BoE Preview (Aug 1): Time to Get Less Restrictive

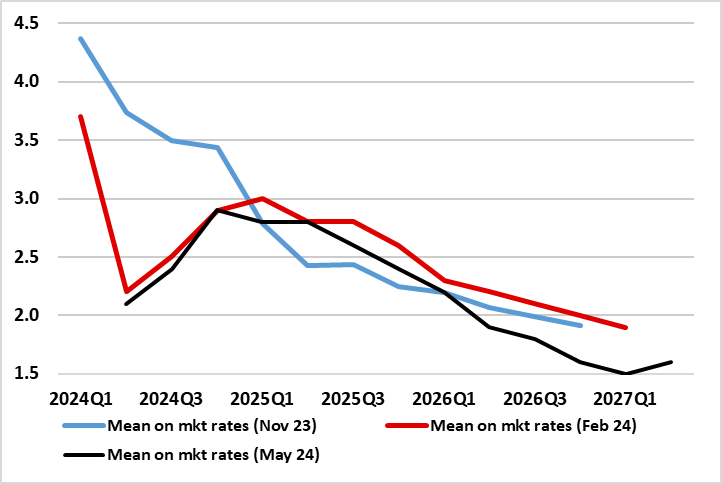

We still think that the BoE will cut Bank Rate by 25 bp at the Aug 1 MPC verdict and that that two further such cuts may arrive by end-year. We accept that stubborn services inflation may harden the hawks, despite softer wage pressures. But while the recent Bernanke Report recommended phasing out the so-called fan chart forecasts, their importance lingers, not least as they will again point to a clear undershoot of the 2% target on a sustained basis in the latter part of the forecast horizon (Figure 1). That such projected undershoots have not triggered rate cuts already is partly (to us) puzzling, not least as recent vintages have removed the projected upside risk to the undershoots. Instead, with the BoE underscoring that its allegiance to its target applies at all times, the fact that CPI inflation has been well above target has been the telling factor. But this is no longer the case and even amid modest upward growth projections, any rise from the current on-target inflation rate is likely to be seen still as temporary. Crucially in presentational terms, the move will be framed as making policy less restrictive but may still have gilt market reverberations!

Figure 1: A Clearer Inflation Undershoot

Source: BoE - last three MPR vintages

Recent Perspective

First some history. As widely expected, Bank Rate was kept at 5.25% for the seventh successive MPC meeting in June, with its rhetoric largely unchanged. But while there were still only two formal dissents in favour of cutting, the minutes clearly suggested that for some of the remaining seven members, the policy decision had been finely balanced. Indeed, for them, despite a real economy backdrop, upside news in services price inflation did not alter significantly the disinflationary trajectory that the economy was on. This implies this group (which may be as large a four) could swing to an actual cut at the looming Aug 1 meeting not least as updated forecasts due then may add to the disinflation ‘story’. The important thing is that even with a few cuts in the next six months, policy would still be clearly restrictive and the MPC has to consider ‘for how long Bank Rate should be maintained at its current level’.

New Member Vital

Of course, there will be more splits and the decision may even be down to that of the newest MPC member. In this regard, MPC personnel churning is market at the moment. Clare Lombardelli partakes in her first MPC meeting this time around, her policy leanings being unclear but important as she will take charge of monetary policy strategy. Otherwise, it may be notable that policy hawk Haskel attends his final MPC meeting with his replacement yet to be named.

Fan Chart Still Influential

We have for some time had issues with the manner in which the BoE’s fan charts are used and computed, most notably in regard to how the Monetary Policy Report (MPR) has steadily increased the assessed degree of uncertainty. Indeed, the MPC May MPR envisaged inflation at 1.6% at the end of its three-year formal forecast horizon, but with an uncertainty parameter still of an elevated 1.9%. In effect this, means that the MPC anticipates that (and with two-thirds probability attached) inflation will actually be in a range from -0.3% to 3.5%. This is a very wide target which implicitly is seen being missed one third of the time. This may be one reason that the recent Bernanke Report recommended reform: both in how the Bank of England’s Monetary Policy Committee operates, not least alternatives to the so-called fan charts. Notwithstanding Bernanke’s recommendation to downplay the baseline inflation forecast, for the time being they will remain crucial to how the BoE assesses the outlook for inflation persistence – and possible more so.

