India CPI Review: CPI Cools but Target Not in Sight

India’s retail inflation eased to a four-month low of 5.22% in December 2024, driven by a seasonal decline in food prices, particularly vegetables and cereals. With inflation within the RBI’s target range, all eyes are on the upcoming monetary policy review for potential rate cuts.

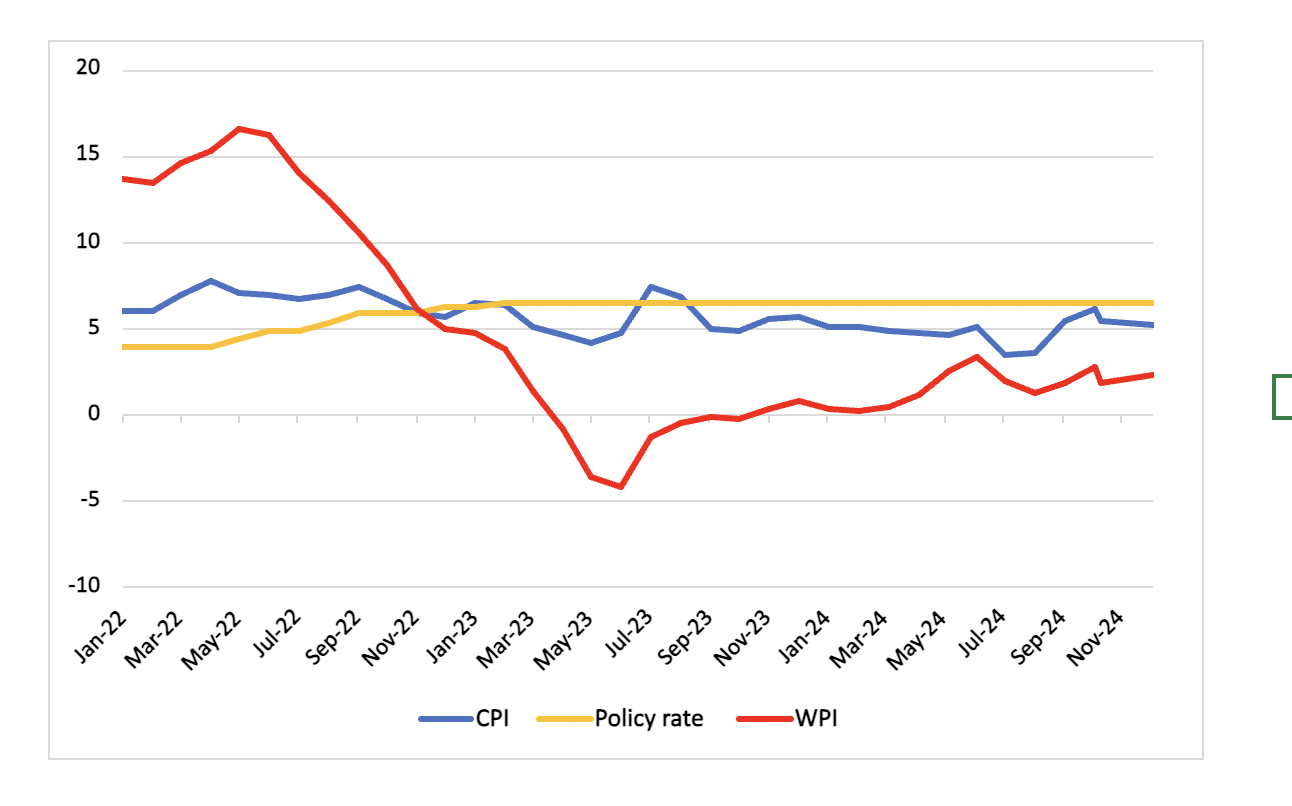

Figure 1: India Consumer Price Inflation and Policy Rate (%)

Source: MOSPI, Reserve Bank of India, Continuum Economics

India’s retail inflation, measured by the Consumer Price Index (CPI), fell to 5.22% yr/yr in December 2024, down from 5.48% in November. This marks a four-month low, driven primarily by a seasonal drop in food prices. The Consumer Food Price Index (CFPI) rose by 8.39% y/ryr in December, compared to 9% in November. The easing was driven by improvements in prices of vegetables, cereals, and pulses given the arrival of new produce to the wholesale market. But it is worth noting, that despite these improvements, persistent high food prices, especially for staples like potatoes, remain a challenge.

Inflation showed regional variations, as well. In rural areas, inflation stood higher at 5.76%, reflecting higher price pressures in these regions. Meanwhile, urban areas showed a lower rate of 4.58% was recorded, benefiting from better supply chain efficiencies and seasonal corrections.

The dip in inflation raises hopes for potential monetary easing by the Reserve Bank of India (RBI). However, global uncertainties, a depreciating rupee, and volatile commodity prices could temper expectations. The central bank is likely to tread cautiously, balancing inflation control with economic growth. RBI’s medium-term target for CPI inflation is 4%, within a band of ±2%. With inflation now within this range, policymakers may face fewer pressures to maintain a restrictive stance. While the current trends suggest that food inflation may continue to ease, supported by a robust rabi harvest, uncertainty looms over global trade dynamics and energy prices. The rupee's depreciation could impact imported inflation, especially for oil.

India's retail inflation trajectory will remain under close watch, as it holds the key to future policy decisions and the broader economic outlook. For now, we maintain our forecast of a 25bps cut in the upcoming meeting by the RBI in February.