UK CPI Review: Inflation Stable and Services Resilience Still Evident?

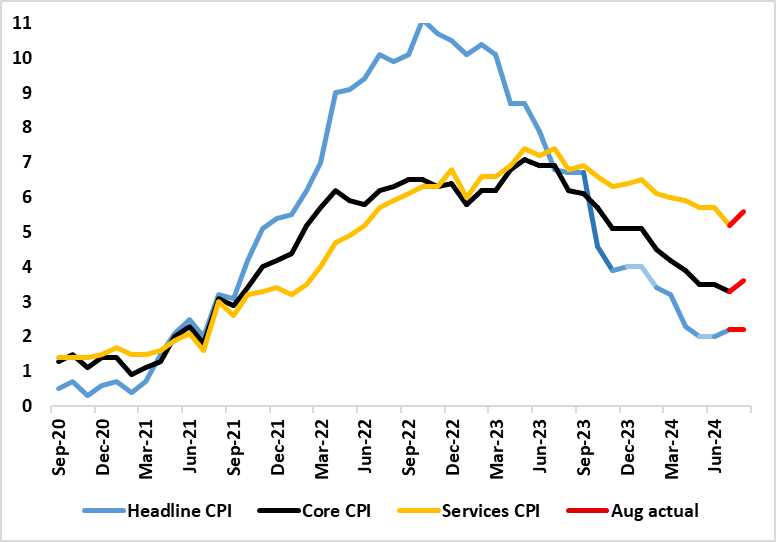

The July CPI was notable for the clear and larger-than-expected fall in services inflation, one driven by a fall in restaurant/hotel inflation, this often seen as a bellwether indicator of price persistence. The August data showed mixed signs on such a basis. Indeed, services inflation rose back 0.4 ppt to 5.6%, up from a two-year low but still below the BoE projection and was almost solely driven by a swing in (very volatile) airfares without which services would have fallen (well) below 5% - this also accounting for the rise in the core rate. Indeed, the core would have fallen (well) below 3% without airfares. Moreover, restaurant inflation hit a new cycle low amid generally softer price pressures in which eight (of 12) CPI components fell. As a result, the overall CPI headline rate stayed to 2.2% in August this chiming with the consensus and two notches under BoE thinking. The data (especially ex-volatile services) do not rule out a further rate cut at tomorrow’s MPC decision, but what may be key will be rhetoric and the closeness of the vote – it may see at least 2-3 dissents in favor of further immediate easing!

Figure 1: Mixed Inflation Signs?

Source: ONS, Continuum Economics

As for underlying trends, the core rose from 3.3% in July (Figure 1), the lowest in almost three years and adjusted m/m data suggest a clear slowing short-term price dynamics. There were always risks to the August numbers as a good part of the July services price inflation was due to so-called volatile items which did reverse in July and this was unwound in August. But as for upcoming inflation data, airfares may drop back and the fall in oil prices now evident could see the headline rate drop back in September numbers and move further below BoE projections.