BOE Preview: Clues From February 5

· No change is expected at the Feb 5 BOE meeting, with communications leaving the door open to further interest rate cuts at a slower pace than 2025. However, we still forecast three 25bps cuts in 2026 to 3.00%, with the first likely arriving at the key April 30 meeting. The UK labor market is still weak enough to prompt further wage inflation and underlying inflation slowdown, while fiscal policy is tightening multi-year. This will get the hawks to give way, as 2026 progresses.

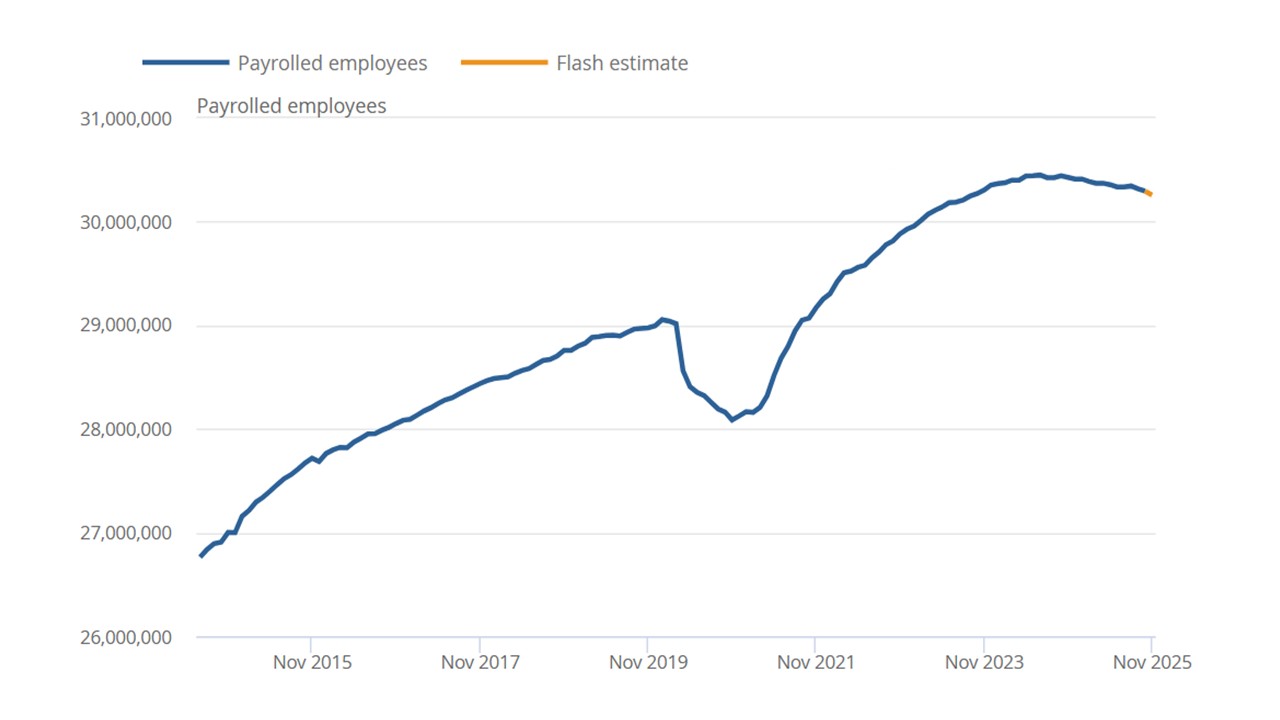

Figure 1: Payrolled employees (SA)

Source: HMRC/ONS

With no change widely expected, the February monetary policy report and MPC minutes will be used to fine tune policy expectations.

· Data since December. Hard and soft survey numbers since the December BOE meeting at face value do not provide any urgency for further near-term rate cuts and sustain a wait and see posture – though some doves could still vote for a cut. Though the 0.3% rise in November GDP reflects volatile elements (JLR production rebound); November and December retail sales were reasonable; December composite PMI edged up to 53.9 and CPI rotated up to 3.4% in December. However, we remain concerned that the underlying conditions in the labor market remain soft and can slow income and then consumption growth and curtail any economic rebound. We place more weight on the HMRC employment data (-45k in December) than ONS data, see Figure 1. Though the vacancy data has shown a small bounce in the last few months, the breakdown shows that most sectors have lower vacancies except arts, entertainment and recreation.

