China Outlook: 2024 on Track, but 2025 Headwinds

Public investment and industrial production in high tech and renewables are helping to support growth and should get the economy close to 5% in 2024. However, underneath the surface, consumption is slowing, private sector investment and employment growth is sluggish, and residential property investment continues to be a negative drag on GDP. These can come through to slow the economy into 2025 and we still forecast 4.0% GDP growth. Meanwhile, we continue to forecast a large undershoot of the 3% inflation desires, with a mere +0.3% for 2024 CPI inflation.

Further policy stimulus measures will likely be targeted in nature. We see two 25bps RRR cuts and 10bps off the Medium-term lending facility rate (MTF) in the remainder of 2024. Some Yuan weakness will be allowed in H2 2024. Meanwhile, some extra targeted fiscal policy measures are likely, alongside further support for the residential property sector.

President Xi could decide politically to be more aggressive in fiscal policy stimulation if the economy seriously falters, but not on the Outlook outlined above. China authorities are also concerned about the general government debt/GDP ratio, alongside the trends in households and corporates.

Risks to the Outlook. The risks are skewed to the downside for real GDP growth, as the adverse feedback loops from the sharp fall in new construction of residential property could be larger than our baseline and causing multiple problems for developers/households/local authorities and weaker banks. This would hit 2025 GDP growth more than 2024. We feel that the risk of a war with Taiwan is low in the next 5 years (here) and being overestimated, both with a pro-China speaker in Taiwan parliament and given the required massive naval build-up required.

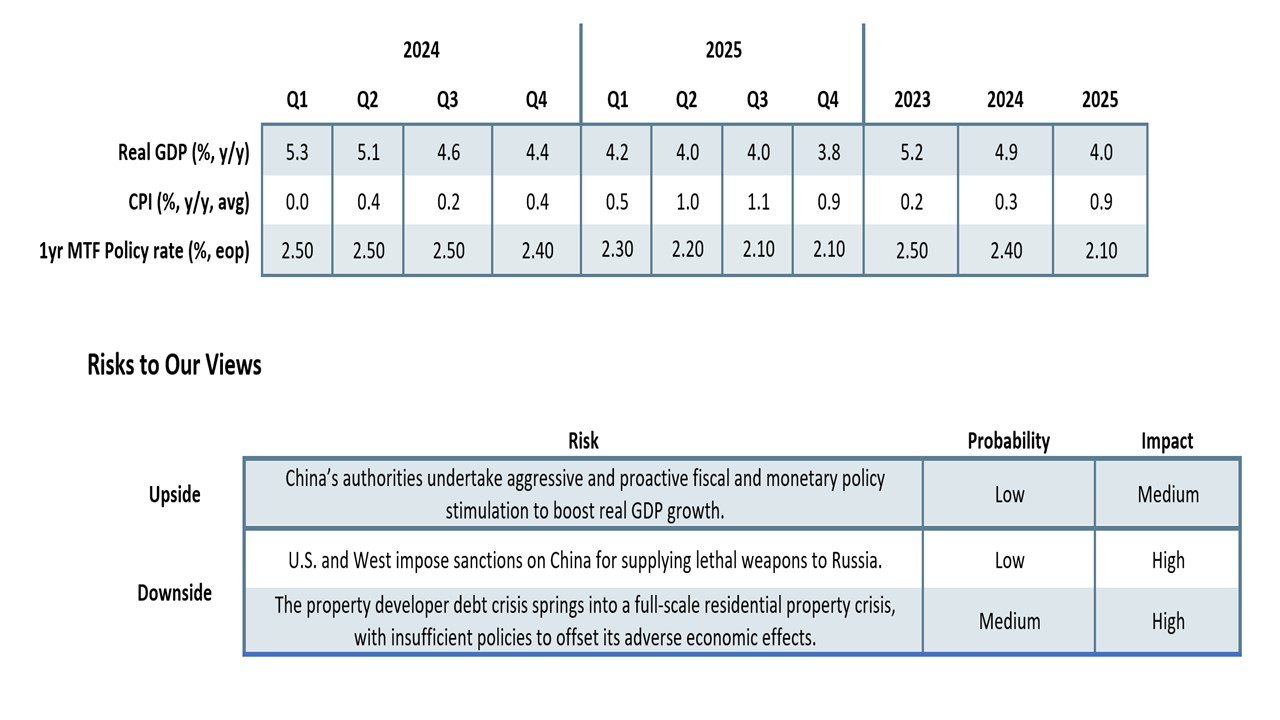

Our Forecasts

Source: Continuum Economics

Support for 2024, But Headwinds Remains into 2025

Unpicking the economic data trends show unbalanced economic growth in 2024, which will likely slow in 2025 due to cyclical and structural headwinds. Key points to note are

