Indonesia CPI Review: Headline Inflation Eases in November, but Core Pressures Build

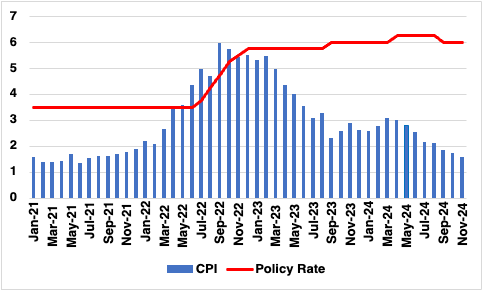

Easing food inflation saw headline CPI decline to 1.5% yr/yr in November. Nonetheless, price pressures from a weakening IDR persist. Bank Indonesia will likely hold rates till the end of 2024.

Source: Continuum Economics

Indonesia’s inflation rate continued its downward trajectory in November 2024, registering at 1.55% yr/yr, according to data from the Central Statistics Agency (BPS). This marks the lowest level since July 2021 and represents a modest decline from October’s 1.71%. The figure remains well within Bank Indonesia’s (BI) target range of 1.5% to 3.5%. The subdued inflation rate reflects a confluence of stabilising forces across key sectors:

Food Prices: Food price inflation dropped to 1.68% in November, the smallest increase since August 2020. The deceleration was primarily driven by ample rice supplies, which followed delayed harvests earlier this year.

Housing and Utilities: Inflation in housing and utilities remained stable at 0.59%, while sectors such as recreation and culture witnessed a marginal decline to 1.49%. Other areas, including education and health services, showed little change, contributing to overall price stability.

In contrast, core inflation, which excludes volatile items like food and energy, climbed to 2.26%, a 16-month high. This highlights emerging price pressures in accommodation and transport, where slight increases were recorded. The divergent trends between headline and core inflation present a nuanced challenge for Bank Indonesia.

With headline inflation remaining low, BI is expected to maintain its current benchmark interest rate in the near term. The uptick in core inflation could warrant closer scrutiny. Despite the encouraging headline figures, challenges remain. The recent weakness in the rupiah could limit BI’s scope for rate cuts, particularly as global economic conditions remain uncertain. Nonetheless, the low inflation environment could provide a boost to consumer spending and investment, aiding Indonesia’s economic activity. In the immediate term, we expect BI to maintain its policy rate at 6% over the rest of 2024. Bank Indonesia will hold rates until the Rupiah reverses is recent losses, in our view.