Rupee Volatility Tests RBI, But Buffers Remain Strong

India’s forex reserves are under pressure from capital outflows and rupee weakness, but the system remains resilient. The RBI has room to manage volatility, backed by strong reserve buffers.

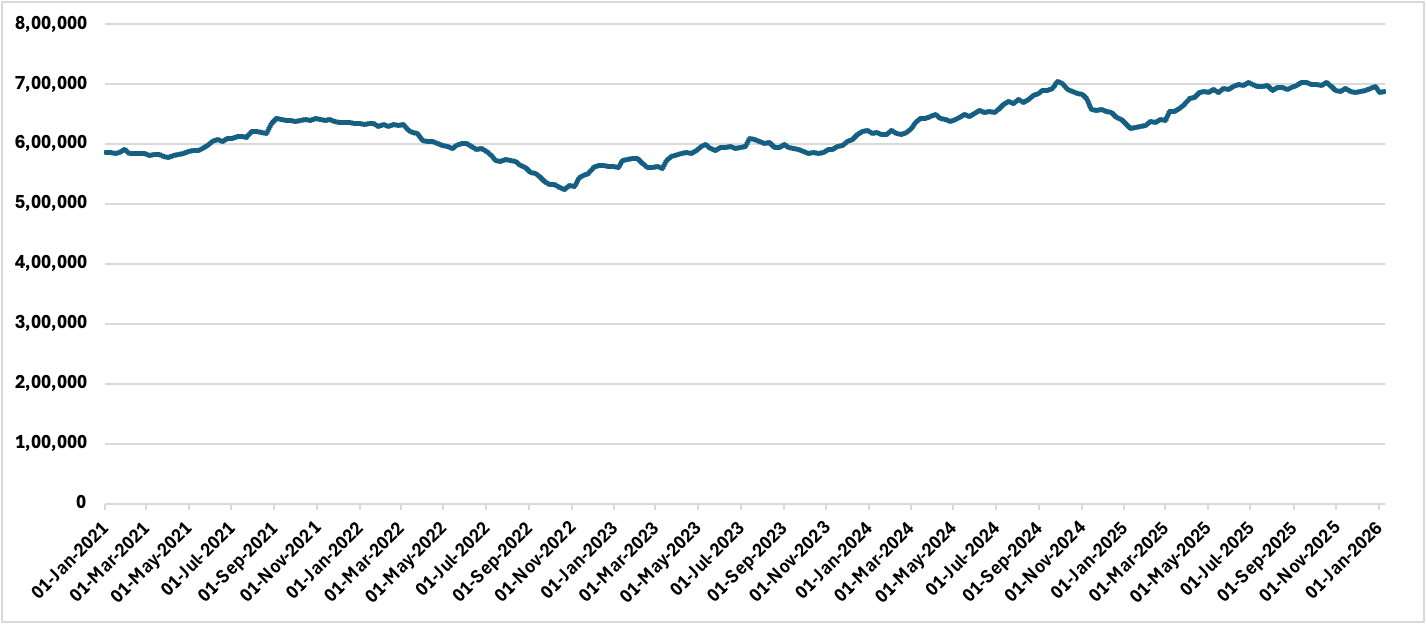

India’s foreign exchange reserves recorded their sharpest drop since mid-2025 in early January, falling by US$ 9.89bn to US$ 686.8bn in the week ending January 2. The drop reflects sustained foreign portfolio outflows and the Reserve Bank of India’s (RBI) ongoing efforts to stabilise the rupee amid a rising dollar and delays in a much-anticipated India–US trade agreement.

The rupee (INR) has slipped 0.8% against the greenback since the start of 2026, after ending 2025 as the worst-performing Asian currency, depreciating by over 5%. This is a reflection of high US tariffs, a widening trade deficit (at US$ 248.3bn in Apr-Dec FY26), and renewed global rotation into Chinese and Korean equities as investors chase the AI upcycle.

Behind the Numbers: Dollar Sales and Valuation Effects

The decline in reserves was largely due to RBI’s active dollar sales, aimed at ensuring currency stability. While India’s headline reserves bounced back slightly in the subsequent week ending January 9, rising US$ 392mn to US$ 687.2bn, the composition of that increase raises concerns. Foreign currency assets (FCAs), the largest and most liquid portion of reserves, declined by US$ 1.1bn, even as gold reserves jumped by US$ 1.5bn, supported by strong global prices. Holdings of Special Drawing Rights (SDRs) and the IMF reserve position also edged lower.

Figure 1: India Foreign Exchange Reserves (US$ mn)

Structural Pressures vs Strategic Strengths

The recent data reflects a broader trend. India’s reserve buffer remains among the strongest in emerging markets, offering over 10 months of import cover. Yet the repeated drawdowns in FCAs (a more dynamic signal of RBI intervention) suggests the central bank is increasingly focused on containing rupee volatility, even at the cost of some reserve depletion. Complicating this task is the RBI’s large short forward dollar position, which limits its flexibility to manage liquidity through the spot market. By late November 2025, RBI's net short positions in dollar forwards hit a seven-month peak of US$ 66.05bn through dollar/rupee forward interventions and buy-sell swaps. These positions carried forward into January 2026, highlighted by a US$10bn three-year FX swap auction launched on January 13 to ease liquidity strains, curb forward premiums, and support the rupee hovering around 90/USD In this context, the central bank is walking a fine line: defending the rupee to avoid panic, while not fully resisting its gradual depreciation. This shift is made more possible under the current RBI governor, who appears less interventionist than his predecessor, in our view.

Capital Outflows and the AI Rotation

The pressure on reserves and the rupee is not purely domestic. A rotation of global capital toward China and South Korea, where equity markets have rallied on renewed AI optimism and tech sector reweightings, has come at the expense of previous India overweights. Foreign Institutional Investors (FIIs) have pared down their India holdings for months, reversing a multi-year trend of sustained inflows. That said, this rotation is likely to be temporary. India’s underlying macro fundamentals, mainly high growth, moderate inflation, political stability, and expanding digital infrastructure remain intact. Moreover, the structural drivers of capital like bond index inclusion and a credible monetary framework are still in place. Simultaneously, the recent rebound in flows to China may not sustain, as investor concerns resurface around structural limits in China's semiconductor ecosystem. China’s dependence on imported advanced chips, combined with tightening US export controls, raises long-term viability concerns around its self-sufficiency push in AI hardware. As these constraints crystallise, investors are likely to rotate back into the Indian market, where supply chain reliability, policy continuity, and capital market depth offer greater confidence.

Overall, India’s foreign exchange reserves are being tested by capital outflows and rupee volatility, but the system is far from fragile. A more open RBI stance on rupee flexibility, solid macro fundamentals, and a maturing domestic investor base are rebalancing the external sector’s response capacity. The drawdowns are real but it isn't a crisis. With over US$ 687bn in total reserves, India retains one of the largest FX buffers among emerging markets, enough to cover more than 10 months of imports and comfortably absorb short-term capital shocks. This gives policymakers ample room to manage volatility without derailing growth or triggering a confidence crisis.