U.S. December Retail Sales - Trend still solid, Philly Fed surges in January

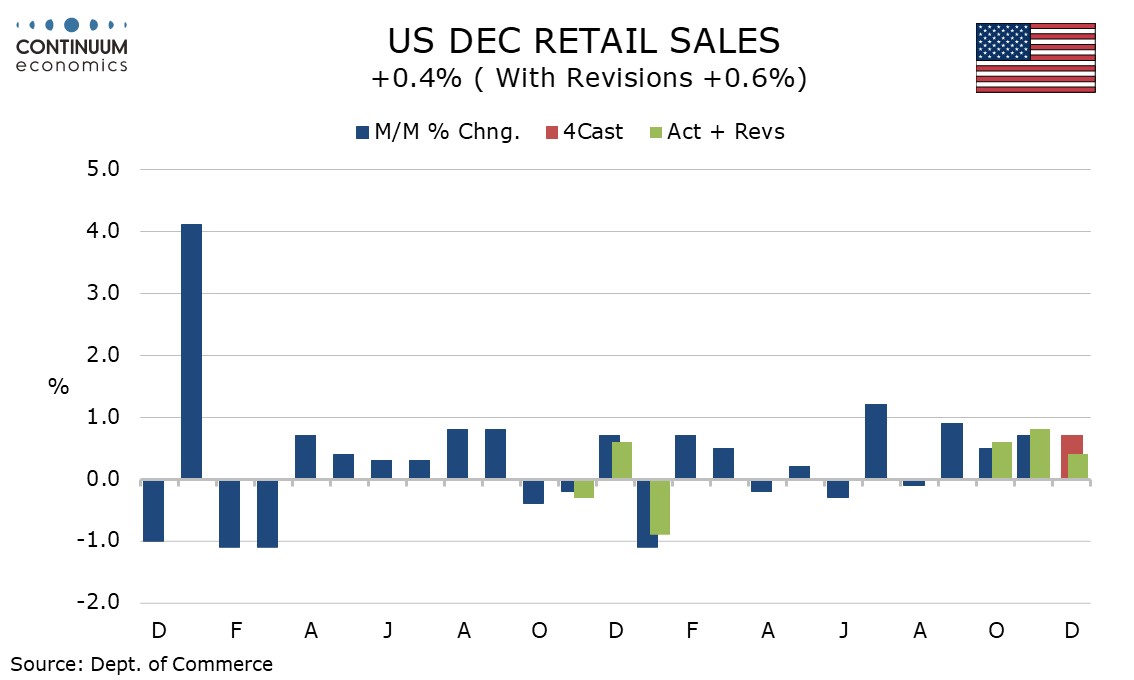

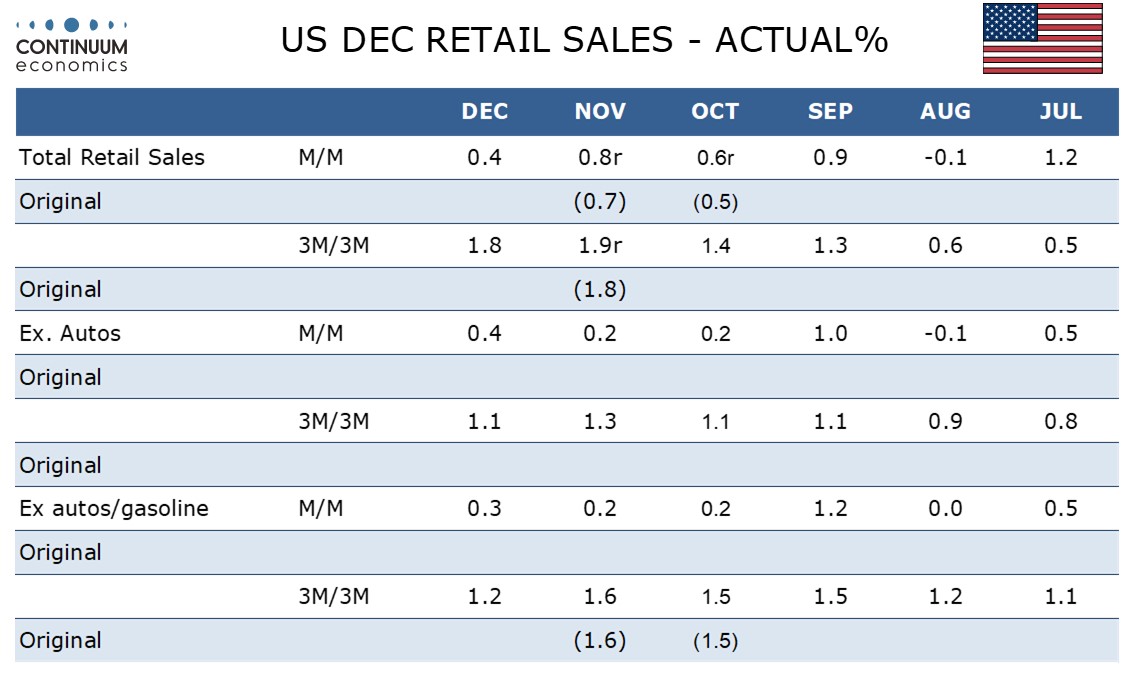

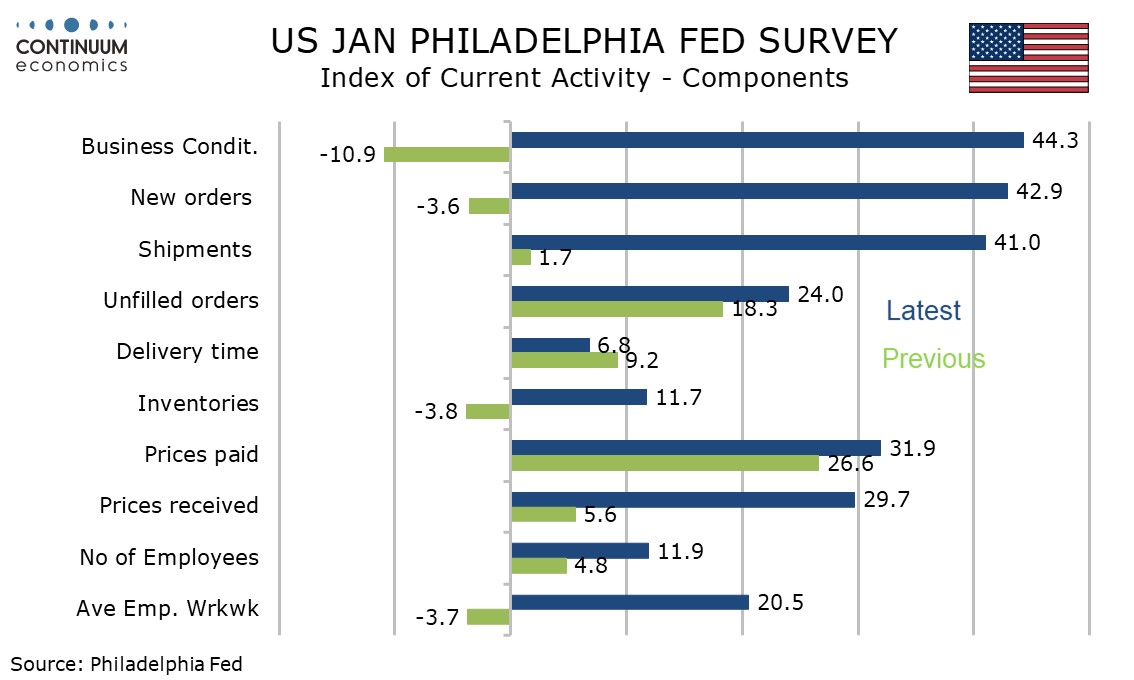

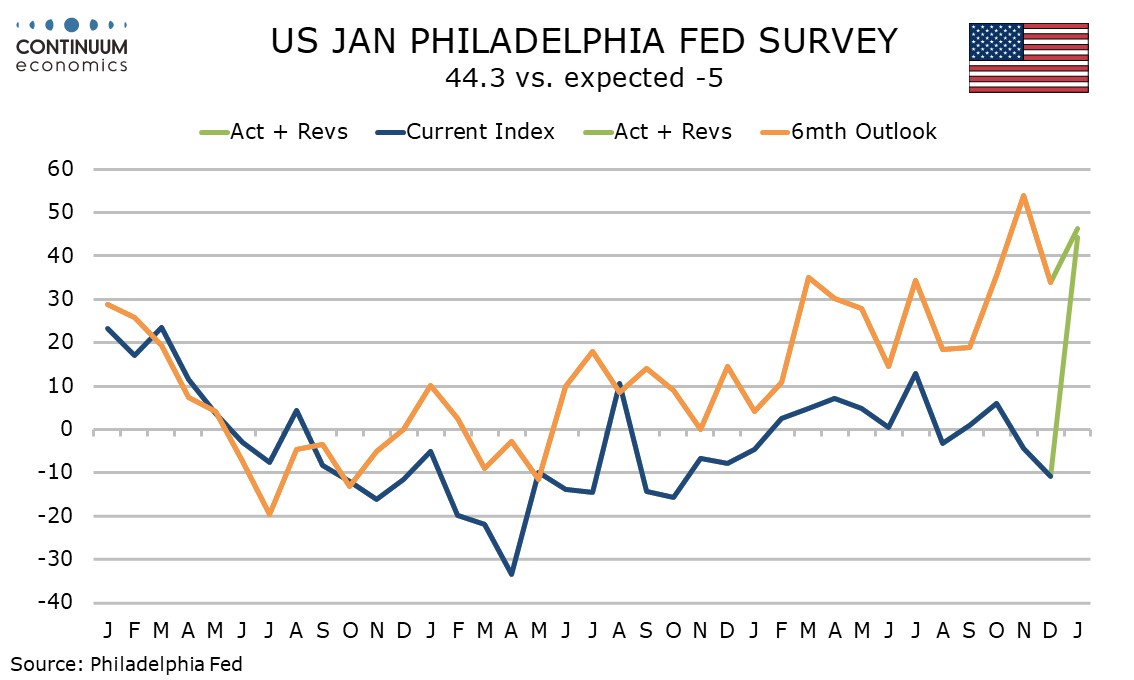

December retail sales with a 0.4% increase overall and ex auto, 0.3% ex autos and gasoline, are on the weak side of expectations but maintain respectable momentum, particularly in the control group which contributes to GDP, which rose by 0.7%. A strikingly strong January Philly Fed manufacturing index of 44.3, up from -10.9 in December, has also been released.

The main restraint on retail sales was building materials, where a 2.0% fall could be a hint that rising bond yields are starting to hit housing. Strength was seen in furniture, up by 2.3%,while clothing and gasoline each rose by 1.5%, the latter supported by prices. Food rebounded from a November decline with a rise of 0.8% but sales at eating and drinking places fell by 0.3%.

Despite the modest disappointment in December, Q4 saw a strong rise of 1.8% (not annualized), the strongest since Q1 2023. Ex autos a 1.1% increase matched that of Q3 while ex autos and gasoline at 1.2%, while down from 1.5% in Q3, was still solid.

The Philly Fed index of 44.3 is the strongest since April 2021 and comes as a sharp contrast not only to a negative December outcome but also a negative January Empire State survey. New orders, employment and the workweek all picked up significantly as did prices received at 29.7 from 5.6, reaching their highest since January 2023. Prices paid at 31.9 from 26.6 are the highest since December 2022.

Six-month Philly Fed expectations at 46.3 from 33.8 are strong but still below November’s 53.9. Six-month expectations for prices paid at 67.3 from 58.3 bounced, but six-month prices received at 53.6 from 54.9 are slightly slower, if still quite firm.

