UK GDP Review: Underlying Economy Fragility Does Continue

First the good news; the UK economy grew for a second successive month in December, something not seen for almost a year. But as is familiar with recent UK real economy data, there is a negative flip side with the 0.1 m/m December advance negated by downward revisions to previous figures (November pared back 0.1 ppt to 0.2) and September downgraded similarly. As a result, the economy grew by 0.1% q/q in Q4, less than consensus and BoE thinking but matching the feeble gain of the previous quarter with weakness in business investment occurring alongside another gain in imports. Activity in December was impaired by fresh weakness in manufacturing, utilities and construction. The data is likely to reinforce the demand worries of what now seems to be an emerging majority on the MPC; six members of the MPC appear worried about the disinflationary impact from a weak economy - four of whom actually voted for a 25bp cut at this month’s meeting.

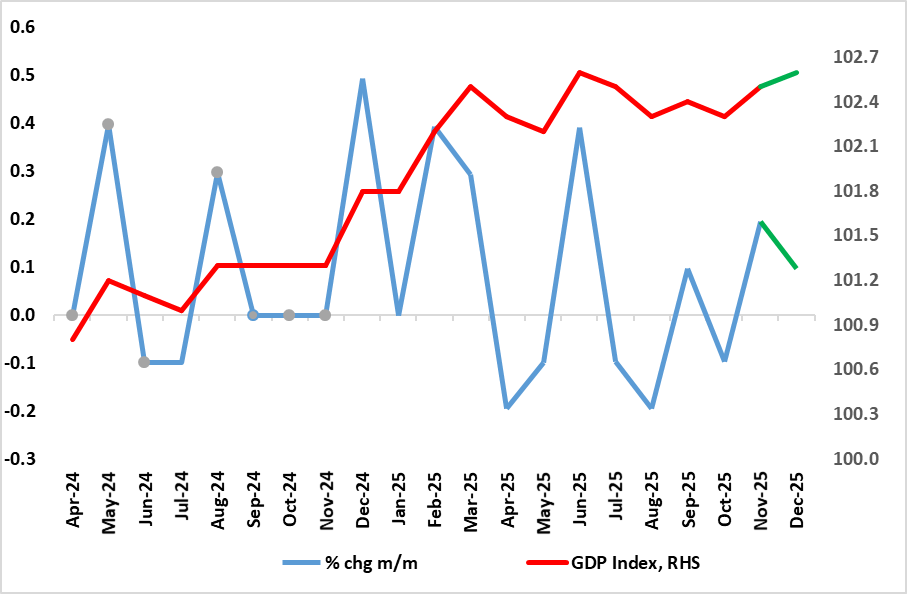

Figure 1: GDP Growth Volatile but Hardly Strong?

Source: ONS, CE

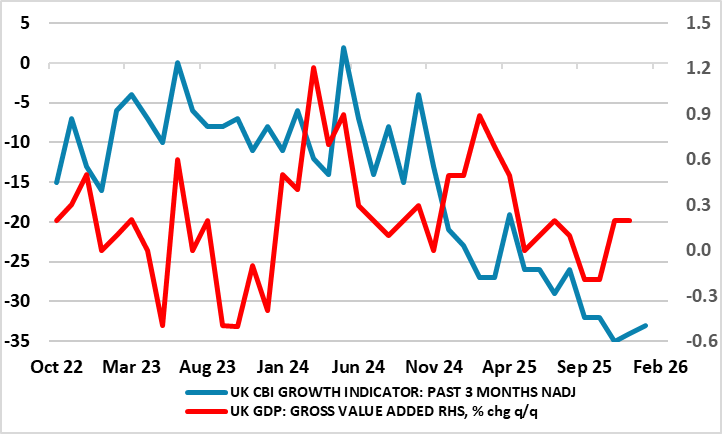

Even given the surprisingly solid, but somewhat pared back November GDP release, December merely returns the level of GDP to where it was in June. Partly undermined by wet and warm weather through the month, GDP advanced by a mere 0.1% in December figure, half that of November. This means that Q4 saw a 0.1% q/q rise which would result in 2025 growth of 1.3%, two notches above that seen for 2024. But we still see no more than 0.8% this year; this actually and merely being a minor pick-up from the anemic growth seen in the last two quarters. Regardless, we remain wary about the GDP numbers, even given their relative weakness. Although there have been some better business survey numbers, other such insights provide still sobering reading (Figure 2) as do non-official employment indicators, the latter actually suggesting a worsening backdrop of late.

It is unclear how uncertainty (especially related to budget worries) affected activity in October and whether a degree of more fiscal clarity even ahead of the actual Budget may have helped sentiment in November. But businesses across the production, construction and services sectors reported that they, or their customers, were waiting for the outcome of the Autumn Budget 2025 announcement on 26 November 2025. These comments came from a range of industries, but were mainly from manufacturers, construction companies, wholesalers, computer programmers, real estate firms, and employment agencies.

Figure 2: Surveys Offering Diverging Signals?

Source: ONS, CE, CBI, Markit

Regardless, for some time, we have discerned very feeble momentum, which may actually be nearer zero, especially once ever-clearer construction weakness is incorporated. While overall GDP is estimated to be 1.0% higher in Q4 2025, compared with the same quarter a year ago, real GDP per head is estimated to have fallen for the second consecutive quarter by 0.1%, and is up by 0.6% compared with the same quarter a year ago. This is a politically important issue amid current immigration issues. Indeed, the IMF see a cumulative per capita growth of 0.9% for 2025 and 2026, the weakest in the DM world save for a similar soggy outlook for Germany.

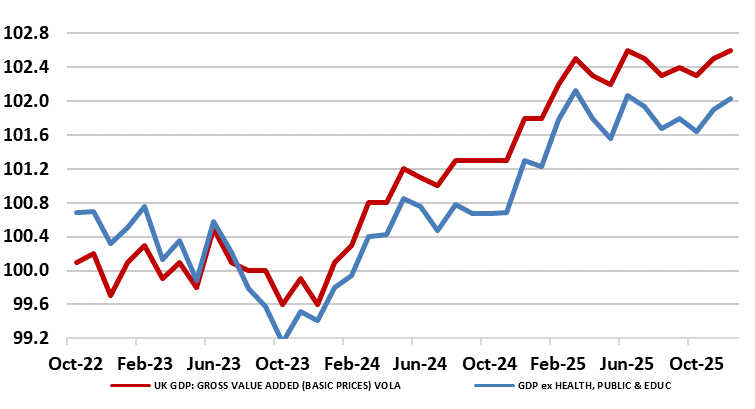

Moreover, gauging the economy is all the more difficult given the extent to which the public sector has supported growth and employment of late (Figure 3). Amid fiscal strains, albeit where the recent Budget legislated some increase in real government spending into 2027, the question is whether this latter factor will go in to reverse, sooner but probably later – health sector jobs already seem to be being shed.

Figure 3: GDP Boosted by Public Sector

Source: ONS, CE