U.S. December CPI - A modest comfort to the Fed, but early 2025 data will be crucial

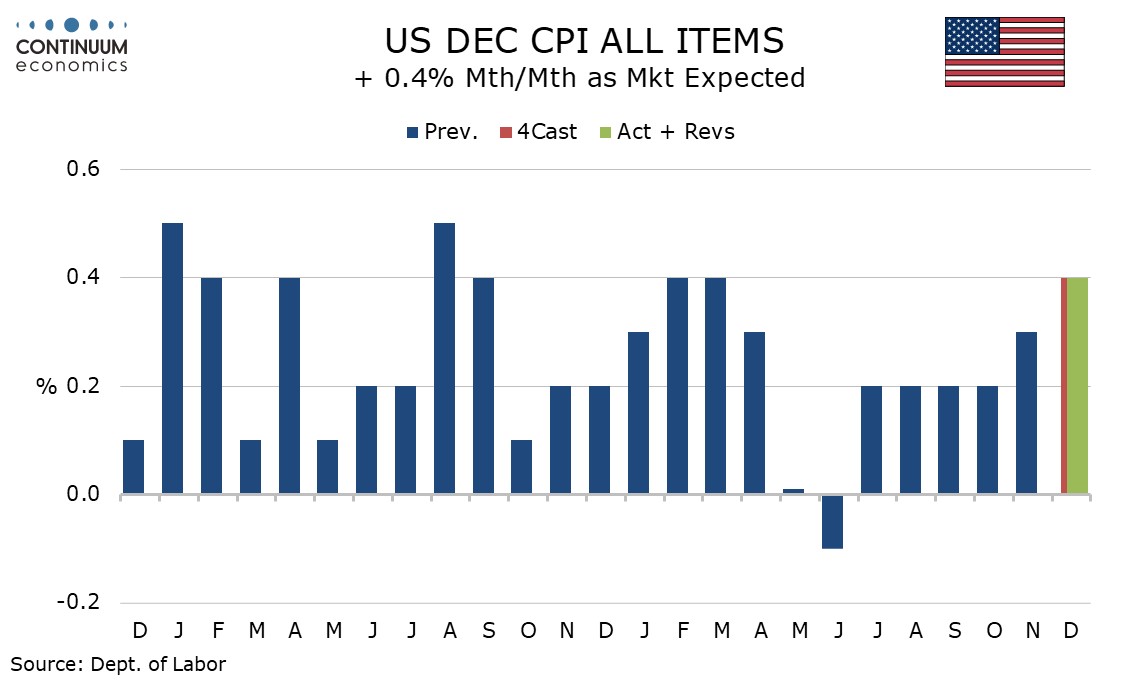

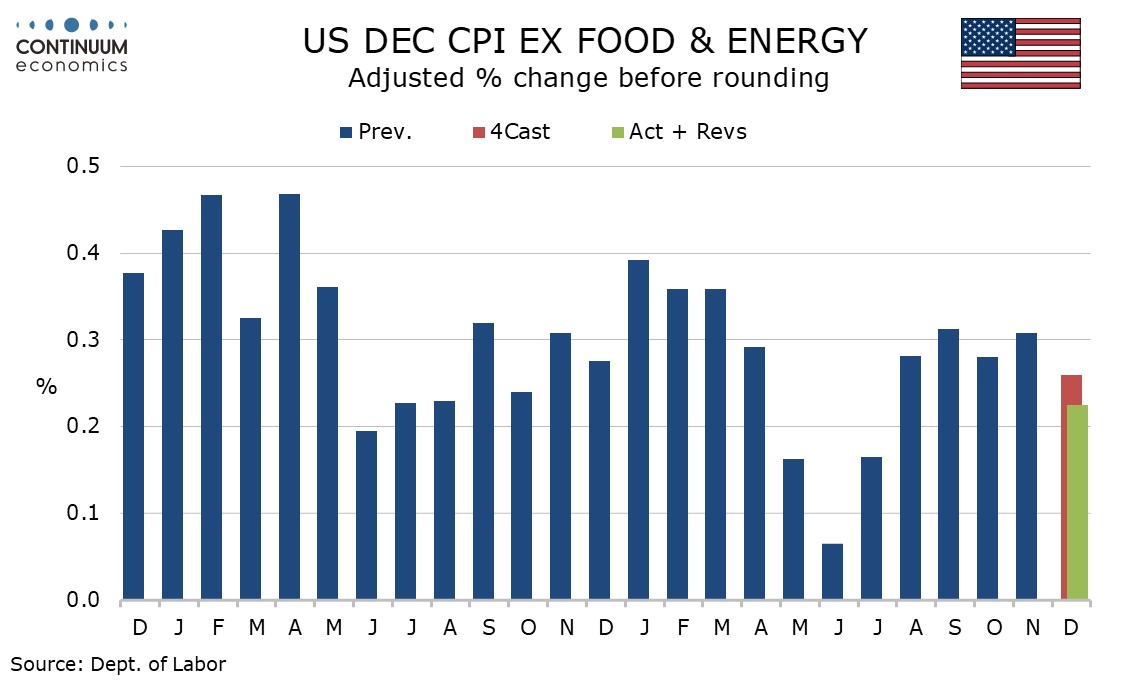

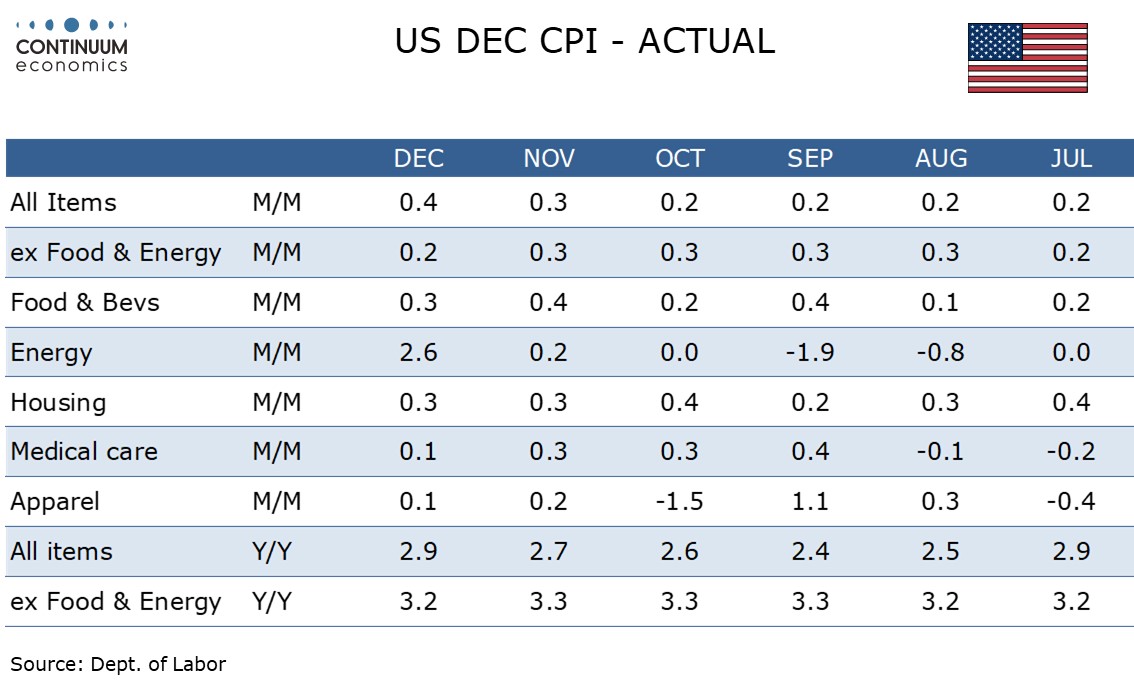

While December’s headline CPI is in line with expectations with a 0.4% increase, the core rate ex food and energy is subdued at 0.2% following four straight gains of 0.3%, and a downside surprise is quite comfortable with the gain before rounding being 0.225%. Price data did however pick up in January's Empire State survey.