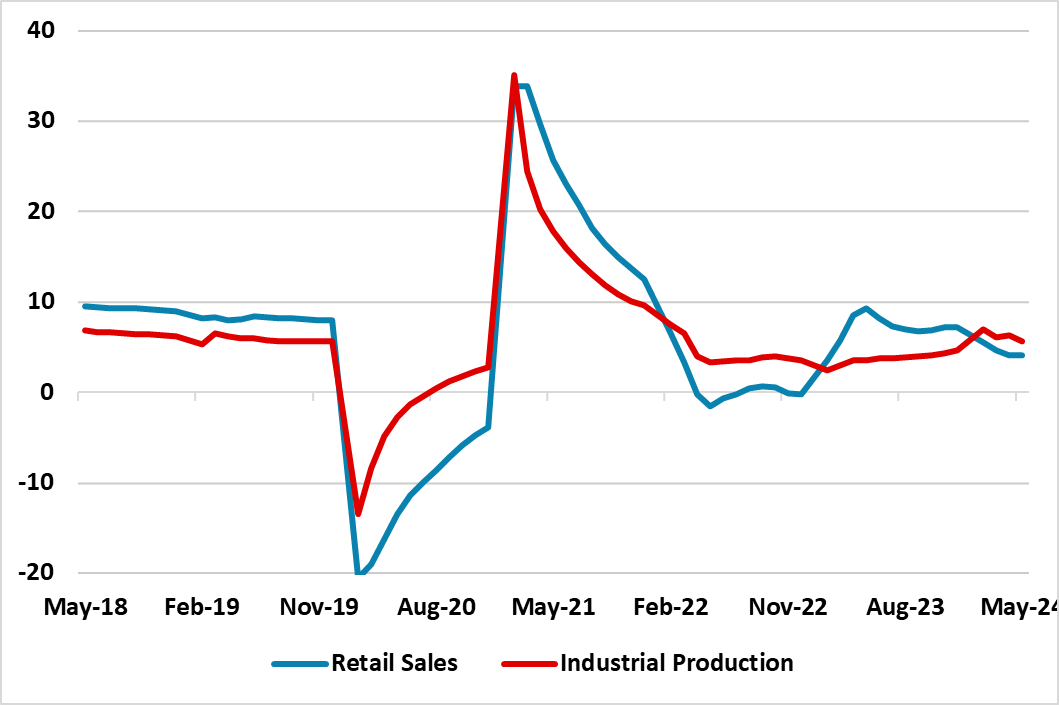

· Public investment/high tech manufacturing momentum. The key positive driver for 2024 GDP growth is good public investment growth helped by the remainder of the Yuan1trn local government flood defence infrastructure program and the Yuan1trn of central government infrastructure kicking in from Q2. Additionally, high tech manufacturing and renewables are positive dimensions of China’s economy, driven by government support and encouragement for domestic production. This has helped industrial production outstrip retail sales (Figure 1). Public investment should help in the remainder of 2024, before more public infrastructure programs are required for 2025 to stop this key segment slowing. Some heavily indebted local governments are also restraining investment, which is a headwind.

Figure 1: Industrial Production and Retail Sales YTD Yr/Yr (%)

Source: Continuum Economics

· Net exports. Export momentum should improve helped both by the recovery in the global economy and increased efforts by China to drive exports. This should mean that net exports are a small to modest positive contribution to 2024 rather than negative and one of the reasons for our upward revision for 2024 from 4.6% to 4.9%. The redirection of some production towards exports has attracted some international criticism that China is dumping excess production on global markets given weak private sector demand in China. Tariffs have been raised for electric vehicles by the Biden administration, but additional action in 2024 will likely not stop this export trend. The ability to direct more production to exports in 2025 is more uncertain and dependent on the outcome of the U.S. elections and what Donald Trump would do if elected. Shifting supply chains out of China also remain an issue for the medium-term and capping net export growth.