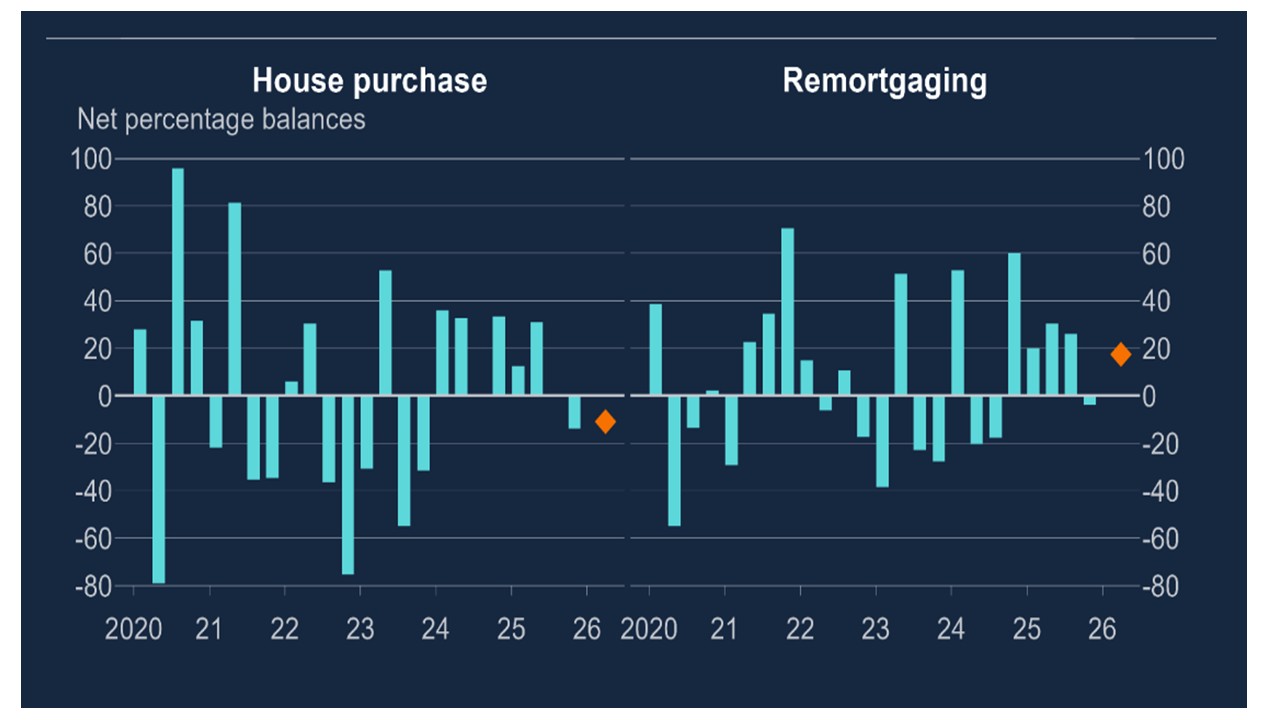

· Latest Credit Conditions Survey. We have also argued that financial and lending conditions are tighter than just looking at the policy rate. The latest January Credit Conditions survey shows mixed signals on credit supply but of great concern is sluggish credit demand from households (Figure 2) and corporates. Refinancing means that the economy is still adversely impacted relative to the ultra-low interest rates between 2008-21. This builds the argument that the BOE needs to do more easing to restimulate the economy, especially given multi-year fiscal tightening that has been hurting business and consumer sentiment.

Figure 2: Demand for secured lending for house purchases and remortgaging

Source: BOE Credit Conditions Survey Jan 15

· February 5 for hints on timing. The February 5 MPC meeting is widely expected to see unchanged rates, but will add to guidance on future rate prospects. Statements since the December MPC meeting suggest no major change of view and the key guidance will remain that some potential exists for lower policy rates but at a slower pace than 2025. The CPI forecasts will be watched closely, but we do not see radical change. Some have noted the jump in UK and global gas prices, but this is mainly spot and end 2026 and 2027 are less impacted. We see the four hawks eventually softening their view and the five cutters becoming more worried, which will combine to deliver three 25bps cut from the BOE this year. The April 30 meeting is key as the monetary policy report is also delivered and we favor a move by then – March would require a run of weak real sector data and lower CPI. The April 30 meeting will also be close to the drop in headline CPI in April as base effects drop out. Timing does depend on when the hawks become more forward looking and change view, which could be gradual or abrupt. However, we are confident that this will happen and deliver three 25bps cuts in 2026.