China: No PBOC MTF Cut and Protesting Low Government Bond Yields

Bottom Line: The PBOC decided not to cut the Medium-Term Facility (MTF) rate, but surprised by also withdrawing liquidity in what looks like a protest at the recent decline in government bond yields. A 10bps MTF cut should still arrive in Q2, but later rather than sooner.

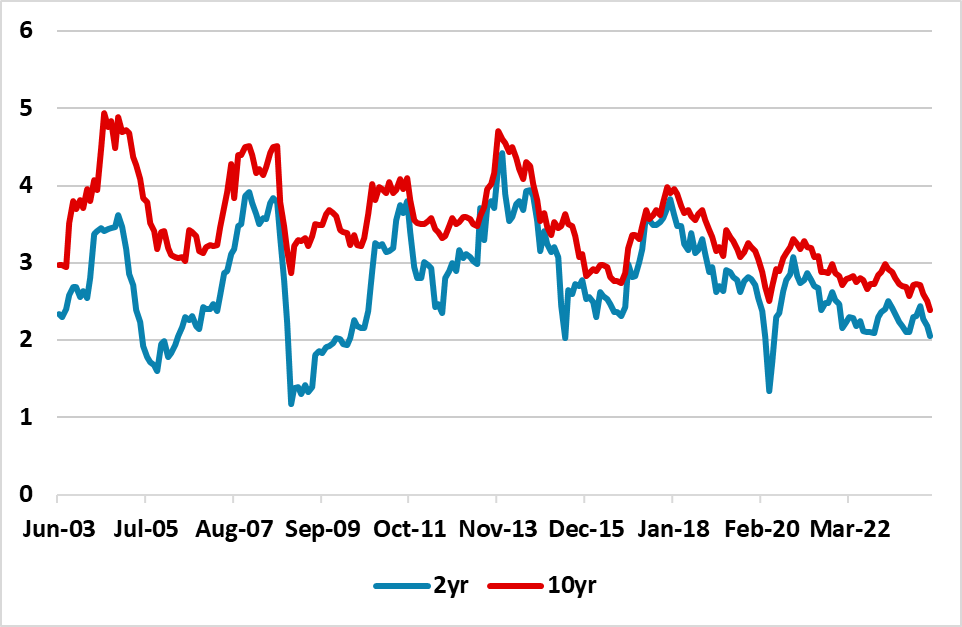

Figure 1: 2 and 10yr China Government Bond Yields (%)

Source: Datastream/Continuum Economics

The PBOC decided not to reduce the 1yr MTF rate, as concern remains that MTF and 7 day reverse repo cuts could widen interest rate differentials versus the U.S. and put the Yuan under pressure. However, with the authorities wanting to support the 5% growth target and the spread between the 5yr loan prime rate (LPR) and MTF rate low, the possibility of an MTF cut in Q2 will remain. However, the PBOC decision to withdraw liquidity today suggests that this will arrive latter rather sooner and we pencil in a 10bps move now in June.

The statement with the liquidity withdrawal that the PBOC had already fully satisfied liquidity needs of financial institutions shows it is concerned about financial speculation. It is also being read as a protest that banks are using liquidity to buy government bonds rather than increasing loans – M2 growth has slipped below 10%. 10yr China government bond yields (Figure 1) have recently reached new lows in the modern era, as the modest growth and disinflationary pressures prompt a move to safe haven assets. The February bounce in CPI inflation is likely to fade and we forecast 0.5% for 2024 (here). 2yr yields have been lower in 2008 and 2020, but still remain low.

Moderate lending growth is not just a reflection of banks desires. Household mortgage growth has ground to a halt, as new home sales have fallen and households remain wary of developers instability and also still expensive house prices – the authorities have tried to curb house price falls to avoid a wider crash, but this only prolongs the negative sentiment towards new house purchases.

We feel that as 2024 progress that the headwinds from private residential investment, net exports and slow private sector jobs growth, will prompt more PBOC easing. Beyond a 10bps MTF cut in June, we also look for a further 20bps cut in H2 2024 and 50bps cut in the RRR rate.