ECB October Rate Cut for Insurance

Recent economic data and national CPI numbers have increased the economic case for less restrictive policy. Combined with softening of guidance from ECB Lagarde and Schnabel, this leaves us inclined to now forecast a 25bps cut at the October 17 ECB meeting. This will likely be followed by a 25bps cut in December, though ECB forward guidance will remain unclear.

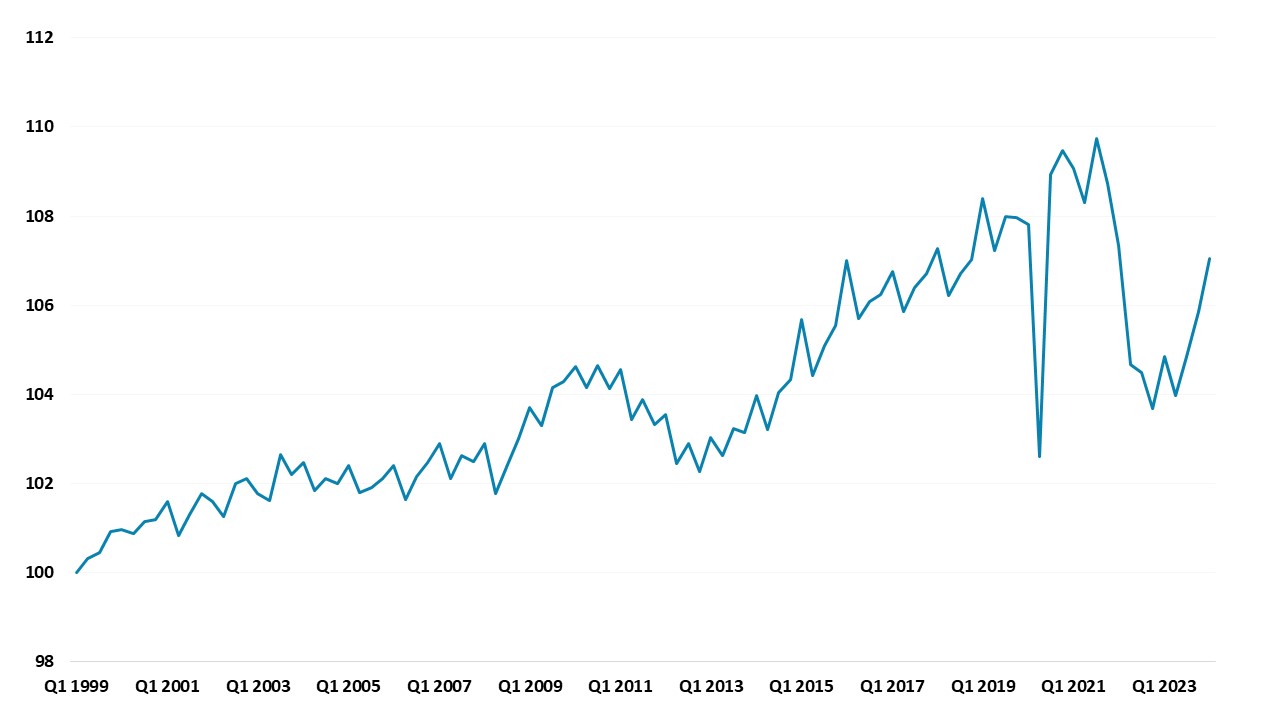

Figure 1: Ratio of Hourly Wage Compensation/HICP Indices (1999 = 100)

Source Datastream/Continuum Economics

The odds of a 25bps October rate cut from the ECB have become much higher for a number of reasons.

· Weak economy/softer inflation difficult to ignore. The September flash PMI data have increased fears that the EZ recovery is stalling before it get started. This is concern that we have highlighted in recent months and is our main alternative scenario in the September outlook (here). The problem is that lagged monetary tightening is still feeding through and the 50bps of cuts so far is not big enough yet. Additionally, low to middle income groups are still suffering from cumulative wage inflation having been outstripped by CPI since 2019 (Figure 1), which is prolonging the cost of living crisis. Meanwhile, downside surprises on CPI inflation in France/Spain/German states, point to a low EZ CPI figure below 2.0% and ECB forecasts.

· ECB speakers change of tone. ECB Schnabel slide deck last Thursday (here) showed a shift of tone compared to her speech on September 19. More apprehension on the real economy; less worry on wage inflation and profit margins being squeezed that is reducing unit labor cost feedthrough. For somebody on the hawkish end of the ECB spectrum, this is a noticeable shift of tone. At the European parliament on Monday ECB chair Lagarde indicated that the latest development increases our confidence that inflation will return to target in a timely manner and that this will be discussed at the October ECB meeting. Later she did note that the breakdown of the CPI suggest service inflation is slowing and other data suggests the labor market is softening.

ECB Lagarde comments could be interpreted as suggesting that an October rate cut will be discussed, but is not guaranteed for the October meeting. However, it is worth noting that the ECB is reluctant to signal too clearly that an interest rate cut is coming after too much clarity before the 1 cut in June. Additionally, Lagarde and ECB officials will be aware that market expectations have shifted towards an October cut and today’s testimony was the ideal time to lean against October speculation if that was the intent. The fact that Lagarde did not push back against market expectations suggest that the ECB are at a minimum happy for the speculation to be intense and more likely that the leaning is towards a 25bps cut at the October meeting. We thus change our view and look for a 25bps cut with a 65% probability.

An October cut is unlikely to be a substitute for a December cut, as we are not even mid cycle and the ECB will also likely cut by 25bps in December. However, to avoid expectations of cuts at every meeting in H1, the ECB is unlikely to provide clarity for the December meeting or onwards. Additionally, it could well signal that an October cut is merely to take out insurance to try to sustain confidence that they are on the right path.