USD, EUR, JPY, CHF flows: JPY under pressure as risk sentiment recovers

USD/JPY and EUR/JPY testing the highs. EUR/USD steady

A risk friendly overnight session has seen the JPY fall back to test the lows against the USD, with EUR/JPY also testing the recent highs above 165. The lack of commentary from the Japanese authorities suggests they have either given up or are preparing for intervention if we see a break above recent highs in USD/JPY and EUR/JPY. The risk friendly environment means that JPY weakness is supported by the correlation with equity risk premia, and in these circumstances intervention is unlikely to have more than a short term effect. In the end, risk premia need to move higher if the JPY is to stage a recovery, and this will likely require lower US yields, so while we may see BoJ action on a JPY break lower, it would be a holding operation awaiting a change in market sentiment rather than an attempt to turn the trend.

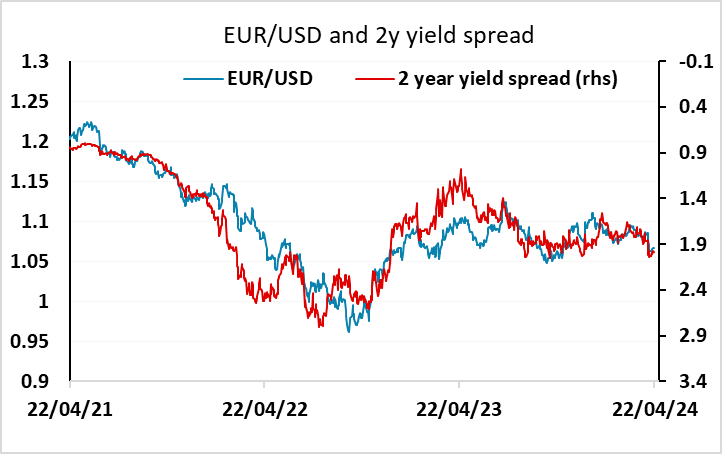

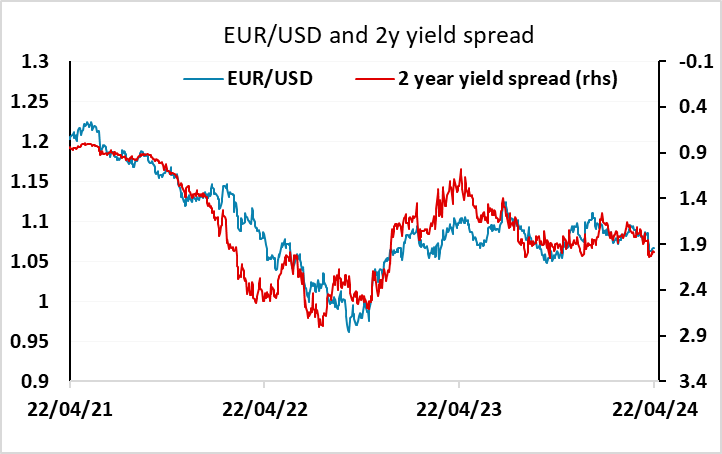

EUR/USD continues to move closely with 2 year yield spreads, and consequently looks unlikely to move away from the mid-1.06s in the short run. There is no data of note today, so it’s hard to see the market changing its assessment of the likely policy paths of the Fed or ECB. However, with the Fed now only priced to make 1 ½ rate cuts this year, the bigger picture risk looks to be that as time goes on more rate cuts are priced in to the 2 year tenor, suggesting some USD downside risk.

News early this morning of the SNB raising minimum reserve requirements hasn’t had a significant impact on the CHF, which has softened with the JPY overnight as risks sentiment has recovered. This would typically be seen as a tightening move, but given the recent SNB rate cut is likely being seen as a macroprudential measure rather than a monetary policy action.