FOMC Preview for December 18: A Cautious 25bps Easing

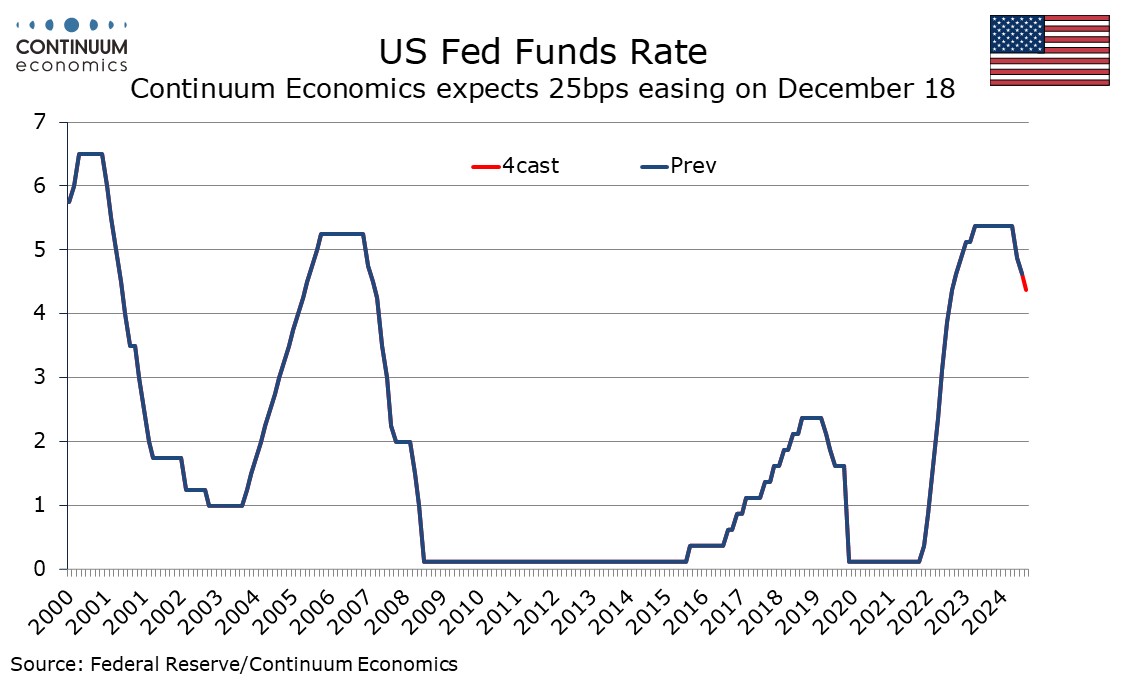

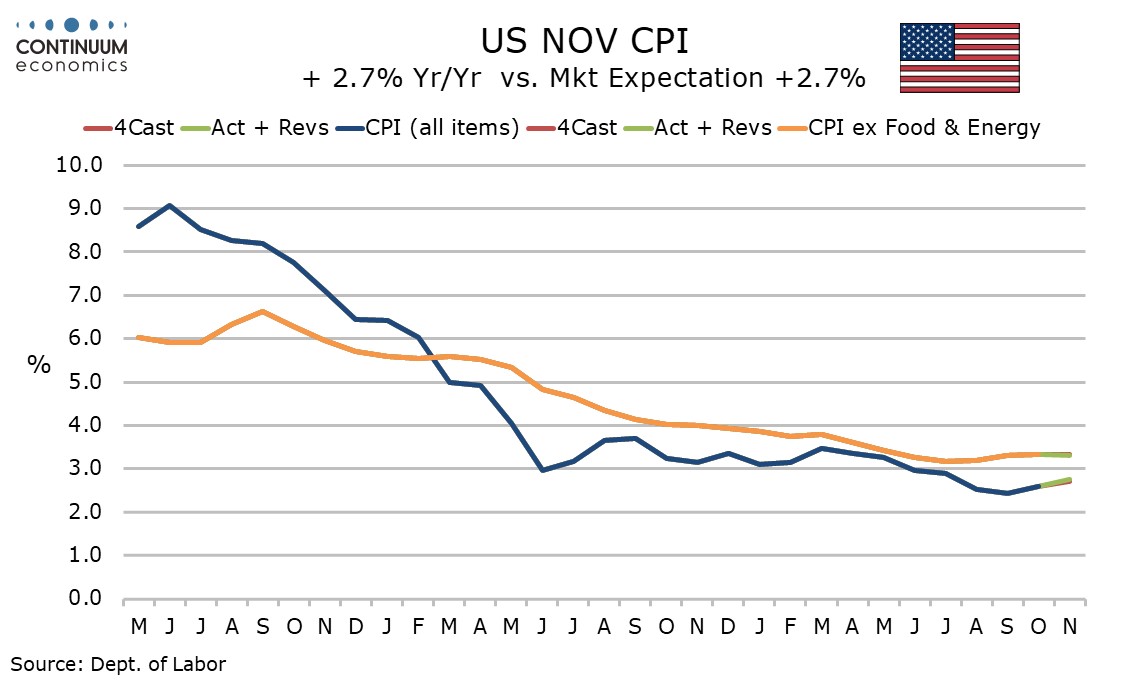

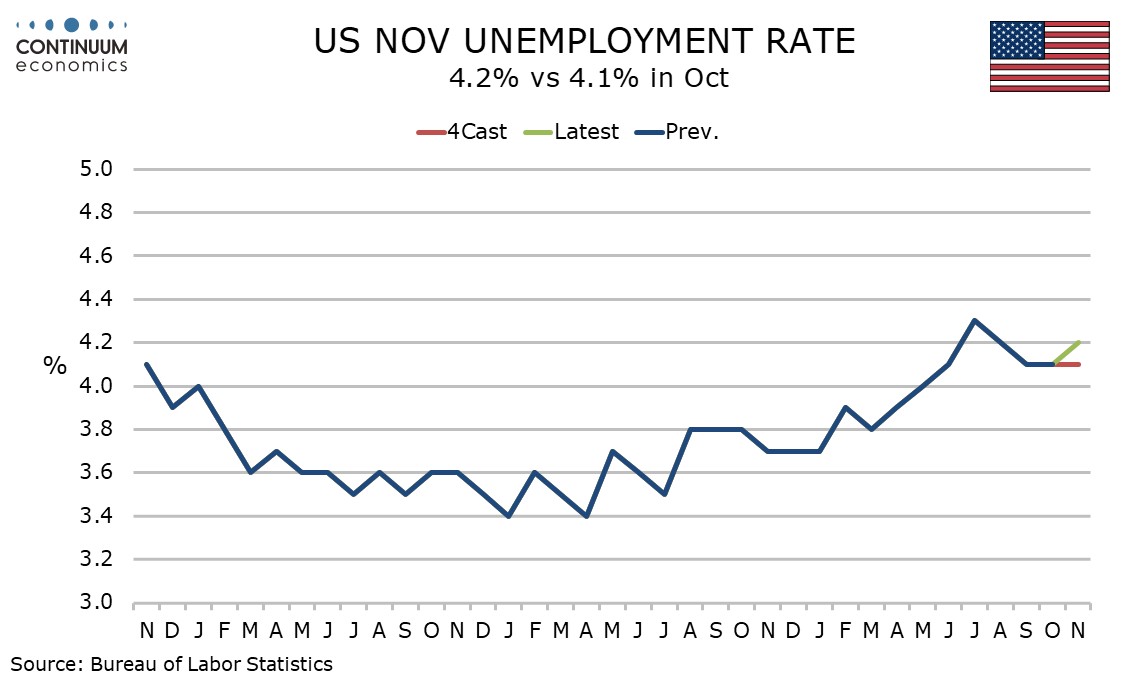

The FOMC meets on December 18 and we expect a 25bps easing to a 4.25-4.5% range. Fed commentary has generally suggested that rates are moving lower while cautioning against assuming easing at any meeting is a done deal. Absence of major surprises in recent employment and CPI data probably clears the way for a 25bps move, but the Fed is likely to suggest that the pace of easing is likely to be more cautious in 2025.

The decision

The FOMC is likely to have a genuine debate between a 25bps move and a pause, and a dissenting vote from an easing decision is possible, most likely from Governor Michelle Bowman, who dissented against September’s 50bps move, preferring 25bps. A 25bps move would be consistent with the median in September’s dots, but then nine out of 19 respondents were higher than the median, and only one below.