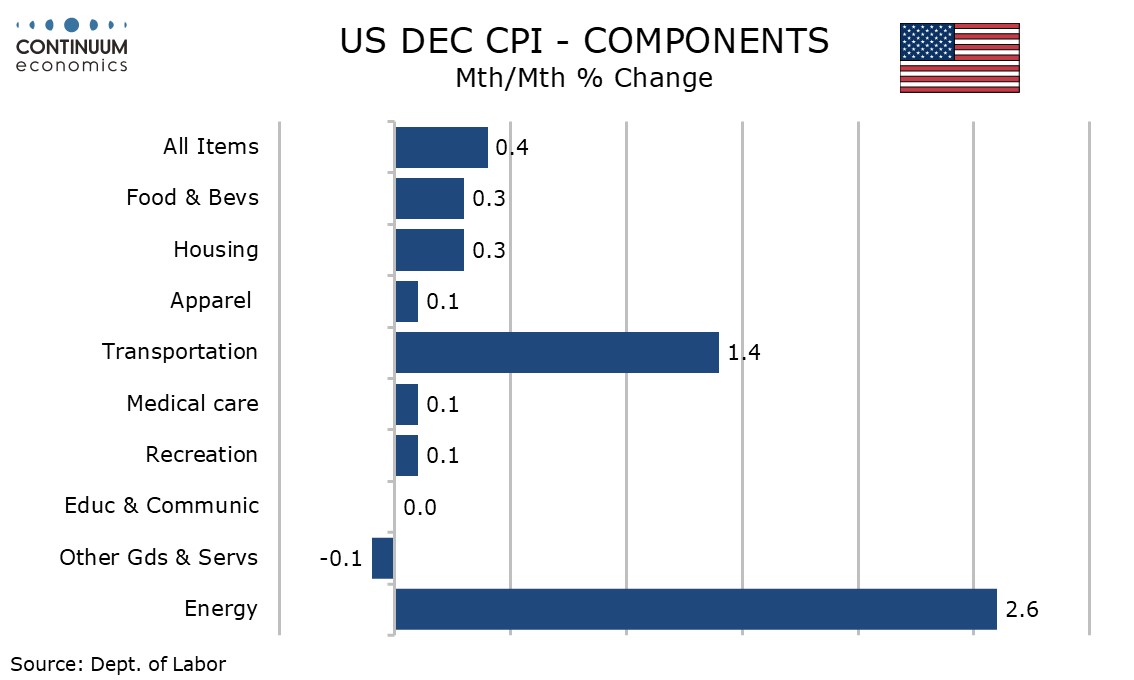

Energy rose by 2.6% led by a 4.4% rise in gasoline. Before seasonal adjustment, gasoline fell by 1.1%. Food saw a moderate rise of 0.3%.

Commodities less food and energy rose by 0.1% with the data subdued outside a 1.2% rise in used autos and a 0.5% rise in new autos.

Services less energy rose by 0.3% for a third straight month. Air fares saw a strong month with a rise of 3.9% but auto services have lost their previously strong momentum, with overall transport services up by 0.5%. Owners’ equivalent rent rose by 0.3% after a 0.2% November gain which corrected a 0.4% rise in October but housing was restrained by a 1.0% decline in lodging away from home.

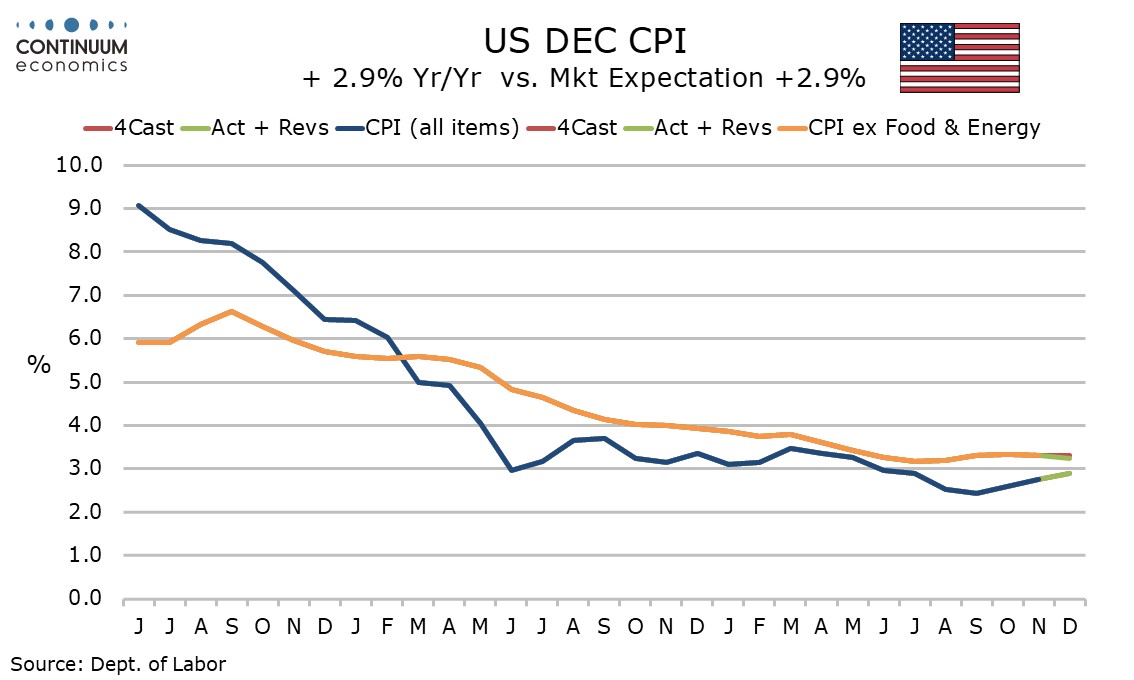

Yr/yr core CPI slipped to 3.2% after three straight months at 3.3%, but remains ahead of overall CPI, which at 2.9% from 2.7% saw a third straight acceleration from a recent low of 2.4% seen in September.

