China: Weak August Data

China August data was worse than expected and confirms the weak trend in H2, with retail sales a real worry. The government risks missing the 5% growth target for 2024 and targeted fiscal policy moves are likely, but need to be implemented quickly. 10bps cut in the 7 day reverse repo rate is also likely in the coming months, with two 25bps RRR cuts.

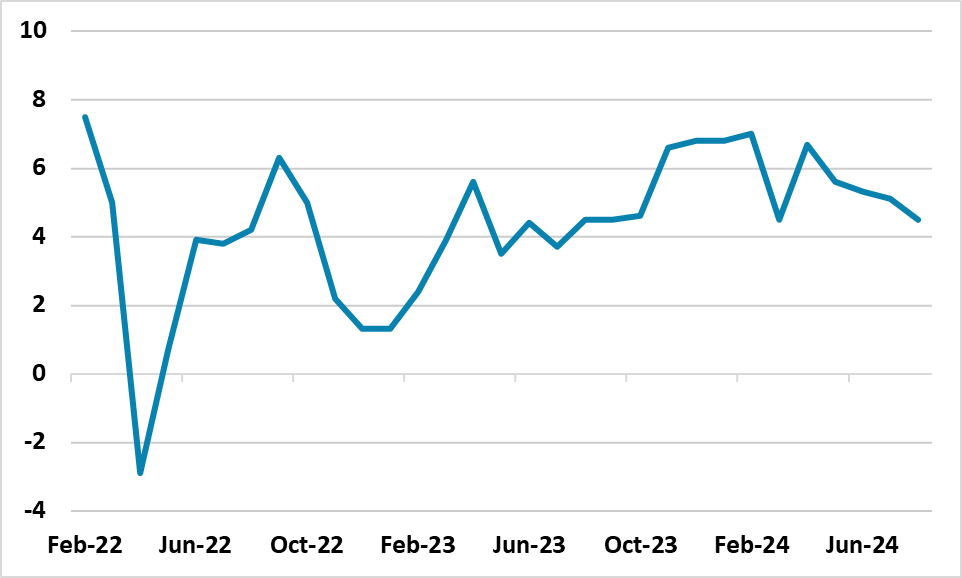

Figure 1: China Industrial Production Yr/Yr (%)

Source: Datastream/Continuum Economics

Source: Datastream/Continuum Economics

August data in China confirm a slowing in the economy. First, retail sales at 2.1% Yr/Yr was lower than expectations of +2.5%. Auto sales slipped to -7.3% v -4.9% Yr/Yr, with weakness also in furniture and building materials due to the gloom in housing. Though appliance sales were up, this is due to a government replacement subsidy. Secondly, industrial production came in at 4.5% Yr/Yr v 4.7% expected. Though electric vehicle production rose to +30.5% Yr/Yr, other production sub sectors were soft. Thirdly, fixed investment slowed to 3.4% Yr/Yr, with infrastructure investment at 4.4% Yr/Yr versus 4.9% in July. Central government appear to be slow in new spending, while reports also suggest that LGFV have been cutting back due to debt strains. Though NBS say adverse weather was the cause of the disappointment in August numbers, the weakness is too widespread to be weather alone.

Residential housing remains the weakest part of the economy, with investment at -10.2% Yr/Yr in August and residential property sales at -25% Yr/Yr. Government programs to buy completed property for affordable housing has been slow, while property developers remain in distress and households love of property has been badly shaken. More aggressive policy action is required to nationalise most developers and circa Yuan3-4trn for the purchase for affordable housing. However, policy remains targeted rather than aggressive, due to concerns about overall debt holdings.

Monetary and fiscal policy also remain targeted. A 10bps cut in the 7 day reverse repo rate could arrive in October, given the Yuan rebound and expectations of the Fed cuts to come. Additionally, a 25bps cut in the RRR rate is overdue and could still arrive in September. On fiscal policy, the government can take some further measures, but these need to be enacted quickly given the risk of missing the 5% growth target.