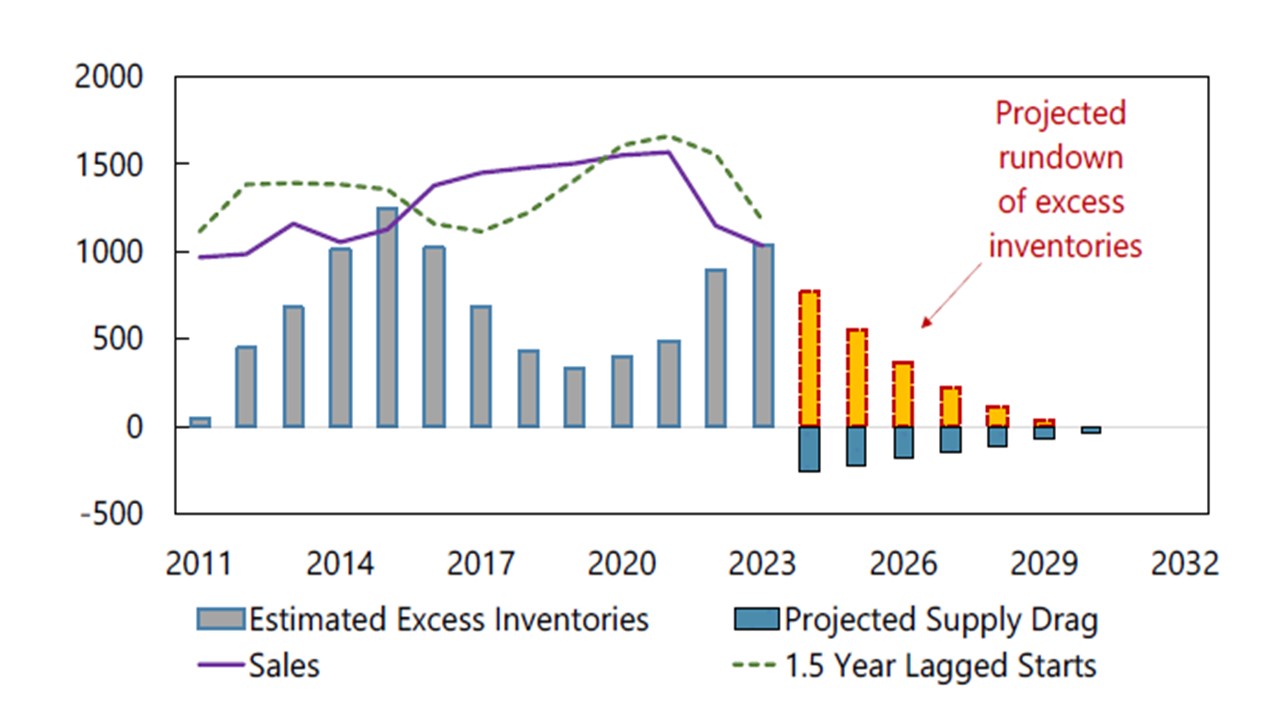

· Residential investment still negative. China authorities are stepping up support for residential property with a Yuan300bln funding for local authorities in May to buy unsold apartments for affordable housing. Combined with lower deposits/reduced mortgage rates and a push to finish uncompleted properties, the drag on GDP will likely be smaller at 1% of GDP in 2024. However, official measures have not been game changers, as they remain of insufficient scale and Yuan2-4trn temporary funding would be required to remove excess inventory (Figure 2) – while lower structural demand for homes is also an issue. The authorities are also not allowing property prices to fall enough to clear the market and this is reducing housing demand and prolonging the housing adjustment. Thus we look for residential investment to continue to be a negative modest drag in 2025-27.

Figure 2: IMF Estimate of Developers Excess Inventory (Mln SQM)

Source: IMF Article IV 2024, selected issues (here)

· Consumption slowing. Consumption trends are slowing in 2024, as the positive force of catch up spending in travel/eating out are slowing after COVID restrictions were lifted in Q1 2023. Some positive momentum in 2024 in these sub sectors can still be seen, before slowing in 2025. Meanwhile, the remainder of consumption remains sluggish hurt by slow private sector employment growth and poor consumer confidence, which will likely remain sluggish but become more noticeable as the year progresses and into 2025. Also production is now outstripping retail sales and this is imbalanced if exports growth cannot take up the difference. Consumption could be boosted by structural reform (more healthcare, unemployment and pension support and raising retirement age) to reduce precautionary savings, but this is a low priority for the authorities.

