FOMC Preview for March 19: No change and few clear signals given exceptional uncertainty

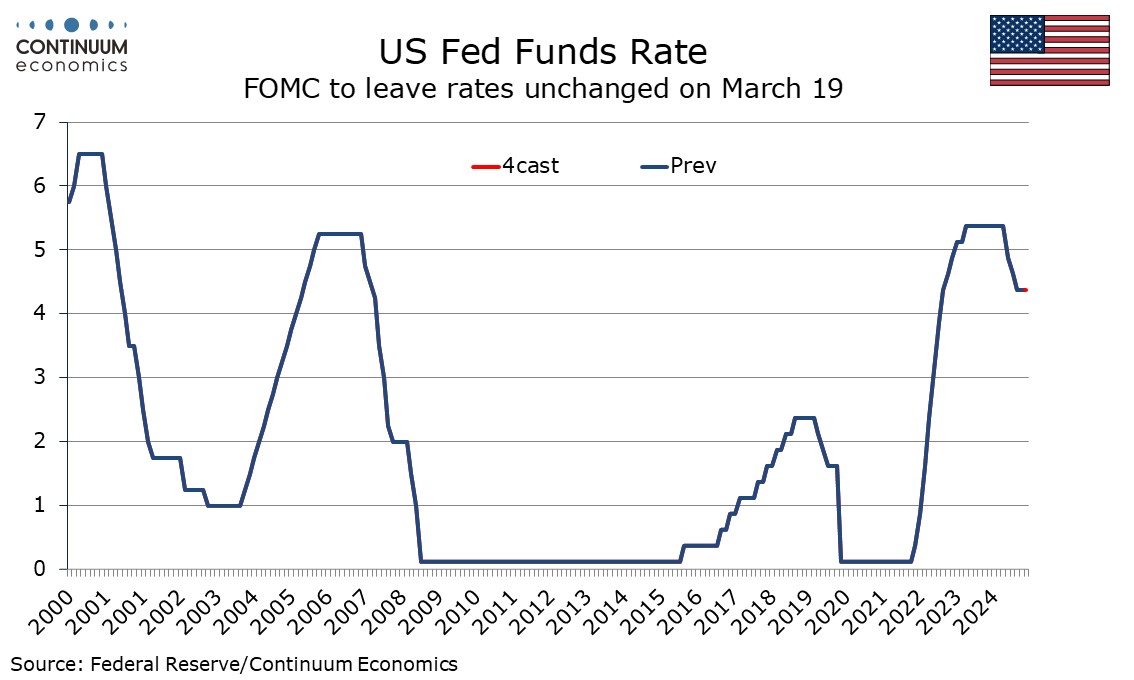

In the current exceptionally uncertain environment, the FOMC looks set to keep rates unchanged at 4.25-4.5% at its March 19 meeting, and give little away on future policy. The dots will be closely watched but we expect they will change little from January 29. Powell is likely to stress at the press conference that policy will be responsive to incoming data and the dots should not be seen as a plan.

Given that the FOMC will not feel able to give any clear signals on future policy, they will be cautious about making any strong changes to the economic assessment delivered on January 29. However, its opening, that “recent indicators suggest that economic activity has continued to expand at a solid pace” may be too positive to simply repeat, though the FOMC will not want to suggest that hints in data that Q1 GDP will be weaker signals more than short term weakness. That labor market conditions remain solid and that inflation remains somewhat elevated remains accurate. If they downgrade the economic assessment somewhat, they may note rising inflationary risks too. They are likely to continue seeing risks as balanced and leave phrasing regarding future policy decisions unchanged.

However, it is possible the pace of Quantitative Tightening will be reduced. Minutes from January 29 showed that various participants noted that it may be appropriate to pause or slow balance sheet runoff until uncertainty over the debt ceiling was resolved, given potential for significant swings in reserves on the issue.

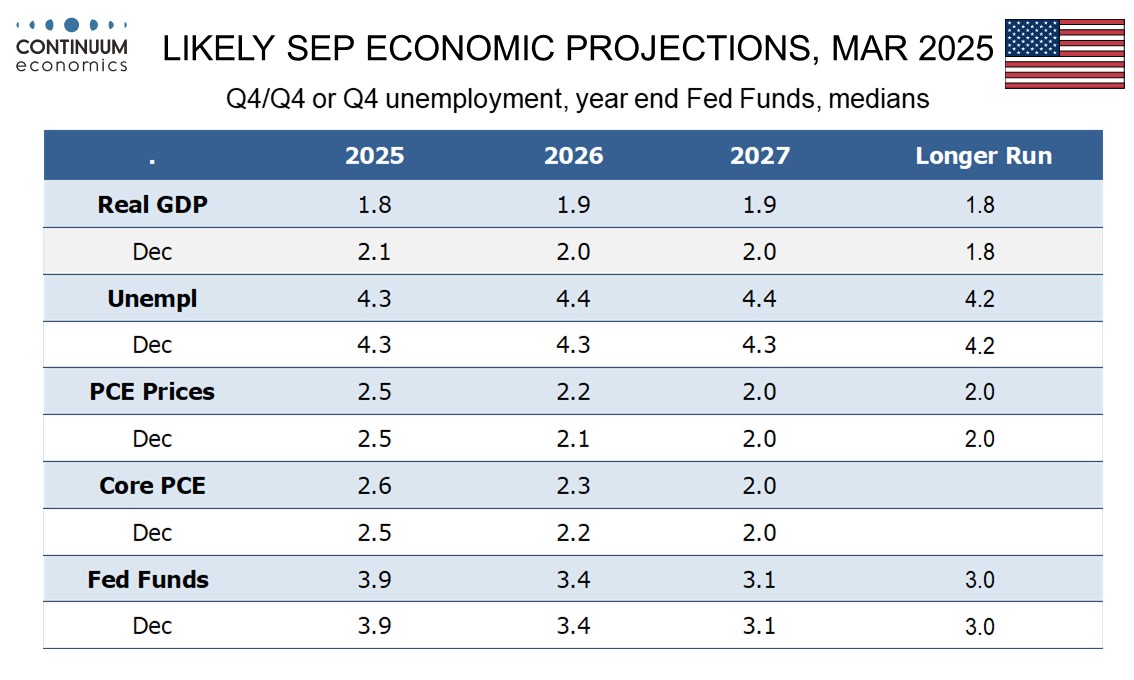

In January the dots looked for 50bps of easing in 2025, 50bps more in 2026 and 25bps in 2027, which would take the Fed Funds target to 3-3.25%, close to the 3.0% rate seen as neutral. We expect that the dots will remain similar to that but the ranges could increase. GDP forecasts may however reflect an increase in downside risk while inflation forecasts may reflect an increase in upside risk, both due largely to tariffs. While the risks to the economy from tariffs are clear, Powell at his press conference will try to stress uncertainty rather than directly criticizing President Trump’s policies. We do not expect easing to be seen until Q4, given that we expect Q2 data to see a tariff-led acceleration in inflation and a rebound in growth after some temporary negatives in Q1. The Fed however will want to leave their options open rather than give a clear prediction on policy based on a data forecast.