After four straight months of modest disappointment the December core CPI will be a modest comfort to the Fed but after the strong non-farm payroll is unlikely to put a January easing on the agenda. Early 2025 data will be crucial going forward. If the strength of early 2024 is not matched, yr/yr data will fall.

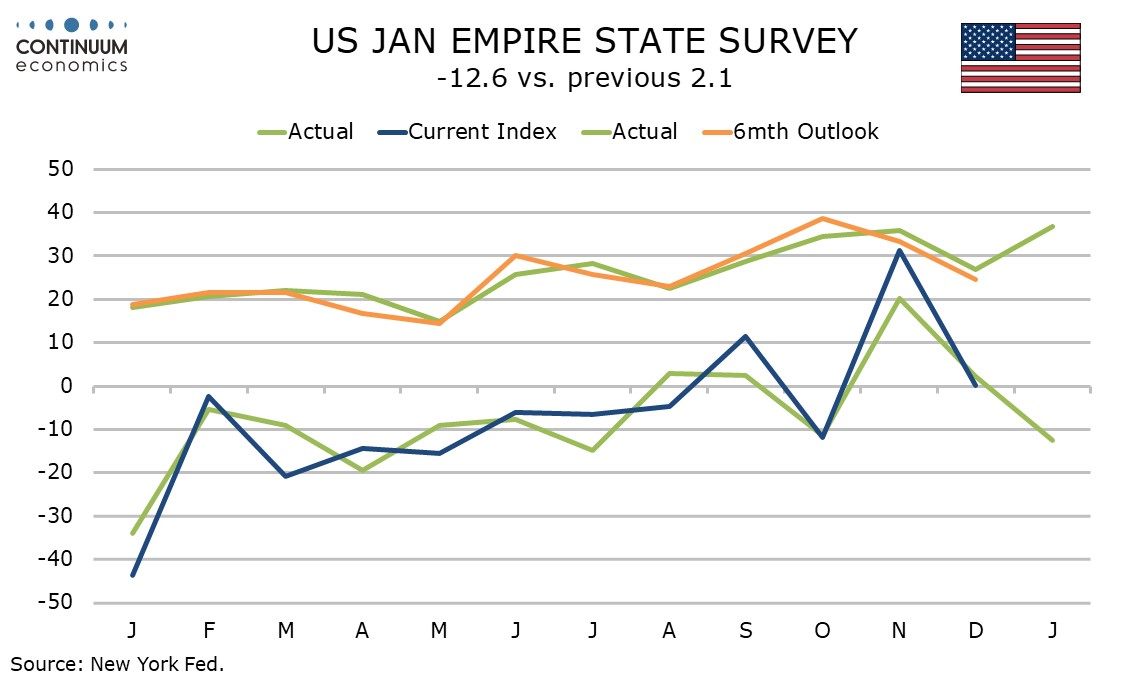

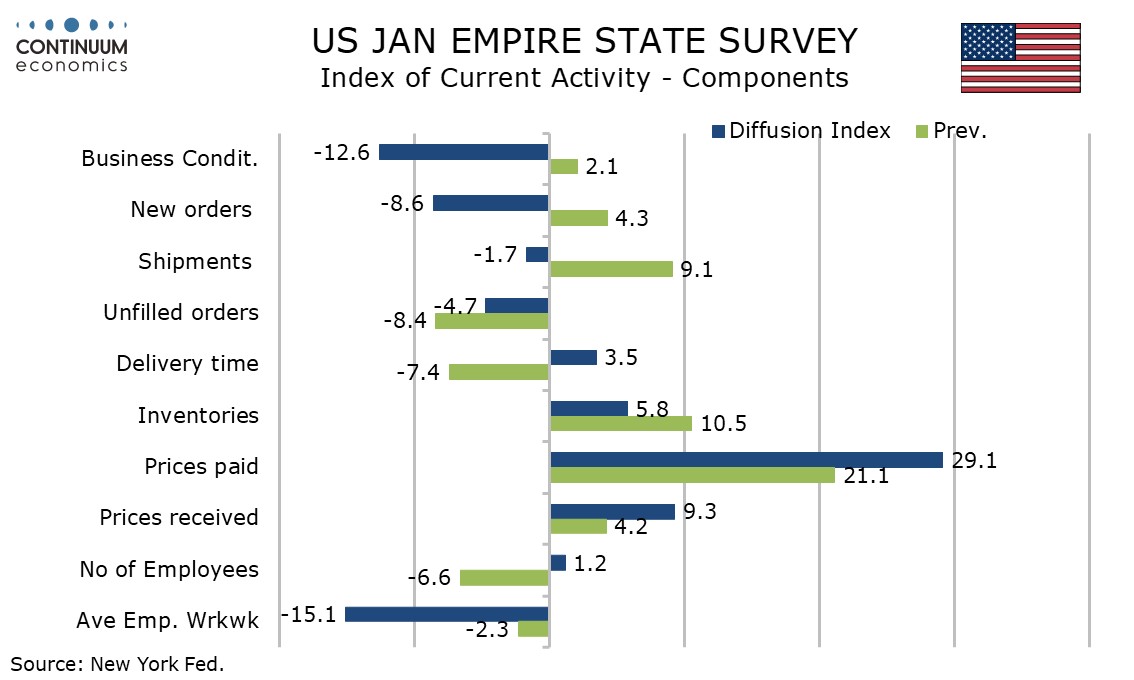

