China: Unbalanced Growth

The February monthly data shows unbalanced growth. Industrial production and public investment picked up, but retail sales slowed and residential property remains a negative drag on GDP. While H1 GDP growth will be ok, it will likely slow in H2 and we still stick to a forecast of 4.4% for 2024 as a whole.

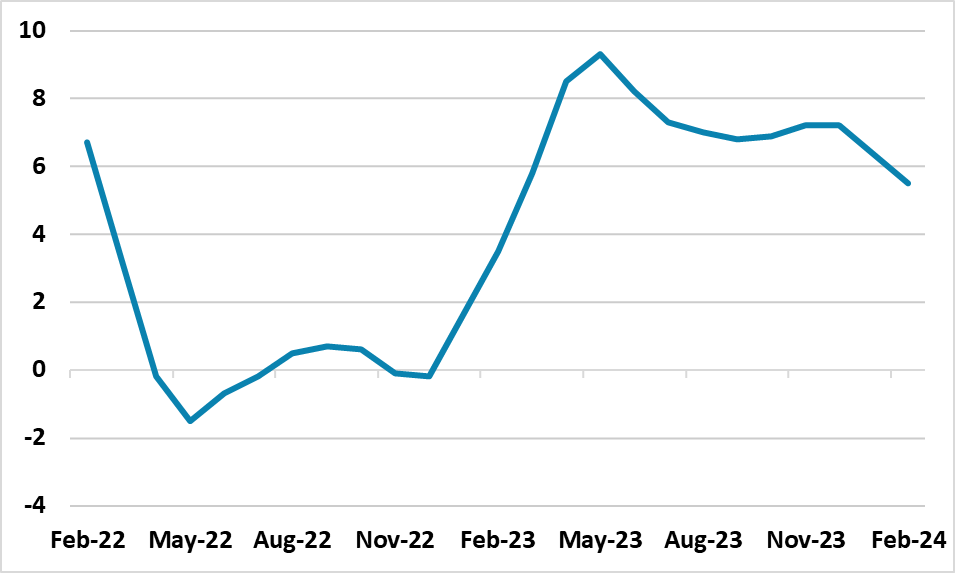

Figure 1: Retail Sales (YTD Yr/Yr %)

Source: Datastream/Continuum Economics

Industrial production at 7.0% YTD Yr/Yr was higher than expected in February, with the breakdown showing that auto production grew by 10% -- partially reflecting the electric vehicle wave for domestic consumption and exports. Meanwhile, public sector investment picked up nicely to 7.3%, which is likely to partially be due to the Yuan1trn flood prevention infrastructure spend for local government.

However, growth is lop sided. Retail sales slowed YTD Yr/Yr to 5.5% (Figure 1). Though tourism and catering did well in the new lunar year period, it appears that consumer spending was directed away from other categories – which fits with the anecdotal comments from companies. Meanwhile, residential property investment at -9.0% and property sales at -32.7% YTD Yr/Yr shows that the negative drag from housing remains, as the authorities have not undertaken a game changer to boost confidence in the residential property sector.

This unbalanced growth will likely remain the story for the remainder of 2024, with a small negative drag on GDP also from net exports – as a soft global economy and switch of some supply chain shifts away from China. Additionally, policy stimulus is investment led and so does not dramatically boost residential investment or private sector employment. The rate of overall GDP growth in H1 will likely be enough that the authorities will only add incremental stimulus measures in Q2, but we see the economy slowing in H2. Consumption boost from pent up demand for tourism will likely slow and this will slow overall growth. We stick with a forecast of 4.4% GDP growth in 2024.