Preview: Due January 30 - U.S. Q4 GDP - Maintaining Momentum

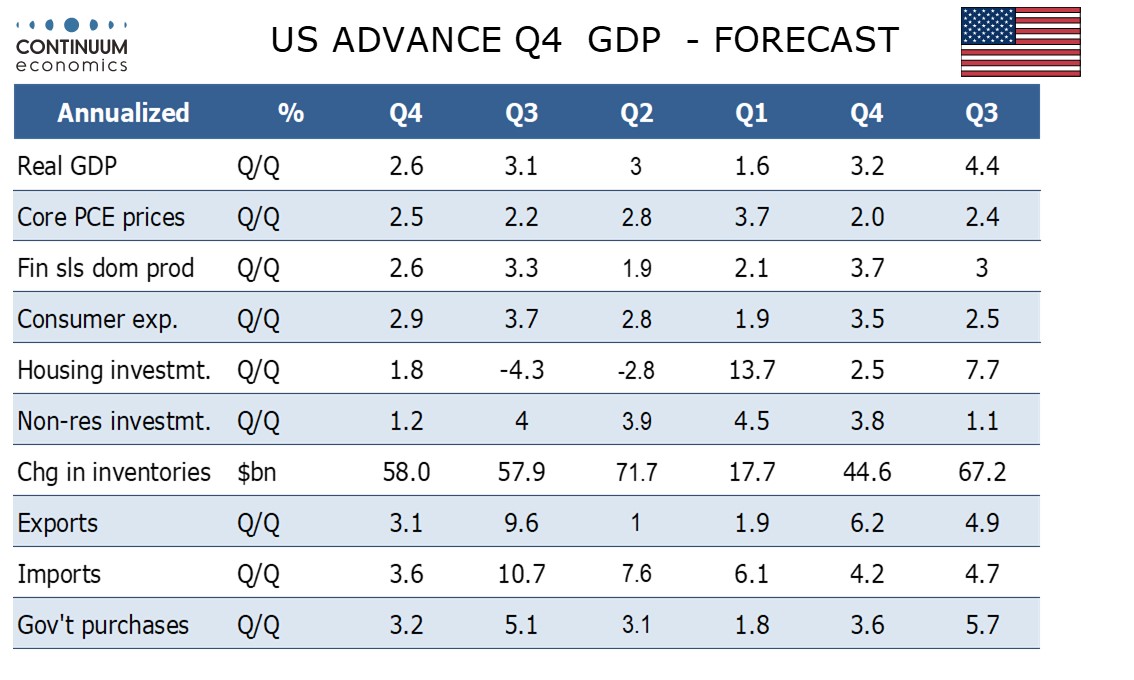

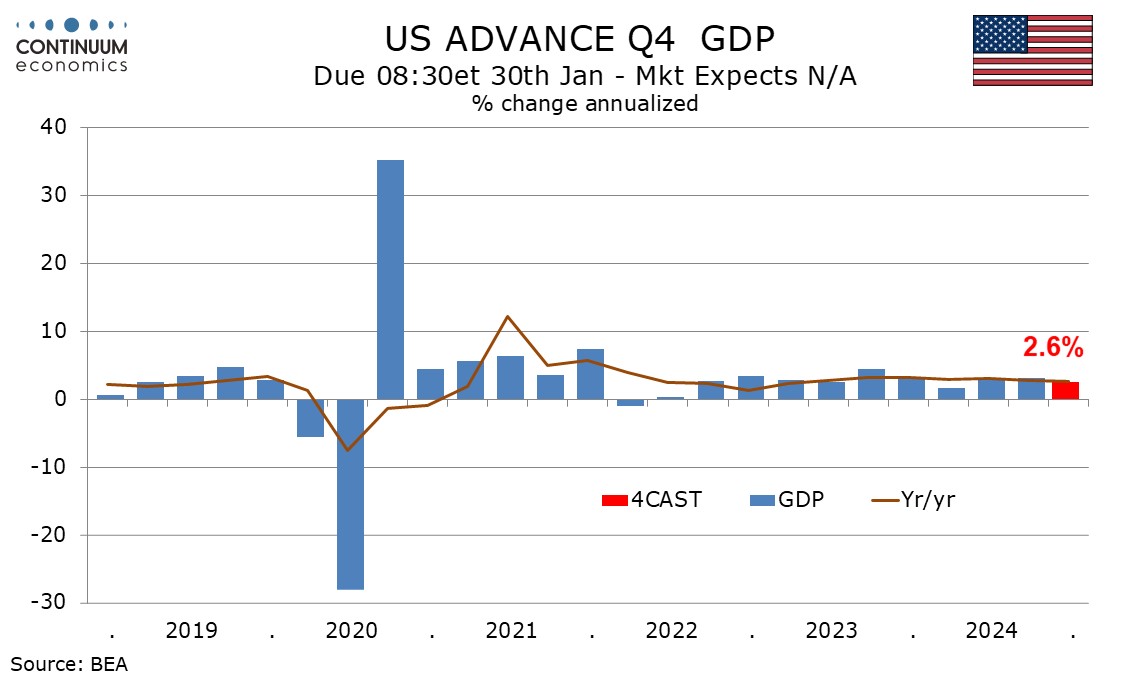

We expect a 2.6% annualized increase in Q4 GDP, slower than Q3’s 3.1% but still maintaining solid momentum.