· Private sector business investment. The boom years of 1990-2019 have been replaced by modest overall private sector investment. Though the authorities have been less critical of greed, the intermittent regulatory crackdowns in certain sectors is restraining business sentiment and investment. Since private sector companies are the largest employer, this is also a restraining influence on households.

Overall, public sector investment, plus remaining momentum in consumption should be the key contribution to get close to the authority’s 5% GDP growth target in 2024. However, the economy will remain imbalanced with drags from slow private sector employment growth and investment, with residential investment growth remaining negative. This will mean that H2 should see a slowing growth trend and momentum will likely fade in 2025 if, as we project, only further modest policy easing is seen (see below).

It is also worth mentioning that our 2024 CPI inflation forecast of 0.3% implies nominal GDP growth in the 5.0-5.5% region, which is very low by China standards and would entail a further rise in total non-financial sector debt/GDP. While this does not stop more policy stimulus, it does restrain aggressive action from being taken. Headline inflation will drift up in 2025, but core inflation will likely remain subdued as excess production causes price cuts in some consumption components.

Policy

Plenty of scope exists for easier monetary policy given the large inflation undershoot, but actual action will likely remain modest. China authorities do not want to hurt the Yuan too much that it increase capital outflows and risks a backlash against the communist party, but they do want to sustain competitiveness. Combined with traditional PBOC caution and questions about interest rate cuts effectiveness suggest that two further 25bps reserve requirement ratio (RRR) cuts will likely be evident in the remainder of 2024. Additionally, we see scope for 10bps of cuts in the medium term lending facility rate in October after the Fed starts cutting, as China seeks to provide stimulus. Household lending has ground to a halt, while total social financing growth is on the low side.

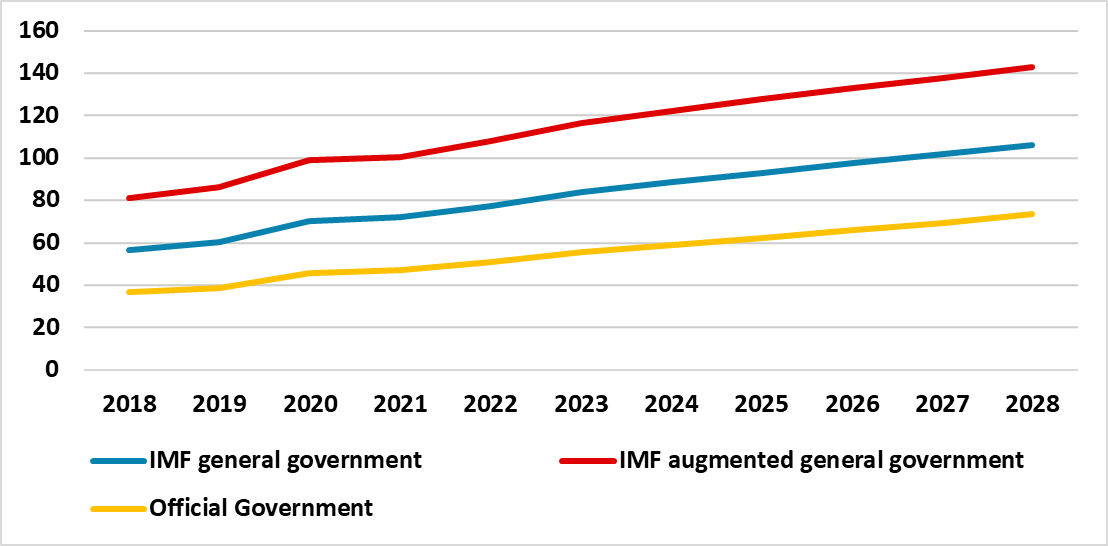

Additional targeted fiscal policy measures are likely later in the year. The reason they are targeted rather than aggressive is that China authorities are concerned about the overall debt build-up in the economy since 2007-08. While official figures show a moderate government debt/GDP trajectory, this excludes LGFV and other special purpose spending and has higher estimate from the IMF (Figure 3). In the February 2024 article IV discussions, China authorities also appear to show sensitivity to debt trends remaining an important factor. President Xi could decide that an aggressive fiscal policy stimulation is required, which could change the 2025-27 GDP profile. However, no signs exist of a major shift in policy at this juncture and we continue to expect additional fiscal policy measures to remain targeted in the coming quarters.

Figure 3: China Official, IMF General Government and Augmented Debt (% GDP)

Source: IMF