ECB Preview: Growth Risks Debate Clearer?

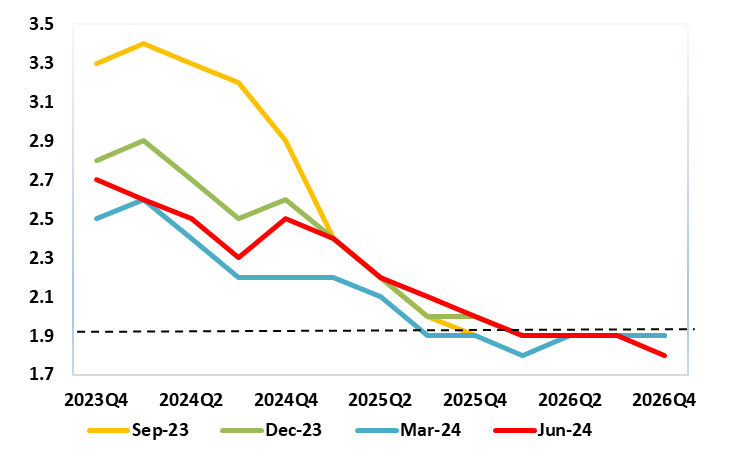

That the ECB will cuts official rates again when it gives its next policy verdict on Sep 12 is now almost a given. Even the hawks on the Council are willing to concede that the discount rate can (and maybe even should) fall another 25 bp (to 3.5%). This will come alongside larger reductions to the two other policy rates thereby fulfilling a shift in the Eurosystem’s operational framework that was laid out six months ago(). But markets will be more interested in what is said, aware too that the ECB is likely to adhere to its data dependent guidance, with nothing like any firm pointer to the speed and/or timing of further moves, albeit some more reassuring comments of wage and price pressures and a continued below target inflation outlook from late 2005 onwards (Figure 1). But even though the (what we think is an optimistic) GDP outlook may be revised higher on the basis of the marked fall in market rates in the last three months, the debate may be about the extent to which downside risks have grown, if not materialized, of late and evident in somewhat weaker business survey data.

Figure 1: ECB Below Target Inflation Outlook More Discernible?

Source: ECB, last four sets of projections

The Base Case

Regardless, we still feel that neither Fed policy, nor the US$, are likely to affect any ECB thinking and thus policy move(s). Instead, and partly as the ECB remains focused on the labor costs updates, numbers produced quarterly, but also wants to amass a broad but fresh thrust of added insights, then subsequent rate cuts may only arrive in three-month intervals, ie the next in December. But any further moves may come with more formal dissent and reservations within the Council. Such a possible lack of policy unanimity is not something the consensus-liking ECB Council may prefer. Regardless, our long-standing view that the ECB may cut only a further 50 bp this year but with President Lagarde implicitly hinting more rate cuts are being considered back in June as the ECB has now entered a third policy phase, ie after hiking and then pausing. However, by year-end more durable evidence of labour costs easing should convince the ECB to continue easing and we see 100 bp further easing through 2025 (still quarterly), with the deposit rate then nearing 2% and thus more in line with a perceived neutral setting but hardly moving into anything like a clear expansionary stance.

Increased Downside Growth Risks That Could be Materializing

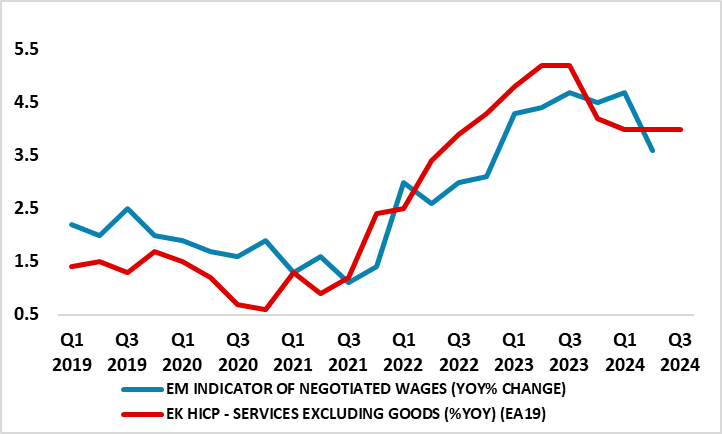

However, there are suggestions that worries about weaker growth are now reverberating within the ECB, albeit with the hawks still more mindful of service price resilience, despite more reassuring wage signs (Figure 2). But these worries chime with our long-standing concern of downside risk to what we still see is a below-consensus growth outlook, emanating not least from tight financial conditions and weaker global activity, also now being accentuated by increased fiscal consolidation measures as economies address budget deficit overshoots. Perhaps more notable are now signs that some of these downside risks may now be materializing, with business survey data showing continued weak manufacturing and construction but now starting to puncture what has been solid service sector activity and the labor market in particular.

The tightness in financial conditions is only partly being tempered by official rate cuts. Bank lending surveys do not suggest that banks have started to unwind what has been a clear and rapid fighting in credit standards. In addition, the ECB balance sheet reduction may be offsetting some of the conventional easing. As explained in the keynote speech by ECB Chief Economist Lane at Jackson Hole last month, the ensuing marked fall in excess liquidity in the EZ banking system means that ‘the transition from a high-reserves environment to a lower-reserves environment can trigger a shift in the risk-taking strategies of banks’.

Figure 2: Softer Wage Pressures to Soften Service Prices?

Source: ECB, Eurostat

Policy Risks

Against this backdrop, and given the added stimulus from the circa-50 bp drop in market rate seen since the last set of formal ECB projections in June, if the GDP growth picture is not revised higher, this would be an implicit acknowledgment of weaker current momentum.

Overall, President Lagarde may echo other comments made in by Lane at Jackson Hole last month which suggested that further monetary easing is on the way but in a path that has to steer between the risks of moving too fast against those from moving too slowly. Very clearly he implied that policy will still have to remain restrictive for some time. But with policy rates very much well above what most consider to be neutral, policy would remain restrictive even with around 150 bp of added official rate cuts that we envisage. To us, the risk is of faster easing than our central case envisages, but the case for additional easing would necessitate a protracted downturn.

(1) the planned changes to the Eurosystem’s operational framework scheduled as of Sep 18 which will see the rate on the MROs (main refinancing operations) and the rate at the MLF (marginal lending facility) will be adjusted such that the spread between the rate on the MROs and the DFR (deposit facility rate) will be reduced to 15 bp from the 50 bp currently, and the spread between the MLF rate and the rate on the MROs remain at 25 bp. The intended relatively narrow spread of 15 bp between the rate on the MROs and the DFR is aimed at limiting the potential upward pressure on money market rates and set incentives for banks to borrow liquidity from ECB open market operations as the central bank balance sheet normalizes.