Indeed, the fan charts may have become more influential of late, not least as the anticipated size of the undershoot has grown (Figure 1). Admittedly policy was persistently tightened until almost a year ago even amid anticipated falling and usually below target projected inflation. But this reflected two other factors. Firstly, the projections had clear upside risks as defined statistically by skewness, or the difference between the mean expected inflation path and the mode. But this is no longer the case and recently the MPR’s point to no upside risks. Secondly, it takes around 18 – 24 months for monetary policy to have its full effect on the economy. So MPC members need to consider what inflation and growth in the economy are likely to be in the next few years. But while forecasts of below target inflation have been frequent, their influence has been diluted by actual inflation having been clearly above target – the BoE says the 2% target applies at all times.

However, the inflation target is now being met and although the MPR is likely to see the rate moving back above target, this will be seen to be short-lived again. Thus, the fact that the fan charts no longer embody upside inflation risks and that inflation is back to target mean they can and should be crucial in framing policy – NB; alternative policy perspectives that have been discussed (such as dot-plots and alternative scenarios) did not prevent the central banks using them (most notably the Fed and Riksbank) from making similarly-sized recent forecasting errors to the BoE.

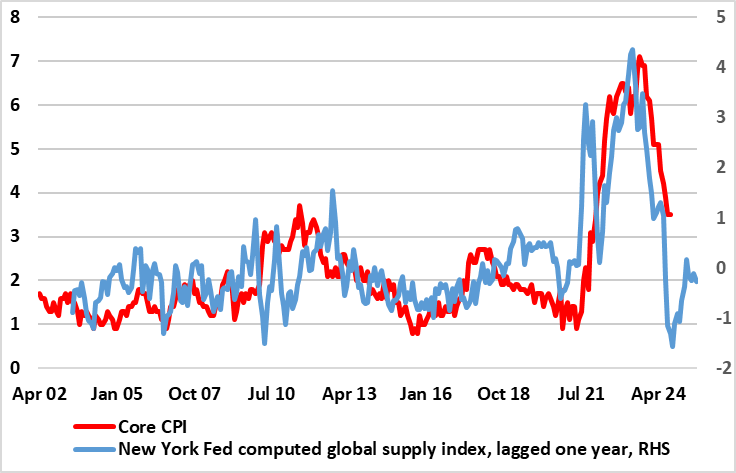

Figure 2: UK Disinflation – So Far Supply Driven?

Source: ONS, New York Fed Global Supply Chain Pressure Index

BoE Considerations

It is clear that real activity data are not having a material impact on MPC thinking regarding how durable and sizeable is the disinflation process. We will be looking to see if the MPR makes any mention of the backdrop where labor market developments (especially jobs) suggest a much weaker, if not weakening backdrop, compared to the much improved GDP picture. Regardless, the BoE will probably agree with us that much of the recent (and possibly looming) disinflation is supply driven (Figure 2shows the extent to which easing global supply pressures as computed by the New York Fed has probably driven UK underlying inflation). This means that even with some reduction in the excess supply picture evident in the May Monetary Policy Report (of 1% of GDP into 2027), domestic price pressures should add to this easing in supply strains – hence the clearly below target inflation outlook the BoE is likely to adhere to in August.

In addition, two key MPC recent reassessments have affected its inflation outlook and probably are influencing the dissenters and those that are erring. Firstly, came an acknowledgement in the last MPR that the feed-though from the recent surge in import prices has occurred faster than previously assumed and thus is now likely to have less of a further potential inflationary impact ahead. Secondly, the BoE seems to think any second-round effects from high CPI inflation into wages may now fade faster than previously thought. All of which helps explain the overall greater overall confidence in a softer inflation outlook and with risks much more balanced. Thus, it was not surprising that the BoE inflation profile has been revised down.

One key area of uncertainty is the fiscal side. New Chancellor Reeves may announce the data of her first Budget in the next week but use the announcement to suggest some fiscal consolidation is on the cards, the details of which will not be embodied into BoE thinking until November. But they add to what to us are still downside activity risks even amid better business surveys which to us more reflect improved confidence in political stability ahead. What remains the case is that the updated BoE projections offered in May at least validated the rate path discounted by markets, with below target inflation, this possibly suggesting larger easing than the two moves then seen through this year and a view that largely is still the case. This is something that chimes with the cumulative reduction of up to 75 bp by year end we are now forecasting and with around a full ppt in 2025. We think that even such a rate cut profile would still leave policy restrictive and thus bearing down on inflation further.