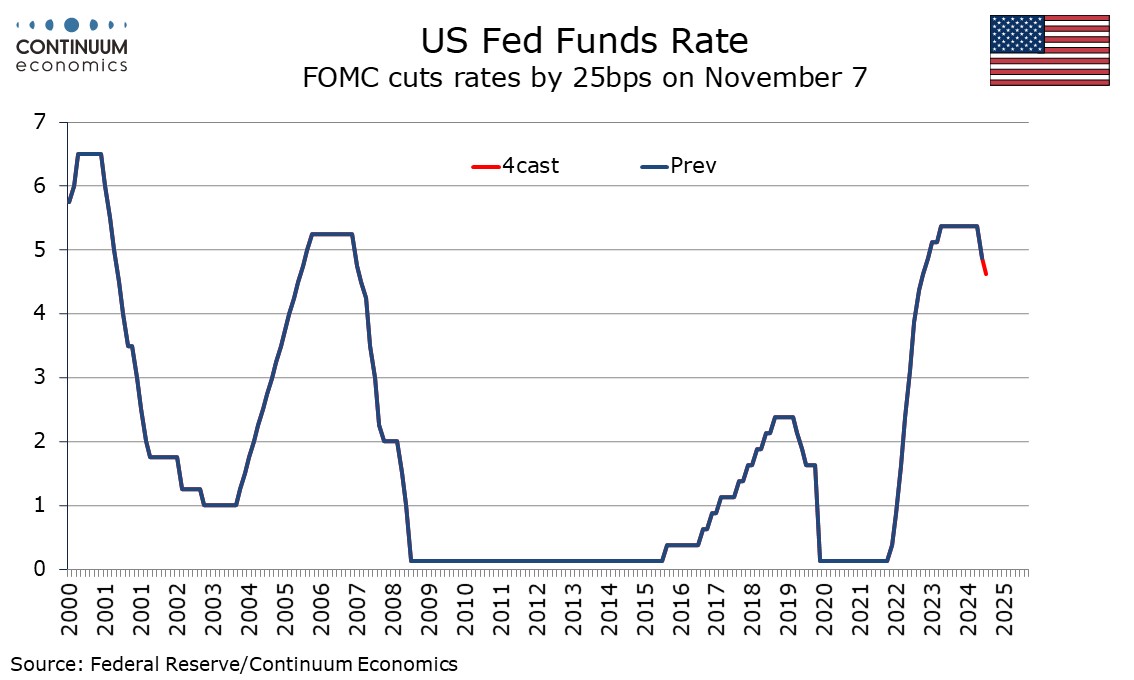

FOMC eases by 25bps, statement avoids dovish hints

The FOMC has eased by 25bps as expected and the statement looks fairly similar to that released on September 18, when rates were cut by 50bps. However, changes in the statement suggest that the Fed has not seen any further reasons for dovishness since its September 18 meeting.

On September 18 the FOMC stated that job gains have slowed. Today it stated that since earlier in the year labor market conditions have generally eased. Since September 18 the FOMC has seen a strong payroll for September but a weak one for October, which may have been depressed by hurricanes leaving the FOMC reluctant to draw strong conclusions. On September 18 the FOMC stated inflation has made further progress toward the 2% objective. Today they dropped the word further, suggesting the picture looks similar to that on September 18, with little further progress.

Going on the FOMC has dropped a phase that it has gained greater confidence that inflation is moving sustainably toward 2%, though still judges risks to be roughly in balance. On September 18, before stating it had decided to ease by 50bps, it made a reference to progress on inflation and the balance of risks. Today it simply stated the 25bps move was in support of its goals. There were no dissents from today’s decision. On September 18 Governor Bowman voted for a smaller 25bps move.