Brazil GDP Preview: Small Contraction in the Last Quarter

The Brazilian GDP is anticipated to have contracted by 0.1% in Q4 2023, yet the annual growth for 2023 is expected at 3.1%, marking the third consecutive year above the 3.0% threshold. Agricultural sector's significant 15% growth, primarily driven by soybean harvest, offsets the deceleration. Tight monetary policy's lingering impact suggests restrained growth in 2024, with a forecast of 1.5%.

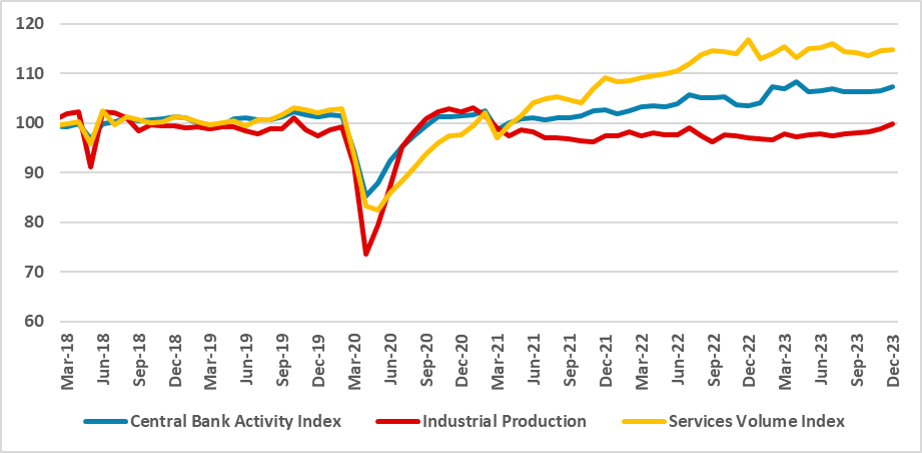

Figure 1: Brazil Activity Indexes (2019 = 100, Seasonally Adjusted) Source: BCB and IBGE

Source: BCB and IBGE

The Brazilian National Statistics Institute will reveal the GDP data for the last quarter of 2023. We forecast the Brazilian GDP to have contracted by 0.1% during the last quarter. However, on annual terms, the Brazilian economy will have shown strong growth in 2023, growing 3.1% compared with 2022. It will be the third consecutive year in which the Brazilian economy grows above the 3.0% mark. However, the story for 2023 is more related to the supply side of the Agricultural sector. This sector has grown around 15% during the year, driven by a record harvest of soybeans. If we exclude these gains, the Brazilian economy would have grown around 1.8%, which is still above initial market expectations of around 0.8%.

The recent deceleration is a direct consequence of the tight monetary policy (MP). As it works with lags, the impact of a very restrictive MP is still being felt, and the impact of the easing is likely to be felt only in the second half of 2024. Most of the contraction in Q4 is likely related to the Services sector and the Agricultural sector. The former responded to the effects of the tight monetary policy, and the latter related to the softening of the harvest as most of the effects of the higher Agricultural output were restricted to the first quarter.

The story for 2024 will be related to whether the government will again adopt demand-sided policies to stimulate the economy, through directed credit and social transfers, or to restrict fiscal policy in order to deliver the zero deficit policy. The latest movements suggest that the government will seek to increase revenues by raising specific taxes, and they will try to judicially reverse some decisions which decreased their revenue base. We are still expecting growth to be more restricted in 2024, as the extraordinary growth of the Agricultural sector will not repeat, the effect of the tight monetary policy will continue to be felt, despite the considerable easing, and the demand measures will have limited effects. Our forecast for growth in 2024 stands at 1.5%.

I,Lucas Eduardo Veras Costa, the Economist, LatAm declare that the views expressed herein are mine and are clear, fair and not misleading at the time of publication. They have not been influenced by any relationship, either a personal relationship of mine or a relationship of the firm, to any entity described or referred to herein nor to any client of Continuum Economics nor has any inducement been received in relation to those views. I further declare that in the preparation and publication of this report I have at all times followed all relevant Continuum Economics compliance protocols including those reasonably seeking to prevent the receipt or misuse of material non-public information.