Bank Indonesia Preview: Rupiah Defense - BI to Hold Rates, Eye Future Easing

Easing food inflation saw headline CPI decline to 2.1% yr/yr in July. Nonetheless, price pressures from a weakening IDR persist. Bank Indonesia will likely hold rates till Q4-2024.

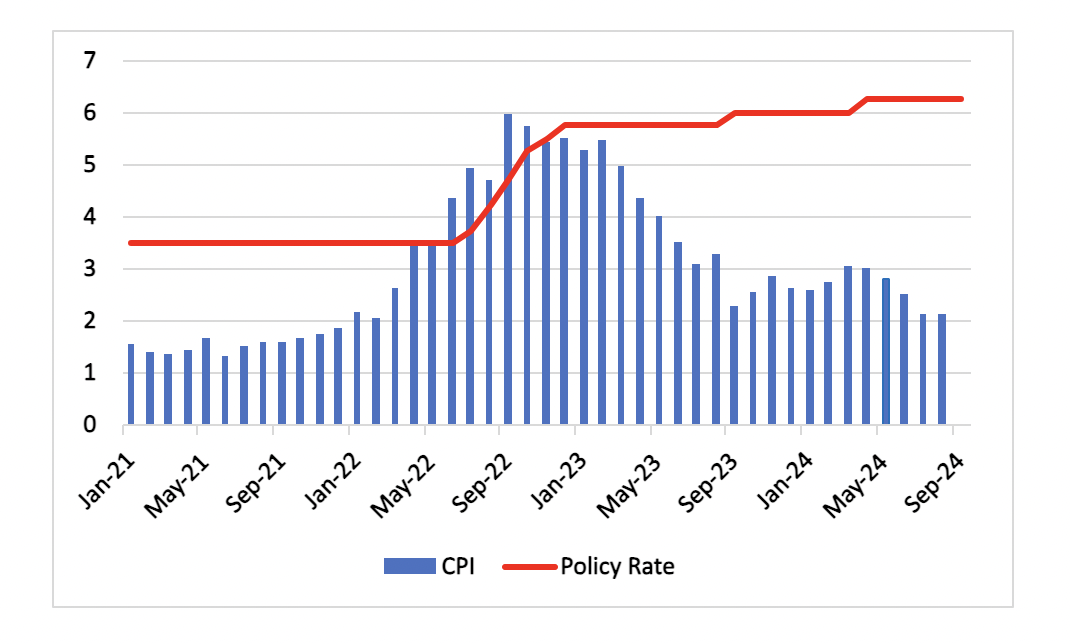

Figure 1: Indonesia Consumer Price Inflation and Main Policy Rate (%)

Source: Continuum Economics

Bank Indonesia (BI) is expected to keep interest rates steady at its upcoming meeting, as the central bank prioritises stabilising the rupiah in the face of external pressures. While inflation remains comfortably within BI’s target range of 1.5%-3.5%, the focus has shifted to maintaining a strong currency, which helps curb imported inflation. This strategic stance comes despite expectations of a significant rate cut by the U.S. Federal Reserve on September 18, a move that could influence global monetary policy trends.

Governor Perry Warjiyo indicated in August that BI’s immediate priority would be defending the rupiah (IDR) against the U.S. dollar, with a view to supporting price stability. The rupiah’s nearly 5% gain in August has provided BI with the necessary buffer to hold off on aggressive policy easing, despite looming cuts by the Fed. In our view, BI is expected to leave its benchmark seven-day reverse repurchase rate unchanged at 6.25%. The central bank is also forecast to maintain its overnight deposit and lending facility rates at 5.50% and 7.00%, respectively.

We expect the first rate cut, of 25 basis points, to occur in the final quarter of this year, in line with the overall market sentiment. In our view, BI is likely to take a more cautious and measured approach to rate cuts despite other central banks adopting a more aggressive approach in line with the Federal Reserve.