Bank Indonesia Policy Preview: Rate Pause Likely as Rupiah Stability Takes Priority

Bank Indonesia is expected to keep rates steady at 5.75% in its February 18-19 meeting after last month’s surprise cut. While inflation remains low and growth is steady, the weakening rupiah and external uncertainties may delay further easing. The central bank is likely to assess the impact of its January move before considering another cut, with Q2 2025 looking like the earliest window for action.

As Bank Indonesia (BI) heads into its February 18-19 policy meeting, we anticipate a hold on the key rate at 5.75%, following the unexpected 25-basis-point (bps) cut in January. While the central bank had signalled a shift towards monetary easing in September 2024, the rupiah’s continued depreciation and external uncertainties prompted the central bank to proceed with caution.

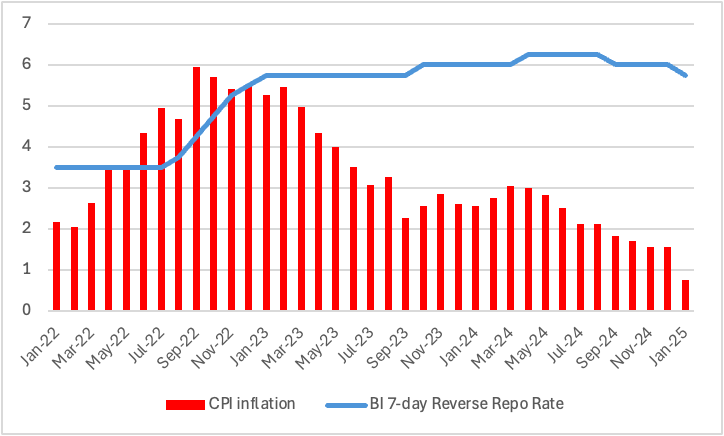

Figure 1: Bank Indonesia Main Policy Rate and Inflation (%)

Source: Continuum Economics

Balancing Growth and Currency Stability

BI’s policy decisions have historically been influenced by rupiah movements, with previous rate hikes aimed at defending the currency. However, January’s rate cut—despite ongoing depreciation—indicates that growth concerns may now be gaining prominence in the central bank’s policy calculus. GDP growth slowed for a second consecutive quarter in Q3 2024, dipping to 4.95% yr/yr from 5.05% in Q2. While this remains close to Indonesia’s long-term average growth rate of 5%, BI marginally revised down its 2025 GDP growth forecast to 4.7%-5.5%, mirroring the 2023 range. Given this backdrop, the central bank is expected to take stock of the January rate cut’s impact before signalling further easing. In our view, with growth still holding up and inflation under control, BI has room to assess external developments before making its next move. Inflation remains at the lower end of BI’s target range (2.5% ± 1%), with January's CPI print at 0.76% yr/yr significantly lower than the 1.57% yr/yr recorded in December.

Despite the rupiah’s weakness, imported inflation has been muted, allowing BI to maintain a growth-supportive stance without the immediate risk of fuelling price pressures. The central bank remains confident that inflation will stay within the target range, providing some policy flexibility in the months ahead.

The rupiah depreciated by 6.3% against the US dollar in 2024, and weakness persisted in early 2025. While there was a brief recovery in Q3 2024, renewed geopolitical tensions and a stronger USD following the US elections have kept pressure on the local currency. The delay in the US Federal Reserve’s monetary easing cycle in 2025 adds another layer of complexity. BI’s previous pause in rate cuts after September 2024 was largely attributed to external factors, and with the Fed signalling a more gradual approach to rate reductions, the central bank may prefer to wait before resuming monetary easing.

Instead of relying on rate hikes to support the rupiah, BI has deployed alternative tools, including foreign exchange interventions and the sale of Bank Indonesia Rupiah Securities (SRBI) to attract capital inflows. The governor has reiterated that these measures will continue to be used to stabilize the currency, reducing the need for aggressive rate adjustments.

Outlook: Hold for Now, But More Cuts Possible in Q2

Given the competing policy priorities, BI is likely to hold rates steady in February, assessing the impact of its January cut on growth and the rupiah before making further moves. The next rate cut could come in Q2 2025, provided the currency stabilizes. The timing of the next move will also depend on the Fed’s monetary easing path—any further delay in US rate cuts could push BI to maintain a cautious stance for longer. For now, Bank Indonesia is expected to stay on hold, watching both domestic and external developments closely before taking its next step in the easing cycle.