RBI Holds Rates Steady as Growth Proves Durable

The Reserve Bank of India has opted for composure holding rates at 5.25% as it weighs past easing, a benign inflation profile, and the rupee’s fragility in volatile global conditions. This is a pause with options, not a pivot.

The Reserve Bank of India left its key policy rate unchanged at 5.25% today, signalling a steady hand amid volatile global backdrops and a shifting domestic growth mix. The decision by the Monetary Policy Committee (MPC), chaired by Governor Sanjay Malhotra, was unanimous and reflects confidence in India’s macroeconomic footing, even as global policy divergence, geopolitical disruptions and rupee weakness continue to shape the external risk matrix. “Growth remains resilient and inflation is well within the target,” Malhotra told reporters, characterising the current policy stance as neutral and well-calibrated. His comments came after the central bank released data projecting 7.4% GDP growth for FY2025–26 and annual inflation at just 2.1%, well below the 4% target.

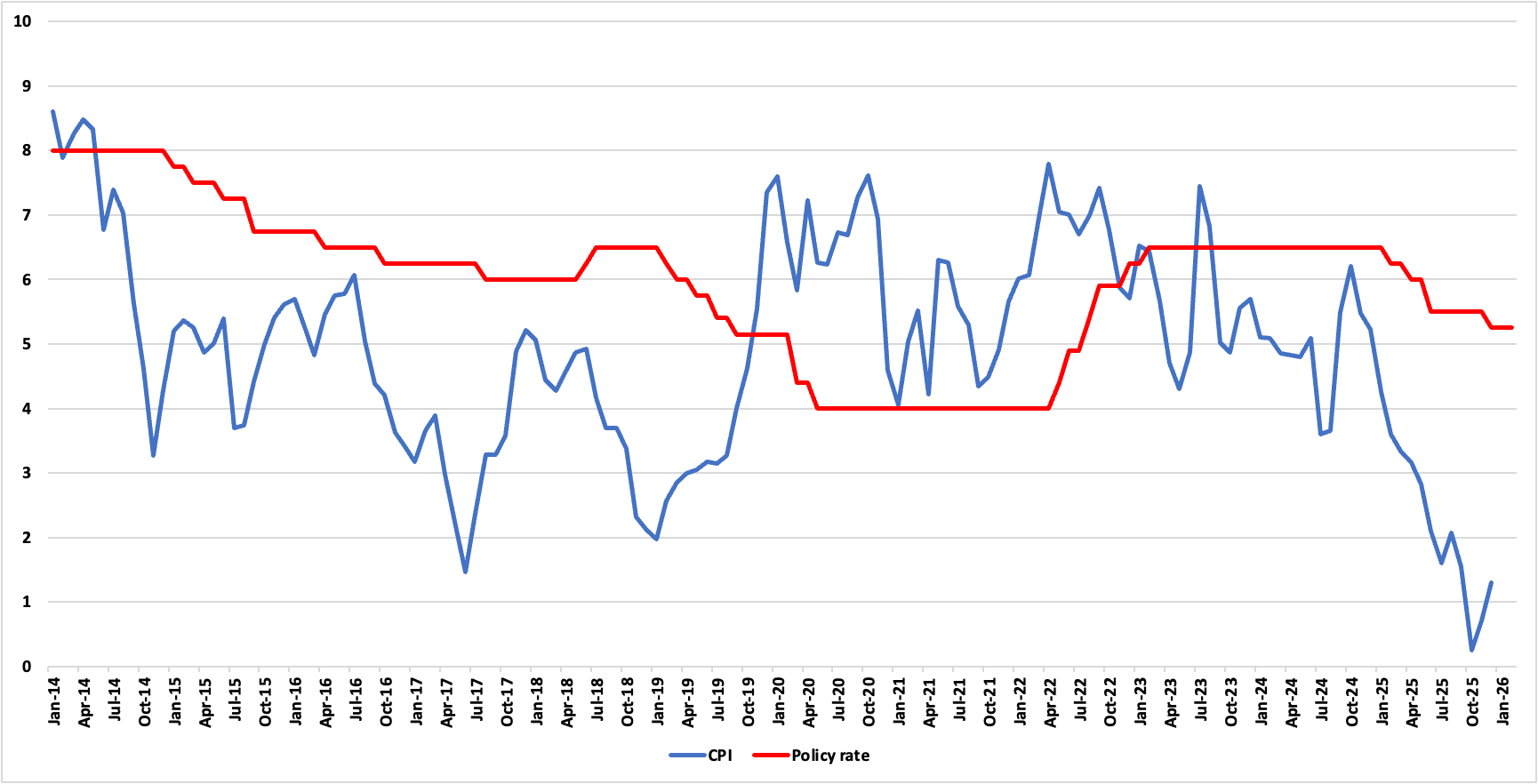

Figure 1: India CPI and Policy Rate (%)

Inflation Risks Tamed—For Now

India’s disinflation cycle remains intact, with CPI easing to 1.3% in December 2025 and food prices in outright deflation territory for seven consecutive months. But the RBI flagged “unfavourable base effects” in the coming quarter, particularly in March, that will temporarily lift year-on-year inflation to 3.2%. Still, underlying inflation pressures, excluding precious metals, remain tame, with core CPI anchored near 2.6%. This benign print, however, has not prompted a rate cut, even as over 125 basis points of easing since February 2025 continue to transmit slowly into credit markets. The MPC believes that monetary easing has already been front-loaded, and that policy transmission remains underway, albeit in an uneven fashion.

Liquidity Tensions Linger

The unevenness is reflected in tight liquidity conditions. Despite the RBI injecting nearly INR 1.9tn via open market operations, banks continue to face funding pressure, with high deposit rates and elevated short-term yields. FX market interventions to defend the rupee have also absorbed rupee liquidity, muting the effect of past rate cuts. Treasury desks report continued upward pressure on money market rates, even as credit to the commercial sector rose 15% yr/yr in the first nine months of FY26 (Apr-Dec). The RBI appears willing to tolerate this strain for now, choosing to safeguard financial stability over headline-driven easing.

Growth Momentum Steady, but Government Hand Still Visible

The RBI revised its Q1 and Q2 FY27 GDP projections upward to 6.9% and 7.0% respectively, pointing to robust services activity, strong credit growth, and the tailwinds of recent fiscal reforms. Yet the composition of growth remains tilted toward public capex and consumption, with private investment still sluggish. The February 1 Union Budget offers little to boost private consumption as tax breaks were not part of it and the focus remained on increasing capex. Trade dynamics also remain mixed: while services exports are holding firm, net merchandise trade continues to weigh on growth, reinforcing India’s external vulnerability.

Rupee Fragility Dictates Caution

The rupee’s performance, down 2% year-to-date and at a record low of 91.96/USD, was a clear subtext to this policy pause. Malhotra did not name specific foreign exchange levels but underscored the RBI’s dual mandate: inflation control and financial stability. It is worth noting that continued equity outflows and no specifc Federal Reserve rate cuts in sight, the RBI's moves remain limited. Indeed, the RBI’s own reserves data showed forex buffers climbing to USD 724bn,among the strongest in EMs, but drawdowns in FCAs reflect continued market intervention. We expect the RBI to remain highly responsive to any further deterioration in capital flows or exchange rate stability.

Outlook

For now, the policy path remains steady. In our view, the RBI will wait for new CPI and GDP data under revised series before making fresh moves, with the next MPC scheduled for April 6–8. We continue to price in 25 bps of rate cut in H2 2026, but only if rupee pressures ease and core inflation remains contained.