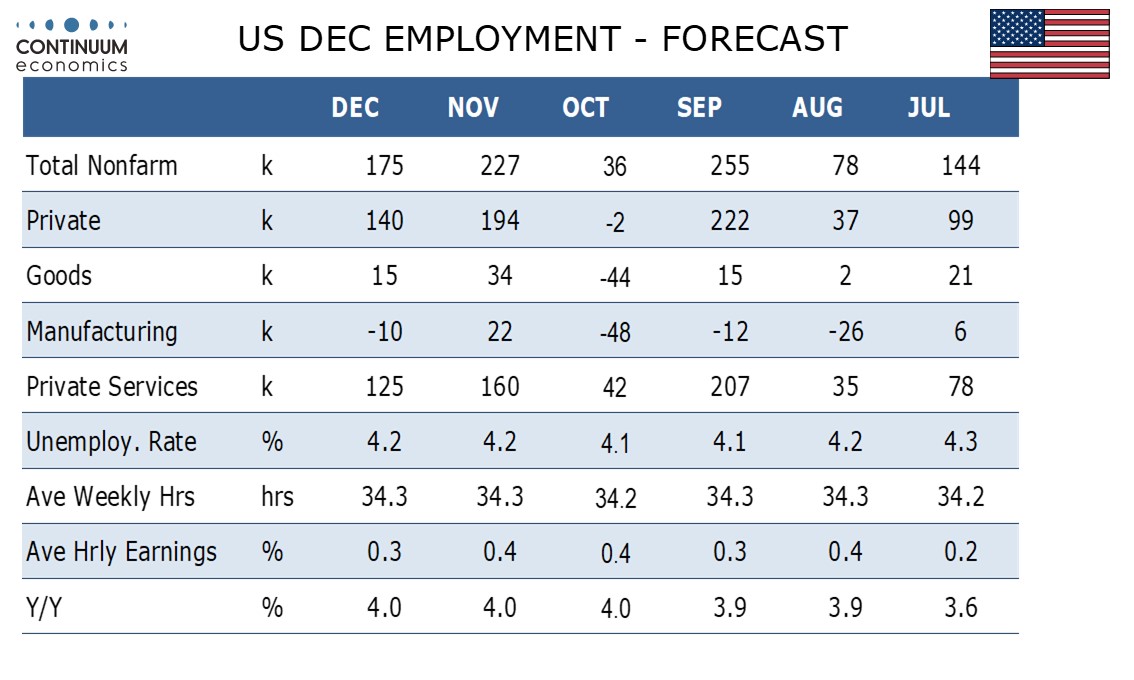

Preview: Due January 10 - U.S. December Employment (Non-Farm Payrolls) - Closer to solid underlying trend

We expect 175k increase in December’s non-farm payroll, with 140k in the private sector, a number that should be closer to underlying trend than a strong November and a weak October. We expect unemployment to be unchanged at 4.2% and average hourly earnings to slow to a 0.3% increase after two straight gains of 0.4%.

October’s 36k increase was restrained by hurricanes and a strike at Boeing and November’s 227k increase saw some catch up. Our forecasts are close to the 3-month averages of 173k overall and 138k in the private sector, though can be seen as positive given that the 3-month average includes September’s strong 255k increase but not August’s weak 78k.

The reason our forecasts are on the firm side of the 2-month and 4-month averages is that we see scope for a stronger rise in construction after two straight below trend gains totaling only 12k, and a rebound in retail after a 28k November decline. Labor market signals are generally positive, though recent very low initial claims numbers came after the payroll was surveyed.

