Turkiye’s Current Account Deficit: Services Surplus and Decreasing Trade Deficit Succour

Bottom Line: Turkiye’s annualized current account deficit (CAD) stood at $25.2 billion as of May 2024, marking its lowest level since June 2022, down from $31.7 billion a month earlier driven by strong services income and improving foreign trade balance, supported by accelerated capital inflows. We envisage CAD will likely be remedied by slowing domestic demand and imports thanks to ongoing strong monetary tightening coupled with bettering services trade balance and tourism revenues in H2 2024 despite risks to the outlook.

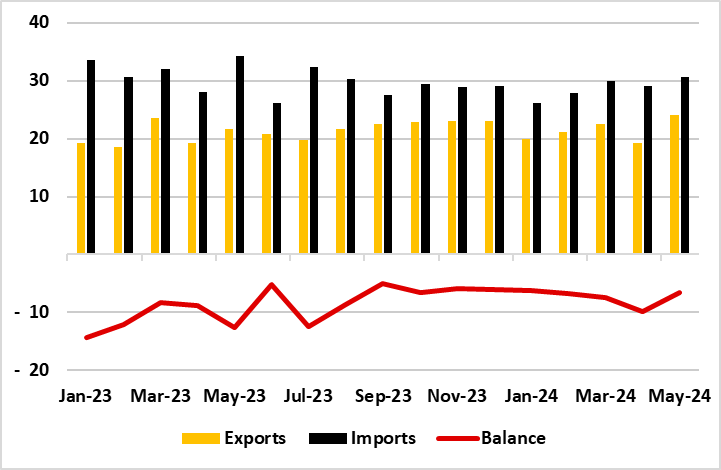

Figure 1: Turkish Foreign Trade (Billion USD), January 2023 – May 2024

Source: Continuum Economics

According to the figures announced by the Central Bank of Turkiye (CBRT) on July 12, Turkish CAD stood at $1.24 billion in May, down from $5.4 billion in April, marking the lowest monthly gap since October 2023.

The trade deficit, the biggest component of the CAD, was $6.5 billion dollars with a 48% decrease compared with May 2023. Turkish Statistical Institute (TUIK) announced on June 28 that exports were $24 billion with a 11.3% increase and imports amounted to $30.5 billion with a 10.4% decrease compared with May 2023.

Services recorded a net inflow of $4.7 billion, according to the CBRT figures. Under services, the travel item recorded a net inflow of $3.93 billion in May demonstrating the acceleration of tourism into the summer vacation period. Annualized CAD improved to $25.2 billion in May when compared to $31.7 billion a month earlier, and stood at approximately 2.2% of GDP.

Speaking about the CAD, Treasury and Finance Minister Mehmet Simsek indicated on July 12 that the current account deficit is no longer a significant problem, adding that the as CAD to GDP ratio is expected to fall below 2.5% in Q2.

Despite increasing geopolitical risks and volatile global energy prices continue to put pressure on Turkish CAB, we think slowing domestic demand and imports thanks to ongoing strong monetary tightening coupled with bettering services trade balance and tourism revenues in H2 2024 will likely heal CAD. We think capital inflows accelerating thanks to foreign investors showing an increasing appetite for Turkish asset could also relieve the pressure on balance of payments. (Note: Portfolio investment recorded a net inflow of $5.6 billion in May, rising from $2.0 billion in April).

As noted, we project 2024 could be a better year, but this will unlikely bring significant relief to Turkiye's CAB or competitiveness as continued volatility in energy prices and food prices particularly ignited by the regional tension in the Middle East and Ukraine will jeopardize the betterment in Turkiye's CAD, which could be coupled with the likely loss of the momentum in tourism revenues in Q3/Q4 due to continued surges in prices of hotels, cafes, restaurants and food, is reportedly a serious concern for tourists.