Turkiye Inflation Review: Inflation Softened to 30.7% in January

Bottom line: Turkish Statistical Institute (TUIK) announced January inflation on February 3. Turkiye’s annual inflation edged down moderately to 30.5% in January while food, housing and education prices drove the surge. Our average inflation forecast stand at 26.5% for 2026 since inflation expectations and pricing behavior remain fragile coupled with sticky services prices.

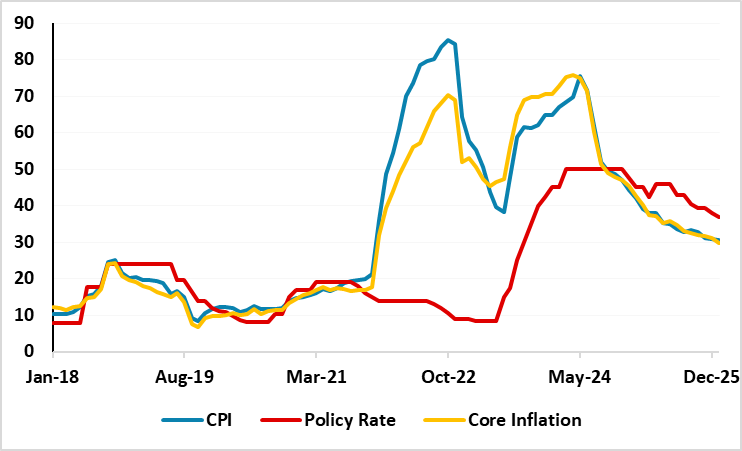

Figure 1: CPI, Core Inflation (YoY, % Change) and Policy Rate (%), January 2015 – January 2026

Source: Continuum Economics

As we expected, some noise has been seen in January reading as upside-tilted inflation risks continued to limit the downward trend during the disinflationary process. After Turkiye’s annual inflation hit 30.9% y/y in December, prices surged by 30.7% y/y in January while food, housing and education drove the inflation.

According to TUIK’s announcement on February 3, education prices recorded the highest annual increase with 64.7% YoY followed by housing prices were up by 45.4%. Annual food and non-alcoholic beverages prices also soared by 31.7%. Prices rose at a slower pace across a number of categories, such as footwear and clothing, which came in at 7.1% YoY in January.

Monthly inflation edged up by 4.8% in January while annual core inflation stood at 4.6% monthly and 29.8% annually. TUIK data showed that domestic PPI rose 2.7% m/m in January for an annual rise of 27.2%. (Note: We think moderate tax increases and 27% hike in minimum wage, effective from January 1, partly supported inflation print despite risks).

Assessing the print, Treasury and Finance Minister Mehmet Simsek said January inflation was mainly driven by food prices, well above long-term averages due to adverse weather conditions, and other seasonal factors. "We will continue our disinflation policies with determination, supported by supply-side measures," he stated.

Speaking about the inflation trajectory, the Central Bank of the Republic of Turkey (CBRT) stressed in its MPC statement on January 22 the MPC will make its policy decisions to create the monetary and financial conditions necessary to reach the 5% inflation target in the medium term, and added that decisions will remain predictable, data-driven and transparent.

With the CBRT committed to disinflation towards its 5% target, we think CBRT will have to proceed carefully on interest-rate adjustments on a meeting-by-meeting basis in 2026 given risks such as sticky services prices, fragile pricing behaviour coupled with unpredictable outlook for the global economy. We envisage upside surprises in food and energy prices and any accelerated TRY depreciation could derail recovery.

With CBRT’s inflation target for end-2026 remains at 16% and the forecast range is at 13-19%, we also expect a moderate slowdown in inflation in 2026, but with a slower pace when compared to 2025. We envisage the inflation will likely stay over the CBRT’s upper band at the end of the year, and our average inflation forecast stand at 26.5% for 2026 due to risks.