Bank Indonesia’s Policy Shift: Is More Easing on the Horizon?

Bank Indonesia’s surprise rate cut marks a departure from its traditionally cautious approach and underscores the central bank’s growing focus on stimulating growth. While the decision provides a much-needed boost to economic activity, it also raises questions about the future trajectory of monetary policy, especially in the face of persistent external risks. As BI prepares for its February policy review, the central bank is likely to tread cautiously, balancing the need for further easing with the imperative of maintaining currency stability.

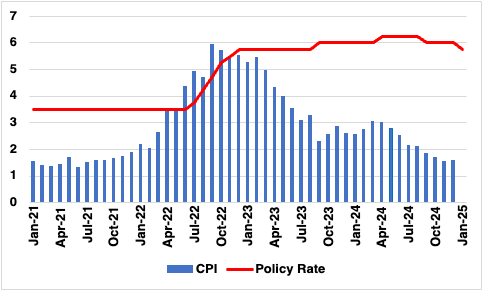

In a surprise move, Bank Indonesia (BI) reduced its benchmark interest rate by 25 basis points to 5.75% at its January 2025 monetary policy meeting. This decision defied both market consensus and our expectations, which anticipated a rate cut later in the year, around February or March. The central bank’s move underscores a notable shift in its policy priorities, moving away from its traditionally cautious stance on exchange rate stability to a more growth-supportive approach.

Figure 1: Indonesia Policy Rate and Inflation (%)

The rate cut was driven by two key factors: the benign inflation environment and the need to support economic growth amid lingering uncertainties. BI’s inflation outlook remains subdued, with consumer price index (CPI) inflation standing at 1.57% yr/yr in December, well within its target range of 2.5% ±1%. Core inflation, which strips out volatile food and energy prices, has remained stable at 2.26% yr/yr, reinforcing BI’s confidence that inflationary pressures are under control.

On the growth front, BI revised its GDP forecast for 2025 to a range of 4.7-5.5%, mirroring 2024’s projections but falling short of the 4.8-5.6% forecast made in December. The central bank appears increasingly concerned about sluggish domestic demand and global headwinds, which could weigh on Indonesia’s economic expansion. Given the recent moderation in growth—Q3 GDP slowed to 4.95% from 5.05% in Q2—BI has opted to act preemptively to support economic activity.

The decision to cut rates despite mounting depreciation pressure on the rupiah (IDR) signals a potential recalibration of BI's policy framework. Historically, the central bank has prioritized currency stability, with monetary policy decisions closely aligned to managing capital outflows and external vulnerabilities. However, with the IDR declining by only 1% year-to-date against the U.S. dollar—outperforming regional peers such as India, the Philippines, and Thailand—BI appears confident in its ability to contain volatility through foreign exchange interventions and bond issuance.

Nevertheless, the IDR remains under pressure, having depreciated by 6.3% against the dollar in 2024. Given the Fed’s delayed monetary easing cycle and persistent geopolitical uncertainties, further depreciation risks cannot be ruled out. BI’s recent sale of Rupiah Securities (SRBI) to attract portfolio inflows indicates its commitment to using non-interest rate tools to stabilize the currency, but the effectiveness of these measures will be closely watched.

Looking forward, BI is likely to adopt a wait-and-see approach in the upcoming policy review in February. The central bank will want to assess the impact of the recent rate cut on economic activity and currency stability before making further moves. We expect the policy rate to remain on hold in the near term, with additional easing contingent on external conditions and domestic growth dynamics. If the IDR stabilizes and inflation remains well-anchored, another rate cut in Q2 2025 could be on the table. However, any signs of renewed currency depreciation or capital outflows may prompt BI to delay further easing and rely on liquidity management tools instead. The pace of the U.S. Federal Reserve’s monetary policy adjustments will also play a critical role in shaping BI’s future actions. If the Fed continues to delay its anticipated rate cuts, pressure on the rupiah could persist, forcing BI to recalibrate its easing plans.