Turkiye’s Inflation Slowed for the First Time in 8 Months: 71.6% in June

Bottom Line: Turkish Statistical Institute (TUIK) announced on July 3 that Turkish CPI cooled to 71.6% annually and 1.6% monthly in June partly supported by the ease in energy and food prices in June compared to a month earlier. As we predicted, favourable base effects, tightened monetary and fiscal policies, additional macro prudential measures, and relative Turkish lira (TRY) stability helped relieving the pressure on the inflation, at least for now. We still think the road to bringing inflation back down to single-digit levels will be very bumpy, and the inflation getting there before 2027 remains very unlikely.

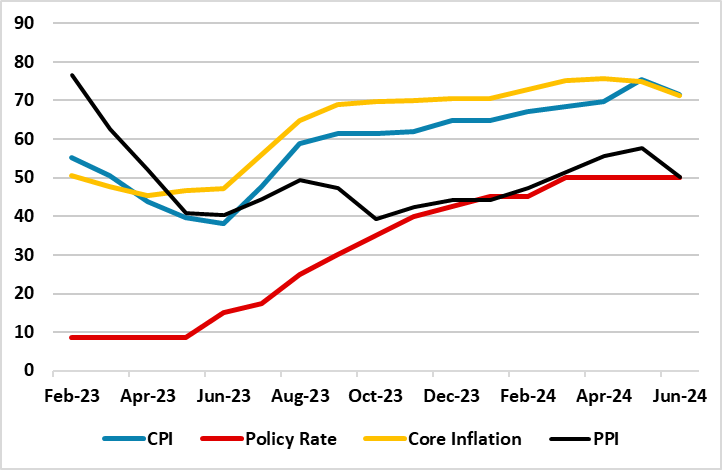

Figure 1: CPI, PPI, Core Inflation (YoY, % Change) and Policy Rate (%), February 2023 – June 2024

Source: Continuum Economics

When annual rate of changes (%) in the CPI’s main groups are examined in June, clothing and footwear with 47.8% was the main group with the lowest annual increase while education recorded the highest annual increase with 107.1%. It is worth mentioning that housing (94.7%), hotels, cafes and restaurants (90.7%) also recorded remarkable YoY increases. Annual price rises in energy and food eased in June compared to a month earlier. Core inflation (CPI-C) recorded a 1.8% MoM increase, scaling up to 72% on an annual basis. The domestic PPI was up 1.4% MoM in June for an annual rise of 50.1%, the data showed.

Treasury and Finance Minister Mehmet Simsek stated after the inflation release that "The disinflation process has begun," and added “We will ensure a permanent welfare increase by implementing our program with determination until we reach price stability, and consumers will start to feel relief soon.” (Note: CBRT increased its year-end inflation forecast to 38% from 36% on May 9, while cumulative inflation in H1 already reached 24.7% after June reading. CBRT’s forecast for end-2025 remains at 14%, while inflation is seen falling to 9% by the end of 2026, which we think would be hard to reach as monthly rises will persist).

Vice President Cevdet Yilmaz indicated that "The decline in core inflation indicators shows a weakening in the trend of price increases." Yilmaz also said "Our primary goal is to reduce inflation, which is the top concern of our citizens. In line with this goal, we have entered a disinflation process thanks to the monetary and fiscal policies we have implemented to combat inflation."

In the meantime, another interesting announcement concerning government’s fight against the inflation was the recent statement by the Minister of Labor Vedat Isikhan on June 26, who emphasized that there will not be an interim increase in the monthly minimum wages in July, and new minimum wage will be determined in December this year. Isikhan also ruled out any adjustments to pensions to protect retirees, a move to contain inflation, while cost-of-living crisis continues to bite Turkish citizens.

Despite inflation softened in June ignited by favourable base effects and relative TRY stability underpinning the inflation relief, we think the road to bringing inflation back down to single-digit levels will be very bumpy and the inflation getting there before 2027 remains very unlikely. We foresee that favourable base effects will continue to dominate the inflation outlook in July and August, but the extent of the decline will be determined by administrative price adjustments taking the recent 38% increase in electricity prices coupled with hikes in oil prices into account. We think buoyant domestic demand, stickiness in services inflation, deterioration in pricing behaviour, and inflation expectations will continue to cause pressure on the general level of prices.