Eurozone: Gauging ECB Neutral Amid a Wandering R-Star

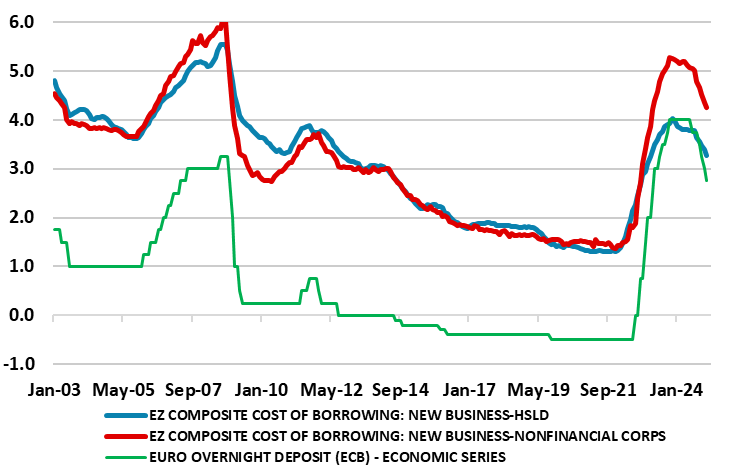

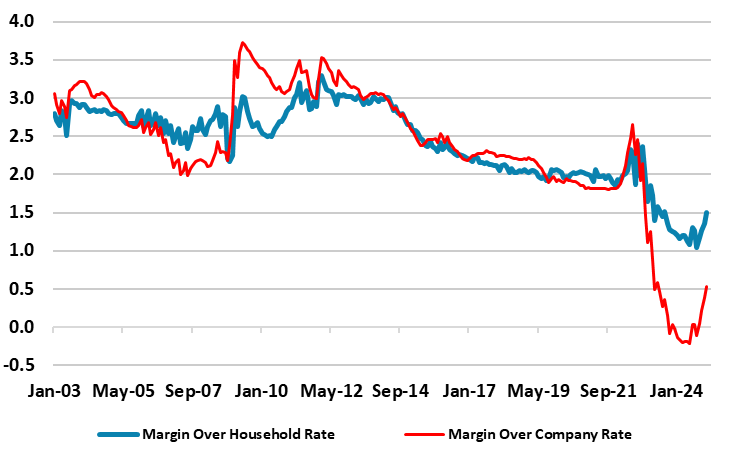

It is clear that, especially with another official rate cut due at the looming ECB Council meeting (Mar 6), the existing debate about how restrictive policy will be may only intensify. Indeed, the debate is already quite vocal, led by the hawks who are trying to argue for policy pause at least. But, as we have suggested before, assessing what may be a neutral rate merely by pointing to particular interest rate (even in a modest range) is both over-simplistic and misleading as it ignores the manner in the transmission mechanism of monetary policy is working. This, after all, determines not just the cost of borrowing but bank’s willingness and ability to supply credit. In this regard, perhaps a key factor is the margin that banks lend relative to any policy rate (Figure 1). This margin has narrowed markedly of late (Figure 2), the question being whether banks will seek to rebuild lending margins back to those seen prior to the pandemic, thereby actually acting not only to slow the impact of policy easing but even to offset it.

Figure 1: Drop in Rates Households and Firms Face Lagging Policy Moves

Source: ECB (%)

For someone who agreed that an assessment of the neutral rate has an impact only on ECB medium-term thinking, Council member Schnabel has been very vocal on the subject of late, repeating her view that the so-called r* has risen of late. Her assertion is that with the global economy transitioning from a global “savings glut” towards a global “bond glut” this essentially reverses a key factor that had contributed to the decline in real long-term interest rates, and hence r*, during the 2010s. The problem here is that global debt has actually fallen in the last few years and where any bond glut is as much a result of central banks reducing their balance sheets than increased credit demand – this raises the question as to whether quantitative tightening is as policy neutral as central banks insist!

Regardless of its merits, this assertion of a higher r* is all the more notable given recent ECB research suggesting real r* has hardly moved, staying within a range of -½% to 1% and the corresponding nominal range is 1¾% to 3% (ie very similar to that computed by the Riksbank for Sweden) but where estimates of the nominal r* from the most recent interval range are between 1¾% and 2¼%. ECB hawks would suggest r* lies near the top of that former range, thereby suggesting even the current policy stance may no longer be restrictive. But as that ECB paper concludes, the connection between an r* defined in terms of the short-term interest rate instrument of monetary policy and the broader economy may itself change, as monetary policy transmission depends on a broader set of financing conditions – including the cost and availability of bank credit, and prices in a range of asset markets. Indeed, ECB Chief Economist Lane has cited at least nine factors that would need to be assessed towards creating a summary “restrictiveness” index, most largely trying to understand how the monetary policy transmission mechanism is working.

Admittedly, Schnabel justifiably uses bank survey and credit data to assess the transmission mechanism of monetary policy and thus back up her assertion that policy is no longer restrictive. But she does seemingly purely from the demand side, pointing to higher credit growth and banks reporting an increase in credit demand in the latest bank lending survey (BLS). But credit growth is still negative in real terms, hardly a sign of fluidity while the better credit demand was based on the assumption of further falls in interest rates to come. Notably, and hardly conducive to a lack of restriction the BLS actually saw a fresh tightening in credit conditions of r firms.

Figure 2: Bank Lending Margins Too Low to Last?

Source: ECB, CE (%)

Focus on Actual Rates Firms and Households Face

But there is further factor we would point to in assessing current and future policy restriction, namely the actual rates at which households and companies borrow as opposed to any particular policy rate. As Figure 1 highlights these have have fallen far less clearly than the main policy rate, especially for company lending as opposed to household lending. This is of only modest importance as it merely suggests more of lag at which any policy change feeds through into actual lending rates. Instead, the effective r* that borrowers would face would merely be a premium over the actual neutral rate based on whatever margin banks charged. But that margin has and will continue to reflect a range of factors, not least banks assessment of credit risks. It is against this backdrop that it hardly surprising that the margin banks have charged has varied markedly, having risen sizeably when banks were in no position to follow the ECB into negative rates.

But as Figure 2 shows that the effective margins that companies and households face relative to the ECB discount rate is currently very low but have started to recover. And if banks are already showing fresh signs of lending wariness then it must surely translate into demanding an ever higher premium over their effective funding costs. Indeed, the question is whether banks will seek to rebuild lending margins back to those seen prior to the pandemic, thereby actually acting not only to slow the impact of existing and possible further policy easing but even to offset it. Notably as the recent BLS pointed out the renewed tightening of credit standards for firms was driven by the fact that banks see higher risks to the economic outlook and have lower tolerance for taking on credit risk. Other ECB-compiled survey data noted that firms reported a small decline in the availability of bank loans and more demanding non-rate lending conditions. If so both companies and households face life against a wandering r*.