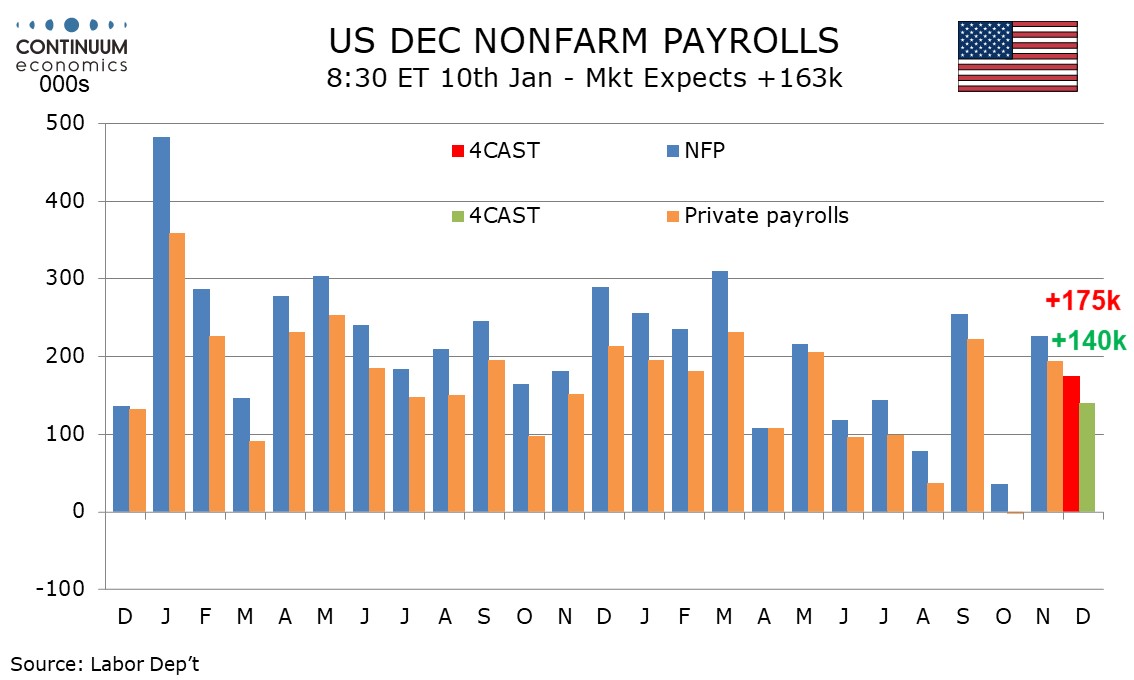

We expect employment growth to exceed that of the labor force causing the unemployment rate to fall before rounding, but at 4.183% will still round to 4.2% after a November increase to 4.246%. Annual revisions will be seen to unemployment rates, which will probably be marginal, though it would not take much to see November revised up to 4.3%.

