Eurozone: ECB Stability Review Broadens the Case for Easier Policy

It seems that worries about weaker growth are reverberating more discernibly and more broadly within the ECB. Indeed, the worries may now be at least twofold. Clearly, weaker growth risks possible (added) downside risks to inflation, with BoI Governor Panetta yesterday warning that restrictive monetary conditions are no longer necessary given the risk of inflation falling well below target. But the ECB is now also flagging elevated financial stability vulnerabilities according to its just-released Financial Stability Review (FSR). It notes risks to economic growth that have shifted to the downside and where growth fears have resurfaced as a key source of uncertainty particularly to firms where debt servicing is possibly more of an issue (Figure 1). All of which chimes with our long-standing concern of downside risks that may be materialising to what we still see is a below-consensus growth outlook. It could be argued therefore that ECB easing is needed not only to minimise downside inflation risks but also help repair debt servicing capacity and persuade households to run down elevated savings!

Figure 1: Stretched Debt Servicing Capacity Signs More Visible?

Source; ECB FSR Nov 24

What the FSR underscores is that there signs of stretched debt servicing capacity are becoming more visible as corporate bankruptcies rise and deleveraging continues (Figure 1). The Report highlights that high borrowing costs and weak growth prospects continue to weigh on corporate balance sheets, with EZ firms reporting a decline in profits due to high interest payments. This adds to already clear evidence that the corporate world is under pressure. Indeed, the recent ECB Bank Lending Survey (BLS) highlighted that growth in lending to firms and demand for bank loans by firms remained weak while credit standards for loans to firms had remained at the restrictive levels reached after more than two years of progressive tightening. This is backed up by firms themselves.

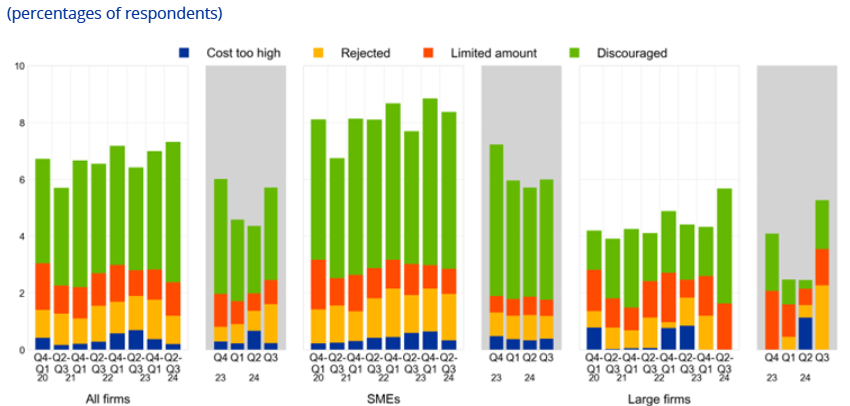

Figure 2: Obstacles Obtaining Bank Loans Still Sizeable

Source: ECB. Financing obstacles are defined here as the total of the percentages of enterprises reporting (i) loan applications that resulted in an offer that was declined by the enterprise because the borrowing costs were too high, (ii) loan applications that were rejected, (iii) a decision not to apply for a loan for fear of rejection (discouraged borrowers), and (iv) loan applications for which only a limited amount was granted. The grey areas represent responses to the same question within a reference period of three months

Firms Understandably Cautious on Outlook

We have put much emphasis in the past on the important messages to be gleaned from bank lending surveys in terms of the cost and supply of credit. But this of course is purely from the perspective of banks. In this regard, the ECB survey on access to finance by enterprises offers the perspective from firms themselves and the latest results are certainly still interesting and a clear cause for continued concern from the ECB. Overall, the survey results suggest that the effects of past monetary policy tightening have continued to raise borrowing costs, ie that the ECB official rate cuts have yet to filter through at all in some cases.

Households and Job Risks

The FSR also notes that the outlook for real estate markets is mixed, with residential real estate prices stabilising but where commercial real estate markets are still stressed. The Report does provide some solace regarding households, echoing the BLS findings. But even here this assessment may be glossing over what are still risks. It suggests that households are benefiting from a strong labour market and have bolstered their resilience by increasing savings and reducing debt. But the labor market is very much on the turn. Indeed, business survey data has seen a distinct drop in employment intentions that bodes ill for jobs growth (Figure 3). Indeed, the PMI reading for last month suggested that may already be happening, noting that amid a further weakening of demand conditions was the sharpest drop in employment since December 2020. All of which makes the flash PMI reading this Friday more interesting

Figure 3: Employment Intentions Suggest Jobs Growth Reversing?

Source: European Commission, Eurostat, CE

Moreover, the ECB Council (at least according to the account of the October meeting seemed more concerned about the consume, especially given the lack of any sign of a recovery in the sector. As for savings it noted different explanations for the increase in the household saving rate but where relatively elevated interest rates may have encouraged a postponement in consumption. But even the FSR concluded that while households seem resilient, weaker than expected growth could erode their debt servicing capacity.

Labor Cost Trends Down Despite Negotiated Wages

Admittedly, some ECB hawks may still need persuading to accelerate easing even as inflation indicators are getting friendlier. This is even given apparent labor costs resilience in ECB negotiated wage data which rose almost two ppt to 5.4%. But this Q3 jump seems aberrant, partly a reversal to the sharp Q2 drop but also very much at odds with other costs data, not least the Indeed Wage Tracker. Notably the October ECB account also highlighted better signals for wage growth in 2025 which were either in line with or below the September projections and where survey indicators also suggested a marked deceleration in wage growth in the coming year.

All of which chimes with our long-standing concern of downside risks that may be materialising to what we still see is a below-consensus growth outlook. It could be argued therefore that ECB easing is needed not only to minimise downside inflation risks but also help repair debt servicing capacity and persuade households to run down elevated savings!