The gain may have been stronger without strikes and hurricanes in early October, though recovery was largely complete by December.

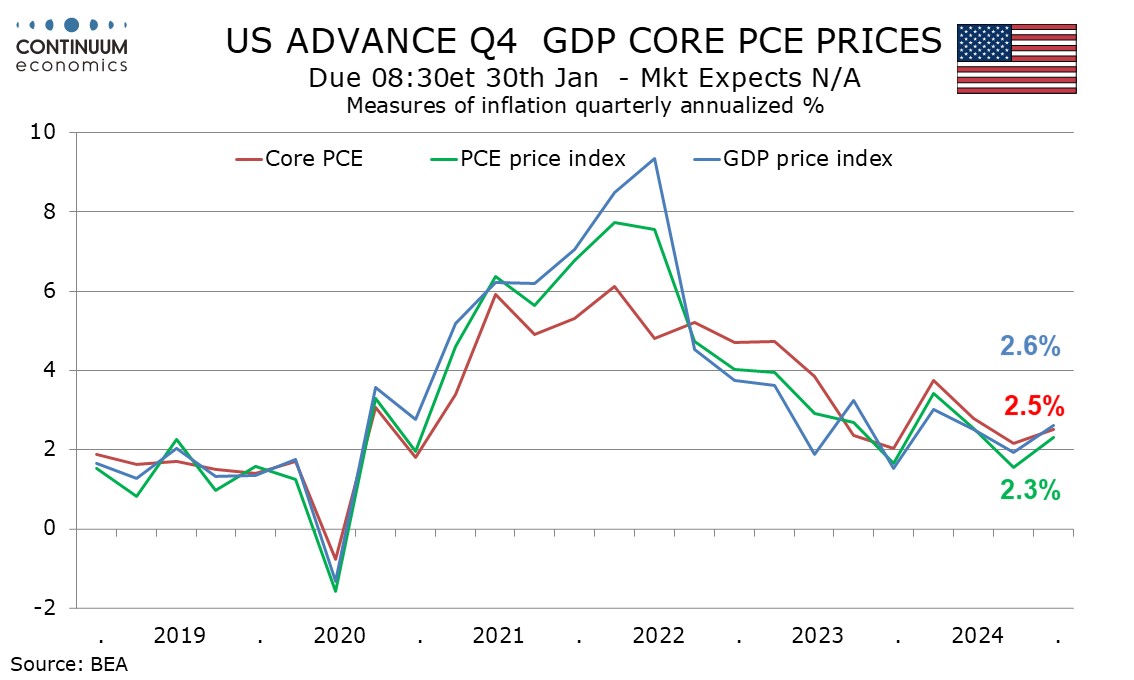

We expect core PCE prices to see a modest acceleration to 2.5% from Q3’s 2.2%, assuming a 0.2% rise in December. Overall PCE prices will be slightly slower at 2.3% but the overall GDP price index slightly firmer at 2.6%, lifted by subdued export prices marginally outperforming import prices.