Price data in January’s Empire State manufacturing survey was quite firm, paid at a 9-month high of 29.1 from 21.1 and received at a 2-month high of 9.3 from 4.2.

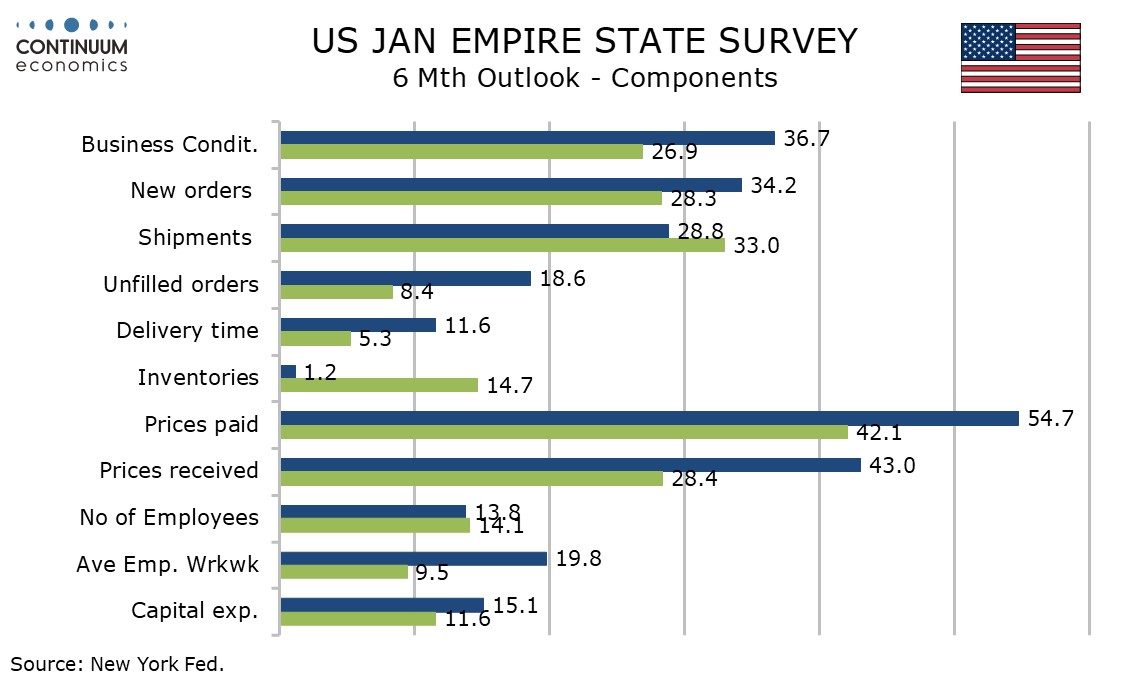

More significant were gains in 6-month price expectations, paid at 54.7 from 42.1 and received at 43.0 from 28.4 both the highest since December 2022.

The Empire State activity index of -12.6 from 2.1 was weak but the series is a volatile one. 6-month expectations at 36.7 from 26.9 are the highest since December 2021.