reelected as U.S. president and likely leading to a peace deal in Ukraine in 2025, this could be a major determinant for Russian economy next year.