JPY, CHF, GBP flows: JPY steadier, GBP, CHF gains stretched

JPY stabilising, CHF and GBP strength statign to look overdone

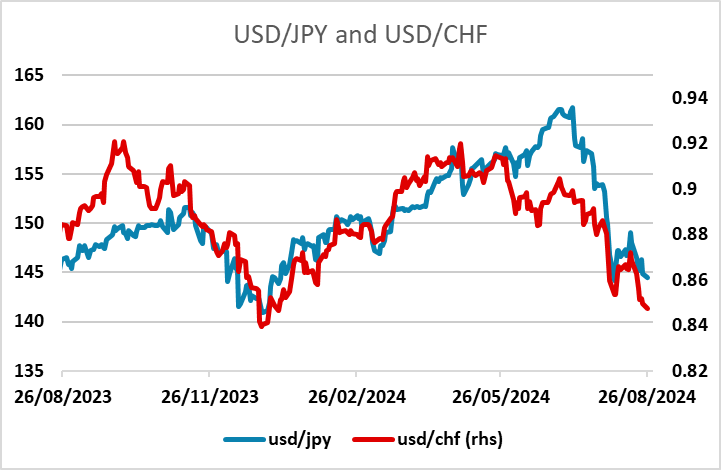

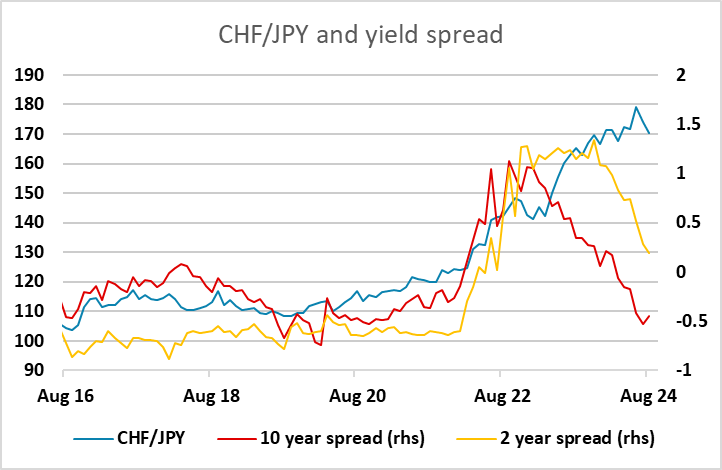

Another quiet calendar on Tuesday leaves the market mostly at the mercy of technical trading. While the Powell and Ueda comments last Friday initially gave USD/JPY some downside momentum, there has been little change in US or Japanese yields in the aftermath of these comments, and while we still see scope for USD/JPY to break lower longer term, there doesn’t look to be the momentum in the market to trigger a break at this stage. However, it is still notable that the JPY has actually underperformed the CHF in the last couple of weeks, even though short term yield have steadily moved in the JPY’s favour. Some of this relates to the risks recovery seen over the period, which has triggered a bigger recovery in EUR/JPY than in EUR/CHF. But if risk appetite is to remain positive EUR/CHF should have more upside scope, while if we see a downturn in risk sentiment, there should be a larger reaction in EUR/JPY than EUR/CHF.

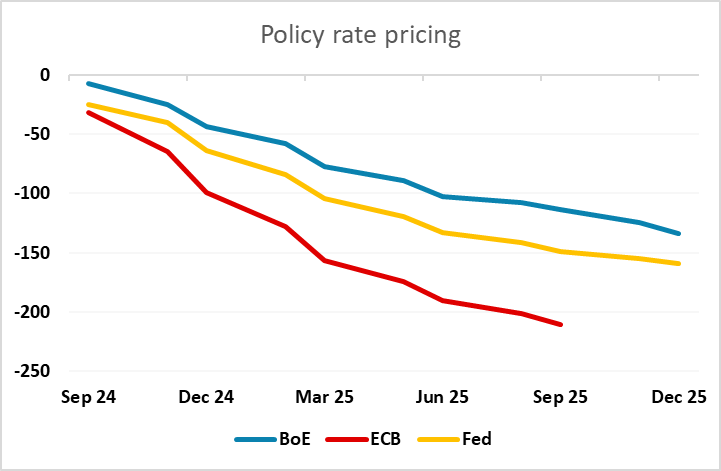

The most consistent move over the last week has been the decline in EUR/GBP, helped by some modest yield spread moves in GBP’s favour and a perception of relative improvement in the UK economy. Still, GBP looks fully valued here and technically EUR/GBP is approaching important support in the 0.8440 area. The yield spread moves in GBP’s favour have been small, and are based on the market pricing a BoE rate cut in September as less than a 30% chance, while a 25bp ECB cut is fully priced and the Fed is fully priced for a 25bp cut with a near 30% chance of a 50bp cut. While there is no certainty of a BoE cut, the chances of a September move look to be higher than the market is currently pricing.