India CPI Review:Rate Cuts in Sight as Prices Cool

India’s inflation cooled to 4.31% in January, clearing the way for more rate cuts as food prices dipped. The RBI is shifting focus to growth. But risks remain—rupee weakness and global commodity prices could still stir inflationary trouble.

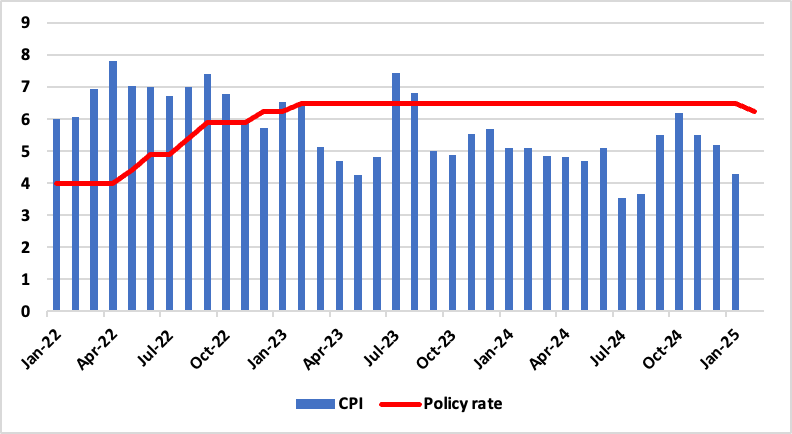

Figure 1: India Consumer Price Inflation and Policy Rate (%)

Source: MOSPI, Reserve Bank of India, Continuum Economics

India’s inflation trajectory has turned decisively downward, with retail inflation hitting a five-month low of 4.31% yr/yr in January. This larger than expected moderation, primarily driven by a steep decline in vegetable prices, strengthens the case for further monetary easing by the Reserve Bank of India (RBI). We now anticipate a cut in April, as the central bank seeks to balance growth with price stability.

Food Prices to Stay Soft, but External Risks LoomThe cooling of food inflation, particularly vegetables, has provided relief to households and policymakers alike. Good soil conditions, strong reservoir levels, and a healthy rabi harvest are expected to sustain this disinflationary trend in the coming months. Food inflation, measured by the Consumer Food Price Index (CFPI), stood at 6.02% in January, significantly lower than December’s 8.39%. Rural inflation saw a notable drop to 4.64%, while urban inflation fell to 3.87%, reflecting broad-based moderation across regions.Beyond food, housing inflation inched up slightly to 2.76%, while transport and communication costs registered a modest rise to 2.76% from 2.64% in December. Fuel and light inflation remained in negative territory at -1.38%, continuing the trend of lower energy costs easing headline inflation. However, imported inflation remains a potential spoiler. A weakening rupee, coupled with a possible rebound in global commodity prices, could stoke price pressures, particularly in fuel and edible oils, which have already shown signs of firming up.

Rupee Risks and the Inflation-Growth BalanceWhile the downward inflation trend supports an accommodative policy stance, risks remain. The rupee’s depreciation could add inflationary pressures by increasing the cost of imports, particularly energy and industrial inputs. At the same time, the RBI must ensure that rate cuts translate into stronger domestic demand. With growth showing signs of cooling, a lower interest rate environment may be crucial in sustaining economic momentum. With inflation expected to hover between 4% and 4.5% in the next few months, there is room for another rate cut as early as April. The transmission of these cuts into lower borrowing costs, however, will depend on the RBI’s liquidity measures.