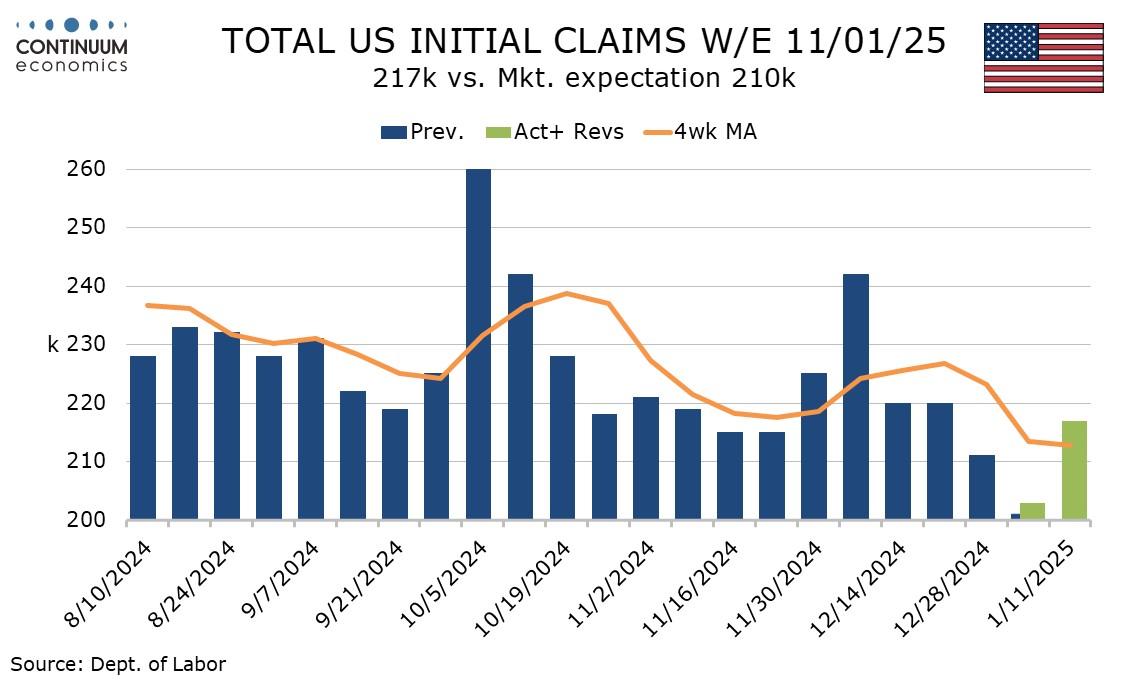

Initial claims at 217k look like a return to what is still quite a subdued trend from lats week’s very low 203k which may have had some holiday seasonal adjustment problems. Cold weather in much of the country and fires in Los Angeles may have lifted the data. The January non-farm payroll will be surveyed next week.

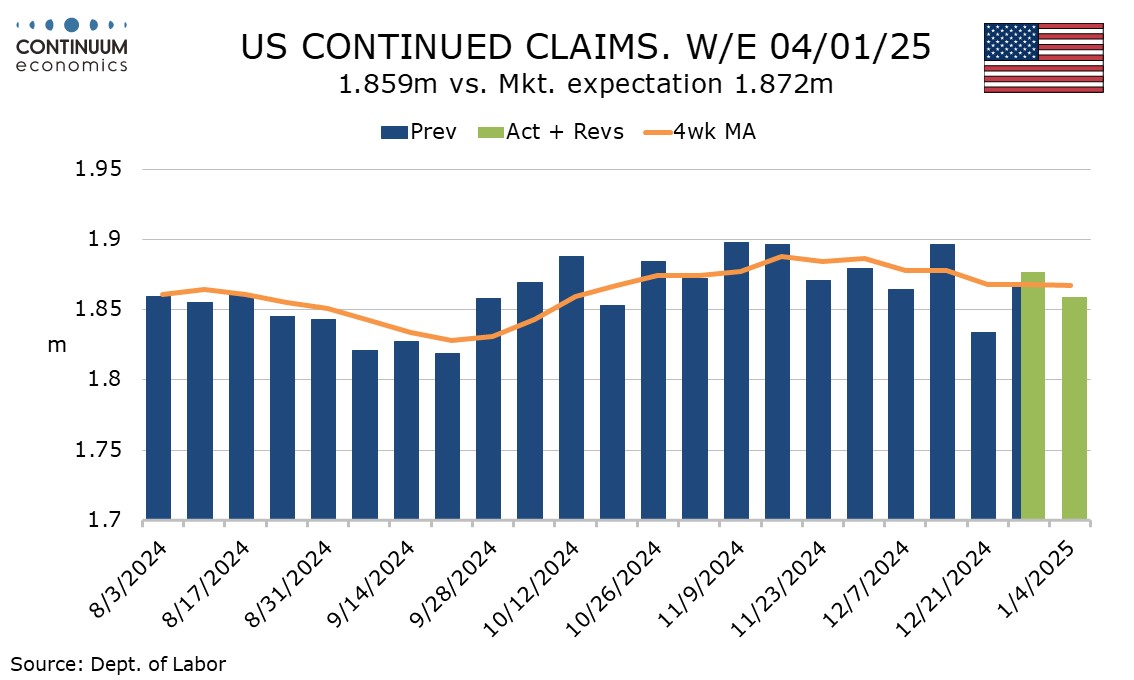

Continued claims, covering the week before initial claims, fell to 1.859m from 1.877m. Trend looks fairly stable.