CBRT Left the Key Rate Constant at 45%

Bottom Line: As we predicted, Central Bank of Turkiye (CBRT) ended monetary hiking cycle under new governor, and kept the key rate stable at 45% after eighth straight rate hikes since presidential elections last May. According to the CBRT statement, the current level of the policy rate will be maintained until there is a significant and sustained decline in the underlying trend of monthly inflation, and monetary policy stance will be tightened in case a significant and persistent deterioration in inflation outlook. In line with this, we expect CBRT to maintain the policy rate constant at 45% in the next MPC meeting, which is scheduled for March 21.

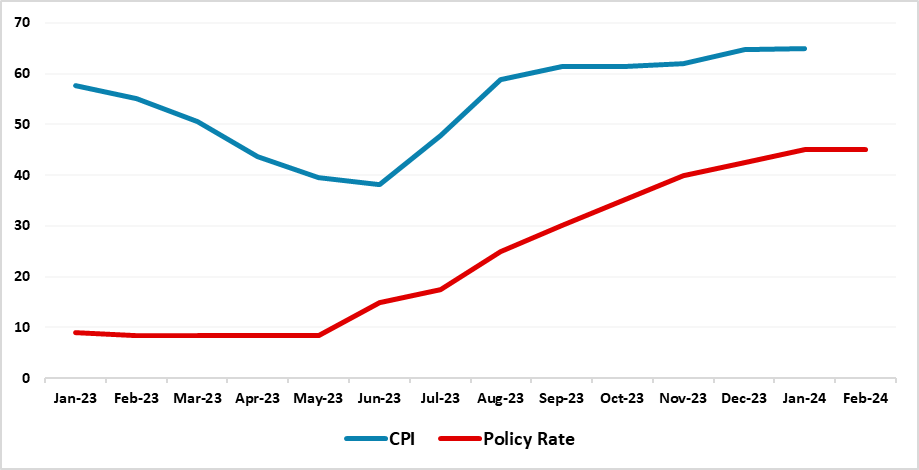

Figure 1: CPI (YoY, % Change) and Policy Rate (%), January 2023 – February 2024

Source: Continuum Economics

The CBRT kept the policy rate unchanged at 45% on February 22 MPC meeting, after increasing the rate in the last eight MPC meetings since last May. The move was widely expected as strongly signalled by the new governor Fatih Karahan, who replaced former governor Hafize Gaye Erkan earlier this month. (Note: Erkan announced that she decided to step down citing a major reputation assassination campaign launched against her on February 3).

One day after taking the office, Governor Karahan emphasized on February 4 that "We will continue our efforts to ensure disinflation, and we are determined to maintain the necessary monetary tightness until inflation falls to levels consistent with our target." Karahan also indicated on February 8 that there is no need for a further rate hike, but warned the central bank would review its decision if the inflation outlook deteriorated, opening the door to maintaining the tightness needed to achieve price stability. As we previously noted, it appears CBRT continues with the conventional monetary policy framework that prioritizes the fight against inflation, -just like in Erkan’s era- taking into account that Karahan was the deputy governor and MPC member before he was appointed as the governor.

Despite key rate decision, inflation remains a pressing issue for the government, especially considering that the local elections will be held on March 31 and AKP wants to win back the control of major cities like Istanbul, Ankara and Izmir. (Note: According to the announcement by the Turkish Statistical Institute (TUIK) on February 5, the CPI surged to 64.9% annually and 6.7% monthly in January, which marked the biggest jump in the last five months).

Following the January inflation data, we are of the view that there are signs that inflation will continue to stay high in the first half of 2024, in line with CBRT’s inflation projections. (Note: CBRT forecasts that annual inflation will record 36% at the end of 2024 after rising to the 70-75% band towards the middle of the year). We think recent hikes in salaries and pensions, elevated services prices, strong domestic demand, continued adverse impacts of deterioration in pricing behaviour, weakening currency, high inflation expectations and uptick in public spending before the March local elections continue to ignite general level of prices. Despite strong monetary tightening in force and lagged impacts of the tightening cycle are still feeding through, we still see upside risks to the inflation outlook. We foresee relative slowdown in the inflation trajectory in the second half of 2024 thanks to CBRT’s hawkish bias and contractionary fiscal policies, but the transition will take time.

According to CBRT’s MPC statement on February 22, domestic demand continues to moderate in line with the projected disinflation process and pricing behaviour shows signs of improvement, despite stickiness in services inflation, geopolitical risks, and food prices are keeping inflation pressures alive. CBRT continues to signal that it has completed tightening cycle as the current key rate level will be enough to establish the disinflation course in the near term, stating that external financing conditions are improving, foreign exchange reserves are increasing, and the rebalancing process of the current account balance continues. CBRT underlines that current level of the policy rate will be maintained until there is a significant and sustained decline in the underlying trend of monthly inflation and until inflation expectations converge to the projected forecast range. In line with this, our projection remains that policy rate will be held at 45% as soon as the inflation shows significant uptick.