UK Labor Market – Private Payrolls Contract Amid Cost Pressures?

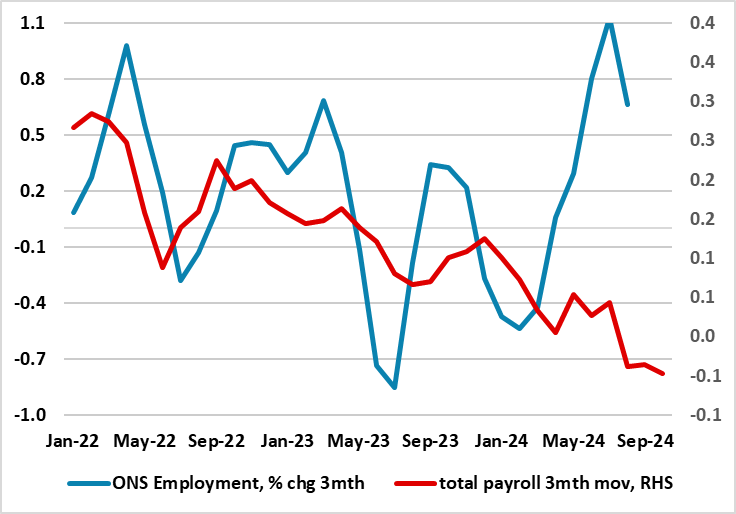

To suggest that the UK labor market is merely getting less tight misses the point entirely. Amid continued reservations about the accuracy of official labor market data produced by the ONS, alternative and very clearly more authoritative data on payrolls suggest that employment is continuing to contract. Indeed, the payroll data produced by the HMRC, have now show three successive m/m falls and four since the level of payrolls peaked five months ago. Admittedly, the drop in this five-month period is only 0.2%, but this is a marked contrast to the 0.7% increase official data suggest has occurred in the last quarter (Figure 1). More notably, overall payrolls have been buttressed by sizeable public sector employment gains to a degree that private payrolls in the last five months are down almost 150K (ie -0.7%). Moreover, amid fiscal strains, non-health public sector jobs have now started to fall too, compounding what has been an ever clearer haemorrhaging of jobs in private services (Figure 2), thereby suggesting that cost pressures (now accentuated by the proposed increase in employee National Insurance Contributions and the actual rise in the minimum wage) have already affected the labor market severely. The marked upgrade the BoE made in its latest forecast to 2024 employment growth thus seems optimistic.

Figure 1: Sharp(er) Fall in Payrolls Contrast with Still-Strong Official Jobs Messages

Source; ONS, HMRC

Amid distortions in much of the labor market data, the BoE is focusing on private sector numbers, especially given the added distortion of recent and looming high public sector ay awards. In that regard it will get some solace from today’s average earnings data which show private regular pay at the lowest in 2½ years and at 4.8% chimed with BoE expectations. But rather than focusing on pay, perhaps the BoE should start to ponder over the employment numbers, at least those authoritative figures provided by His Majesty’s Revenue and Customs (HMRC). As we have highlighted before they show continued weakness in employment that questions the validity and/or durability of recent upbeat GDP data and official employment numbers compiled by the Office for National Statistics (ONS). But the fact that this weakness actually reflects even sharper fall in private sector jobs, also questions the validity and/or durability of ever more upbeat PMI numbers whose coverage excludes the public sector and retailing.

Private Pay Growth Slow-Down Stalled or Reversing

Given the impact of very sizeable pay awards, there is clear merit and method is concentrating on private sector pay, not least as it should better chime with cyclical developments. Admittedly, the data is also affected by the sampling problems that bedevil all ONS-compiled labor market numbers, but HMRC pay data have also show a clear slowing late, albeit one that may even have starred to reverse. This is important as HMRC data is very authoritative in that it covers all those who are employed and paying tax as opposed to the extrapolation needed with survey data. Indeed, mean pay on this basis has picked up from a four-year low of 3.0% in June to over 5%, and where median pay picked up even more.

Private Jobs Slumping

Notably, just as HMRC-compiled pay data are still statistically sound and authoritative, so are the payroll data that are compiled alongside. These cover the 30.4 mln of those officially employed and as we have been noting have been showing a slowing of late, at least in terms of private sector payrolls. What is perhaps less known is that while overall payroll jobs have risen, (up around 180K in the last year) this is solely due to public sector worker increases - a circa-250K rise in the last year. Around half of this rise is health and social care and a quarter on education. But amid ever-clearer signs of intensifying fiscal consolidation, questions must be asked about the durability of such public sector jobs gains at least outside of the clear commitment to the NHS.

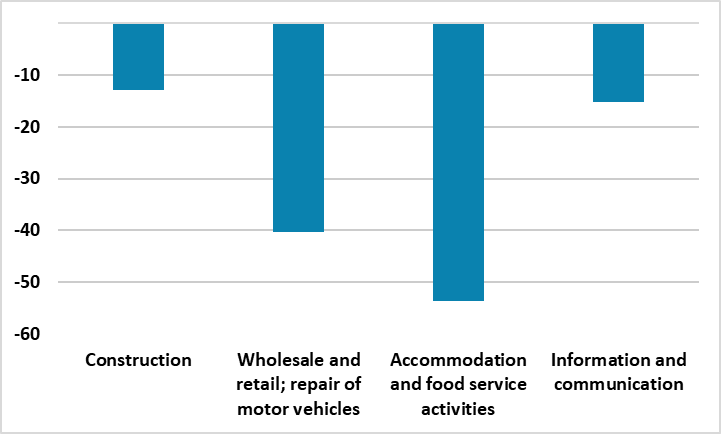

Figure 2: Sharp Fall in Payrolls in Services and Construction Already Very Evident

Source; HMRC, thousands, chg in last five months

Indeed, amid fiscal strains, non-health public sector jobs have now started to fall too, compounding what has been an ever clearer haemorrhaging of jobs in private services. Notably, private payrolls in the last five months are down almost 150K (ie -0.7%) mainly on the basis of an ever clearer haemorrhaging of jobs in private services (Figure 2). This suggests that cost pressures (now accentuated the actual rise in the minimum wage) and evident in still resilient earing figures have already affected the labor market severely, not just curbing the appetite for firms to take on new staff, but to reduce employment instead. Against this backdrop, surely the proposed increase in employee National Insurance Contributions may only add to company nervousness and the deferral, if not a drop, in employment. The marked upgrade the BoE made in its latest Monetary Policy Report forecast to 2024 employment growth (from zero to +¾%) thus seems optimistic and merely adds to our reservation that the MPC is overlooking continued, if not growing, downside risks.