Canada September CPI - Subdued, pause in BoC core rates downtrend likely to be temporary

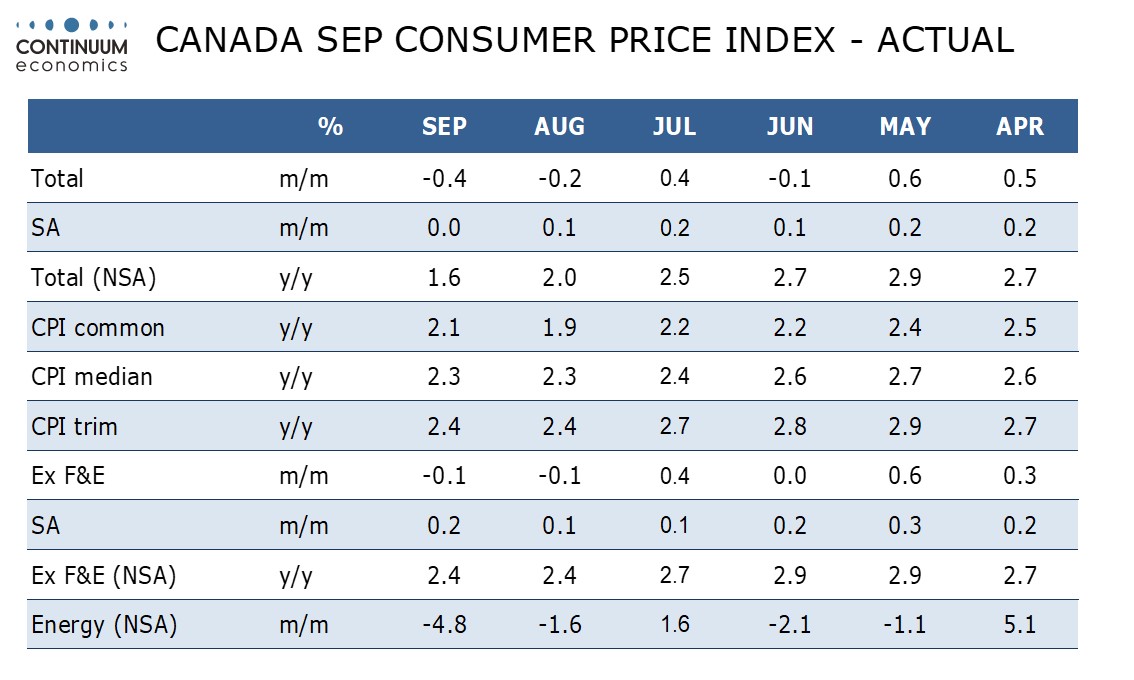

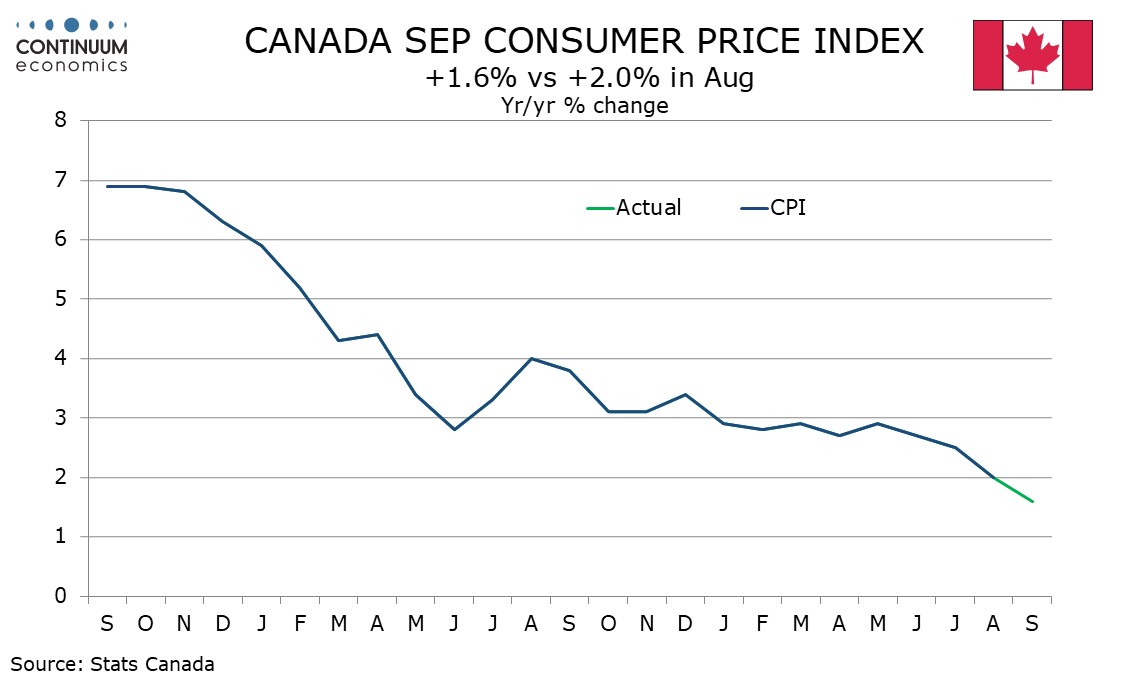

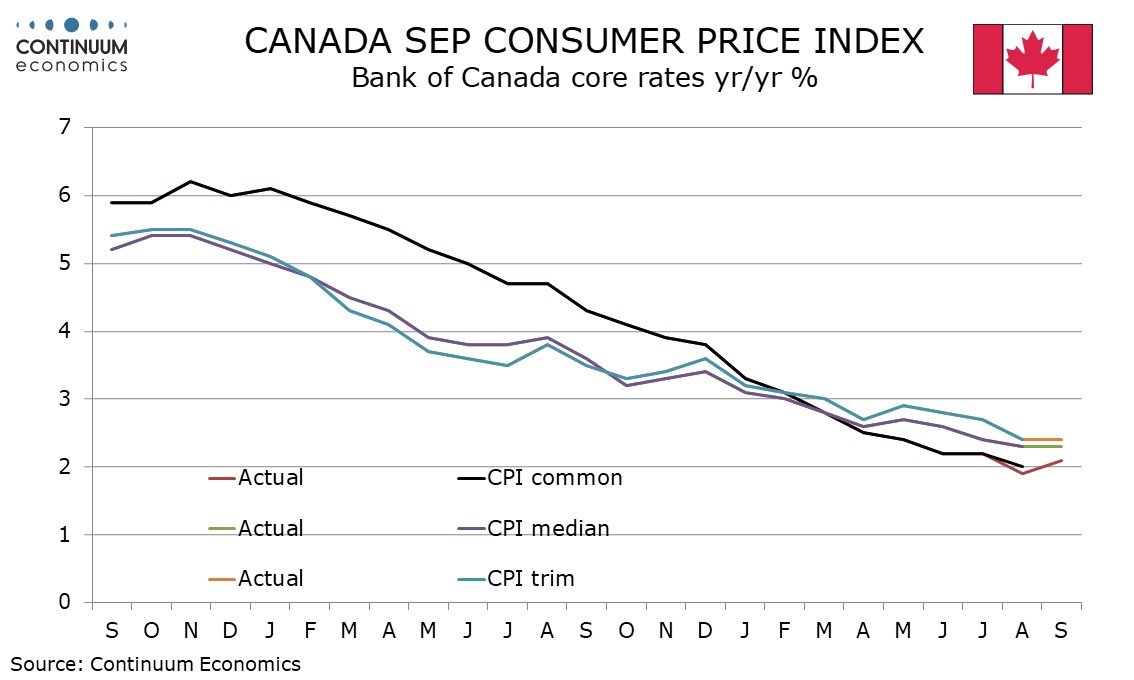

September Canadian CPI is weaker than expected overall at 1.6% from 2.0% yr/yr, and subdued on the month, though there has been a lack of further progress on the Bank of Canada’s core rates, largely because year ago data dropping out was also subdued and below where trend then was. This leaves next week’s BoC call a close one, but we feel a 25bps easing is more likely than 50bps.

Overall yr/yr CPI is the slowest since February 2021, and is now below the BoC’s 2.0% target, but the BoC’s core rates remain above, and CPI-Median at 2.3% and CPI-Trim at 2.4% are unchanged from August. The third BoC core rate, CPI-Common, actually edged up to 2.1% from 1.9%. This puts all three above target, but only marginally. Renewed slippage is likely in Q4 with the year ago data due to drop out not as subdued at that seen in September 2023.

On the month the data is clearly subdued, with overall CPI falling by 0.4% unadjusted on energy with ex food and energy CPI falling by 0.1%. Seasonally adjusted CPI was unchanged overall and up by 0.2% ex food and energy. The seasonally adjusted ex food and energy gain follows two straight gains of 0.1% and will not trouble the BoC. Even if the yr/yr core rates are still above 2% Q3 ex food and energy CPI is consistent with underlying trend falling below. Yr/yr ex food and energy CPI, not one of the BoC’s core rates, was unchanged from August at 2.4%.

The seasonally adjusted monthly changes show a 0.5% fall in transportation on gasoline and a 0.3% fall in clothing and footwear. Recreation, education and reading was the only area of strength with a 0.4% increase. Shelter, which has outperformed in most recent releases was subdued at 0.1%. Shelter remains firm at 5.0% on a yr/yr basis but the latest monthly data suggest that momentum is slowing.