The dots

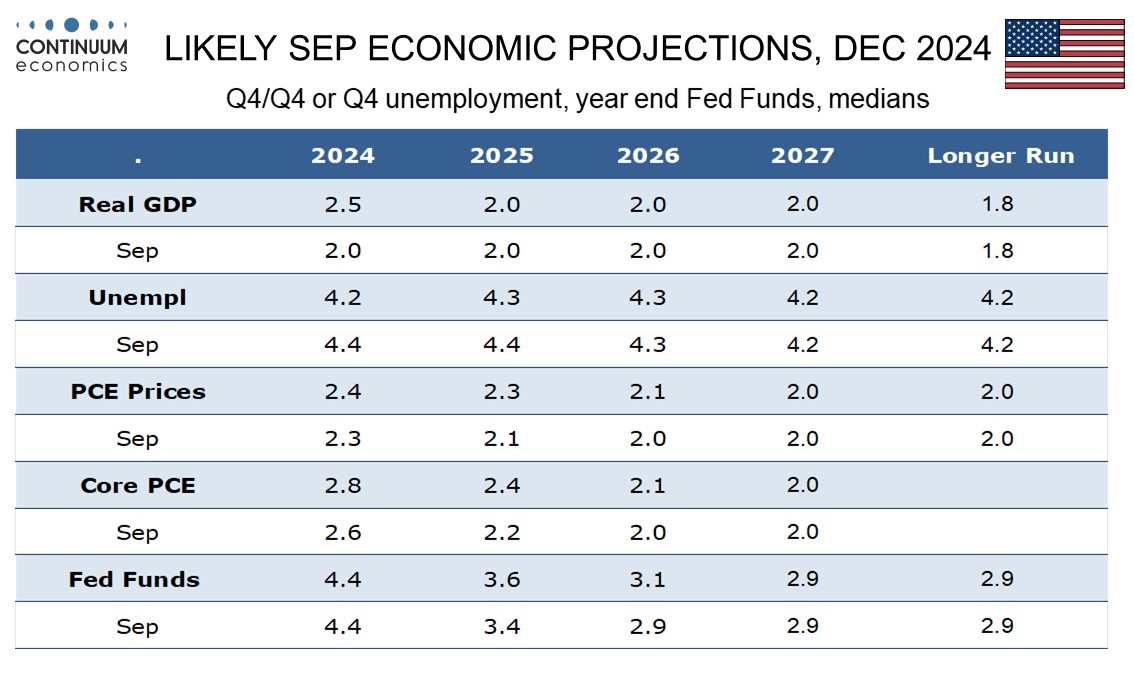

We expect the median dots for end 2025 and end 2026 policy to be revised marginally higher, by 25bps each to 3.625% and 3.125% respectively, thus implying 75bps of easing in 2025 and 50bps in 2026, while leaving 2027 and the long-run neural rate unrevised at 2.875%. Recent data suggests economic forecasts for end 2024 will look stronger than in September, GDP significantly so at 2.5% Q4/Q4 rather than 2.0%, while unemployment will be seen at 4.2% rather than 4.4%. We expect core PCE prices to be seen at 2.8% yr/yr in Q4 2024 rather than 2.6%. Revisions to forecasts for 2025 through 2027 will probably be small, but we expect 2025 unemployment to be revised marginally lower and core PCE prices to be revised marginally higher for 2025 and 2026, reaching the 2.0% target in 2027 rather than 2026.

We would not give strong weight to the dots as a predictor of policy given uncertainty over policy under the incoming Trump administration. Higher budget deficits from tax cuts and tariffs would however raise inflationary risk, and mean risk for a more hawkish Fed trajectory than seen in the dots, but the Fed will not assume any major policy changes until they are implemented.

The statement

The statement could see some fine tuning in a hawkish direction to reflect recent signs of stabilization of an uptrend in unemployment and a downtrend in inflation, though we doubt the statement will clearly state that unemployment is no longer rising or that inflation is no longer falling. For inflation Q1 2025 data will be crucial, with strong year ago data due to drop out. The FOMC is unlikely to repeat that it has gained greater confidence that inflation is moving sustainably toward 2% but is likely to state that it still believes it is doing so. They will probably repeat that risks to achieving its employment and inflation goals are roughly in balance, but downside risks to employment appear to have reduced while inflation risks have not changed much, meaning that the word roughly has become increasingly necessary.

The press conference

The statement will probably avoid giving hints on future policy, but Chairman Jerome Powell at the Press conference will probably suggest that future easing will be done cautiously, and dependent on incoming data. This could suggest a likely trajectory of 25bps in easing per quarter in early 2025, though he will not want to suggest that is a plan, with more possible should data come in weak and less possible should data come in strong.