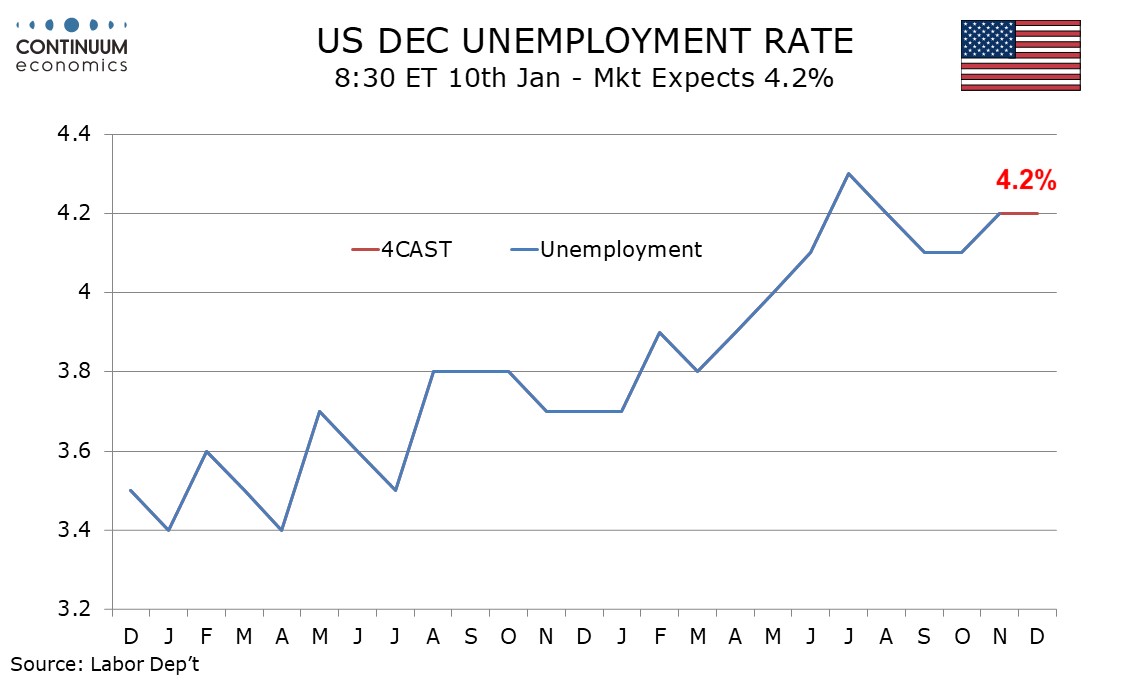

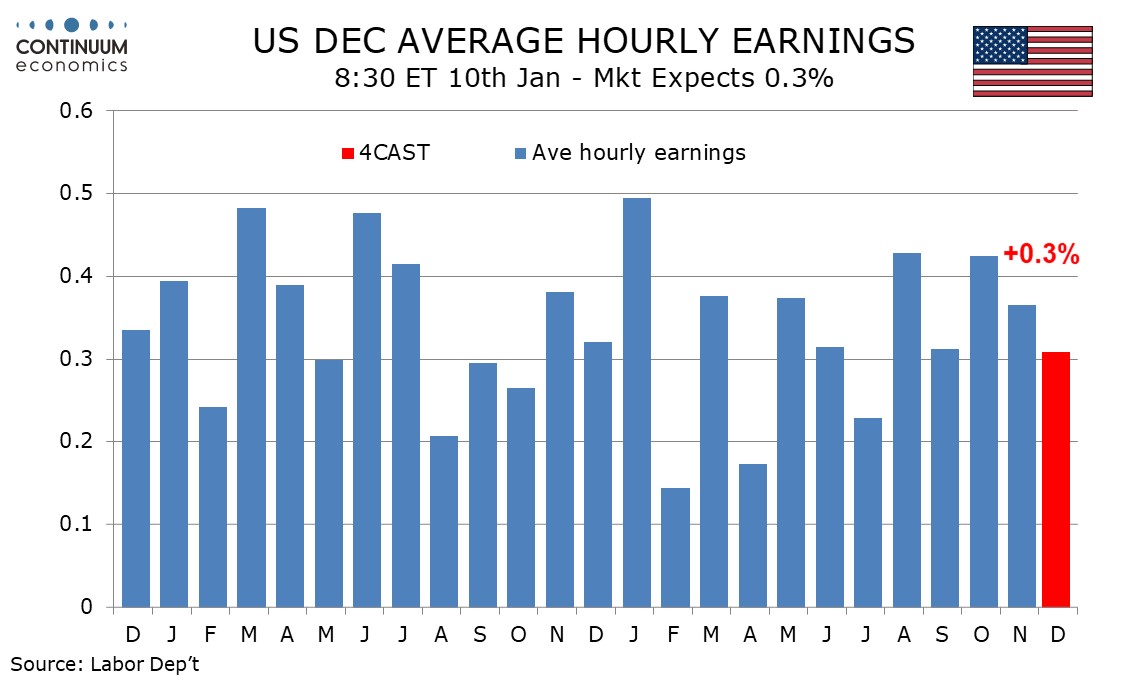

A 0.3% rise in average hourly earnings would be on the low side of trend after two straight slightly above trend gains of 0.4%. Yr/yr growth would then stand at 4.0% for a third straight month.

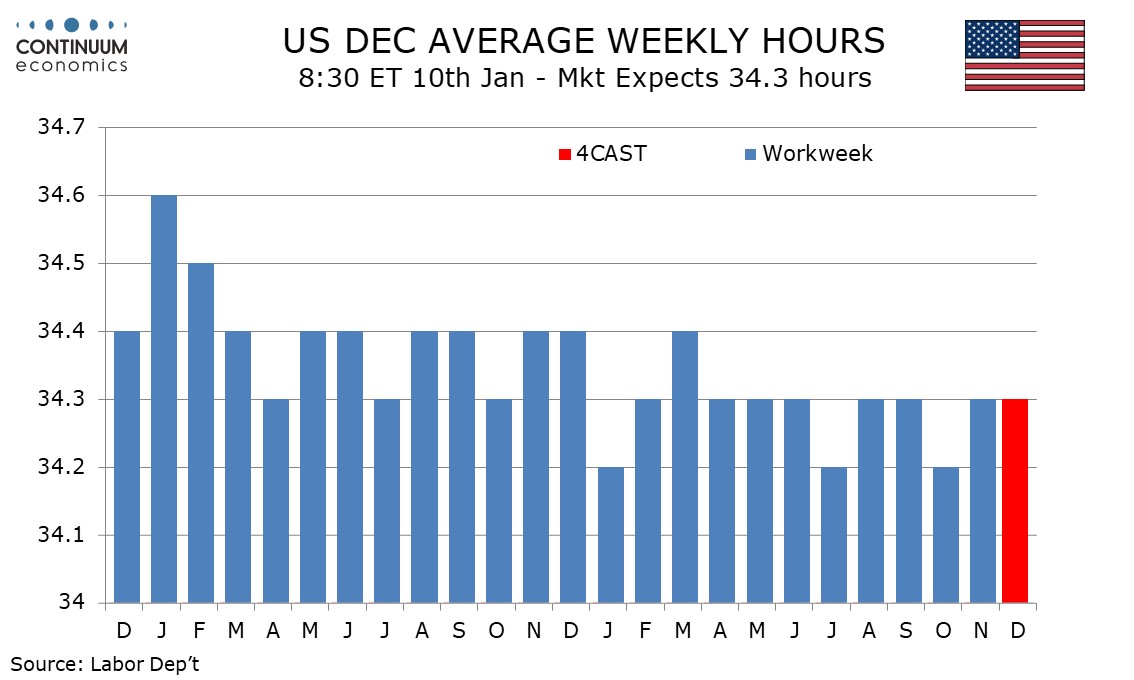

We expect an unchanged workweek of 34.3 hours, matching six of the last eight months and three of the last four, the exception being October’s hurricane-impacted reading. Aggregate hours worked would then rise by 0.8% annualized in Q4, up from 0.6% in Q3. Stronger GDP growth would require continued strength in productivity.