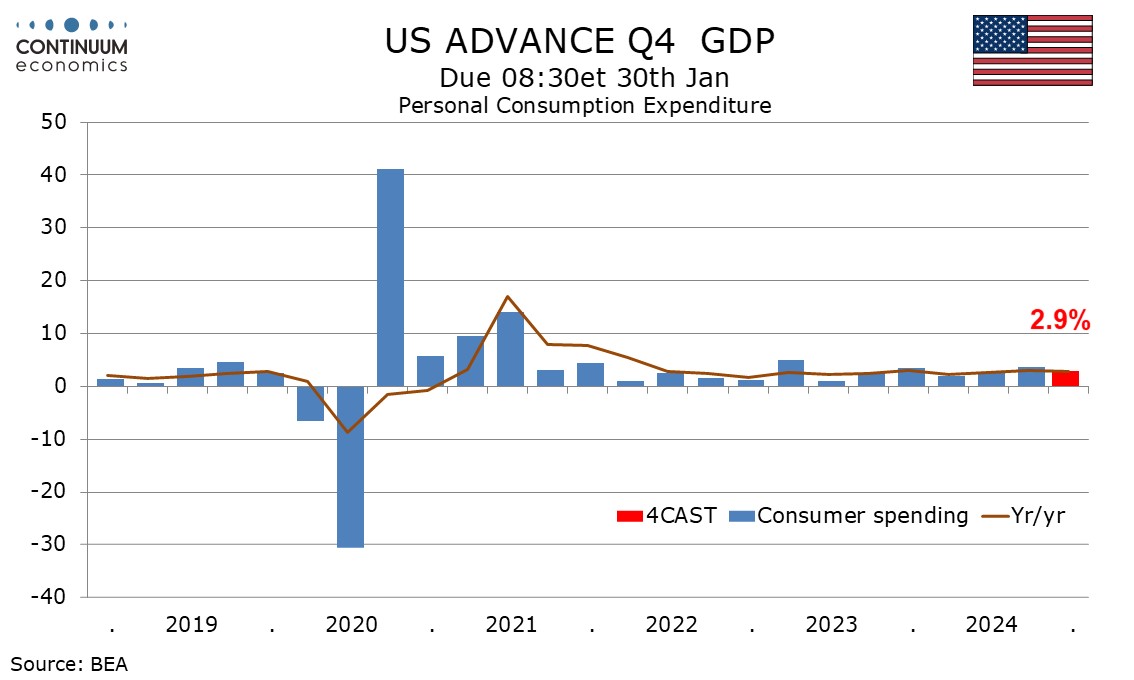

We expect final sales to domestic buyers (GDP less inventories and net exports) to rise by 2.7%, with consumer spending at 2.9%. Consumer spending will be led by durables, autos in particular, with a rise of 9.2%. We expect non-durables and services to see modest gains of 2.3% and 2.2% respectively. We expect consumer spending to marginally underperform a 3.2% increase in real disposable income, correcting a more significant outperformance in Q3.

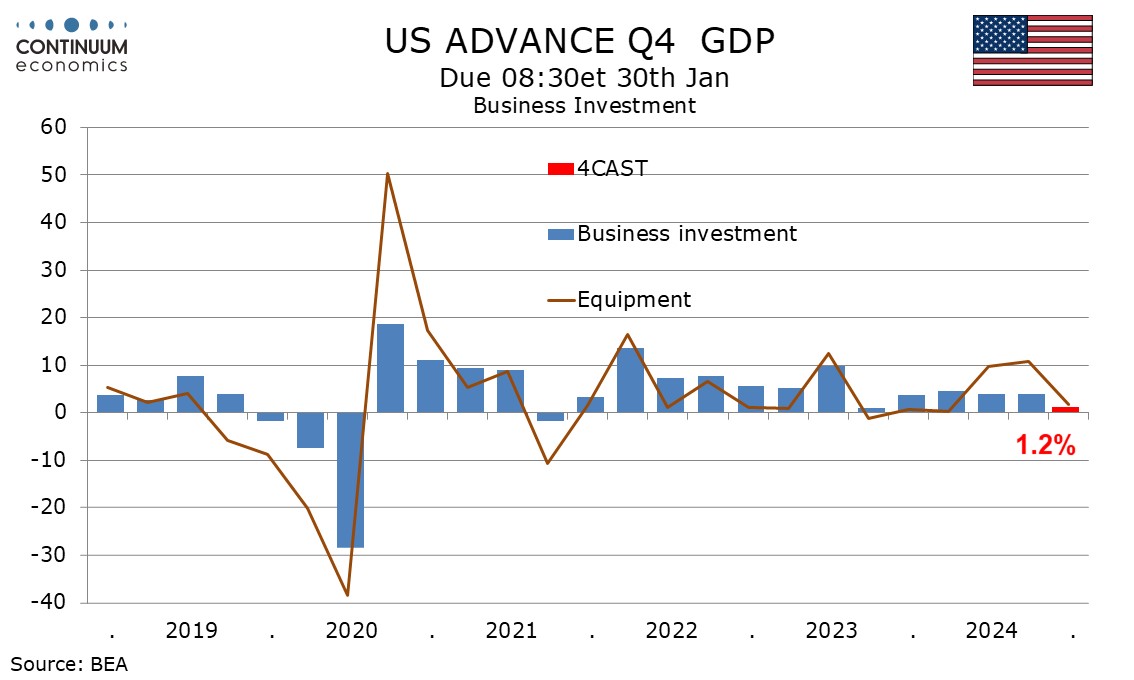

Housing activity has picked up modestly with the start of Fed easing and we expect a 1.8% rise in residential investment after two straight declines. However, we expect business investment to slow to a 5-quarter low of 1.2%, restrained by a strike at Boeing and continued weakness in structures. For government we expect a rise of 3.2%, similar to Q2 but a slowing from Q3’s 5.1% when defense was particularly strong.

We expect exports to rise by 3.1% and imports to rise by 3.6%, leaving final sales (GDP less inventories) at 2.6%, meaning a negative contribution of 0.1% from net exports. Both series will slow from Q3 restrained by a ports strike in October, but are likely to finish the quarter strongly, with imports likely to be lifted by the threat of tariffs. This would also lift inventories, which we expect to pick up in December after two subdued months, leaving inventories neutral in Q4 GDP.