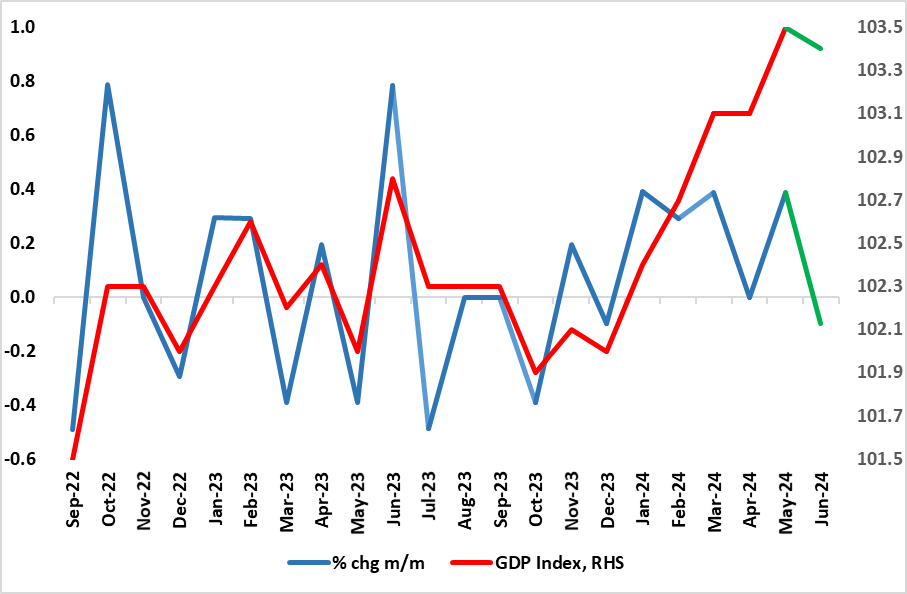

UK GDP Preview (Aug 15): Small Correction After Run of Upside Surprises

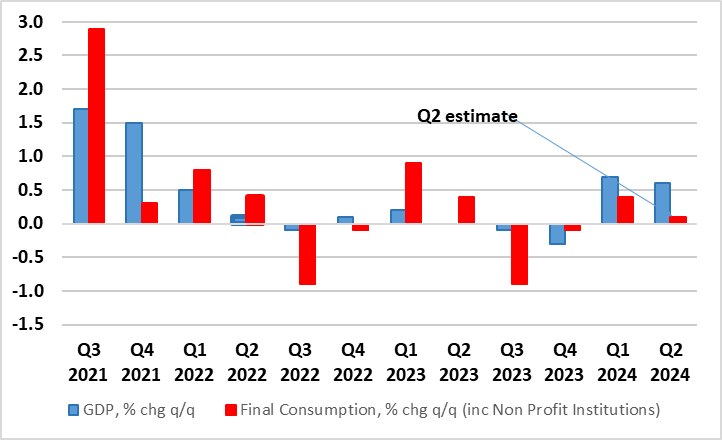

After the mild recession in H2 last year, the ‘recovery’ now evident is much clearer than any expected with GDP growth notably positive in all but one of the five months to May. But amid weaker retail sales, property transactions and car production data, we see a 0.1% m/m correction in June GDP data (Figure 1). But this will still leave Q2 GDP numbers (released alongside the monthly data) showing a 0.6% q/q rise after the 0.7% gain in Q1. That Q1 ‘strength’ was partly due to a further fall in imports, but that may not be the case in the Q2 breakdown, albeit with consumer spending likely to soften (Figure 2). Regardless, the anticipated June drop will create a soft base effect for Q3 growth which we see advancing just 0.1%, a quarter of the BoE estimate. But we do note the upbeat PMI data of late instead suggest a continued, if not more, solid picture for Q3. But we are somewhat puzzled why the UK is seeing such gains in its PMI updates just when the very opposite is happening in the EZ, especially when alternatively-sourced survey data (from the CBI) is far from being anything as upbeat.

Figure 1: Clearer Recovery to Date?

Source: ONS, Markit CE, green is CE estimate

Coming in more than expected, GDP rose by 0.4% m/m in May, accentuating the bounce in the two months prior to the flat April reading. As a result, this would be consistent with a circa-0.6% Q2 q/q outcome, building and almost matching the strong but possibly misleading Q1 jump. It has prompted BoE thinking to be much more positive for the last quarter and make it now suggest growth of around 1.25% for the whole year, more than double the previous estimate, albeit we think a little too optimistic. Our reticence reflects that this apparent resilience, if not strength, in the GDP data contrasts increasingly with employment weakness and is partly a result of public sector gains, but also does not appear to be a result of import weakness as was the case in Q1. But the strength in GDP is chiming with PMI survey data and this resonates with the BoE.

A Mixed Momentum Message?

Volatile weather appears to have affected activity in recent months and may do again in June numbers. But there are already hints that may have affected some data, not least the clear m/m correction in June retail sales and the small drop reported for property transactions. That sales correction implies a weaker Q2 consumer picture, but with a recovery in net imports highlighted in trade data, it may be that a welcome bounce in capex has underpinned Q2 activity. Regardless, these numbers are too historic to affect already upgraded BoE thinking. Instead, the concern will be how the juxtaposition of a more stable government, vs public unrest and stock market turmoil reconcile themselves.

Figure 2: Clearer Recovery But Consumer Likely to Grow Slower?

Source: ONS, CE