U.S. Treasuries: Economy v Foreign Investors

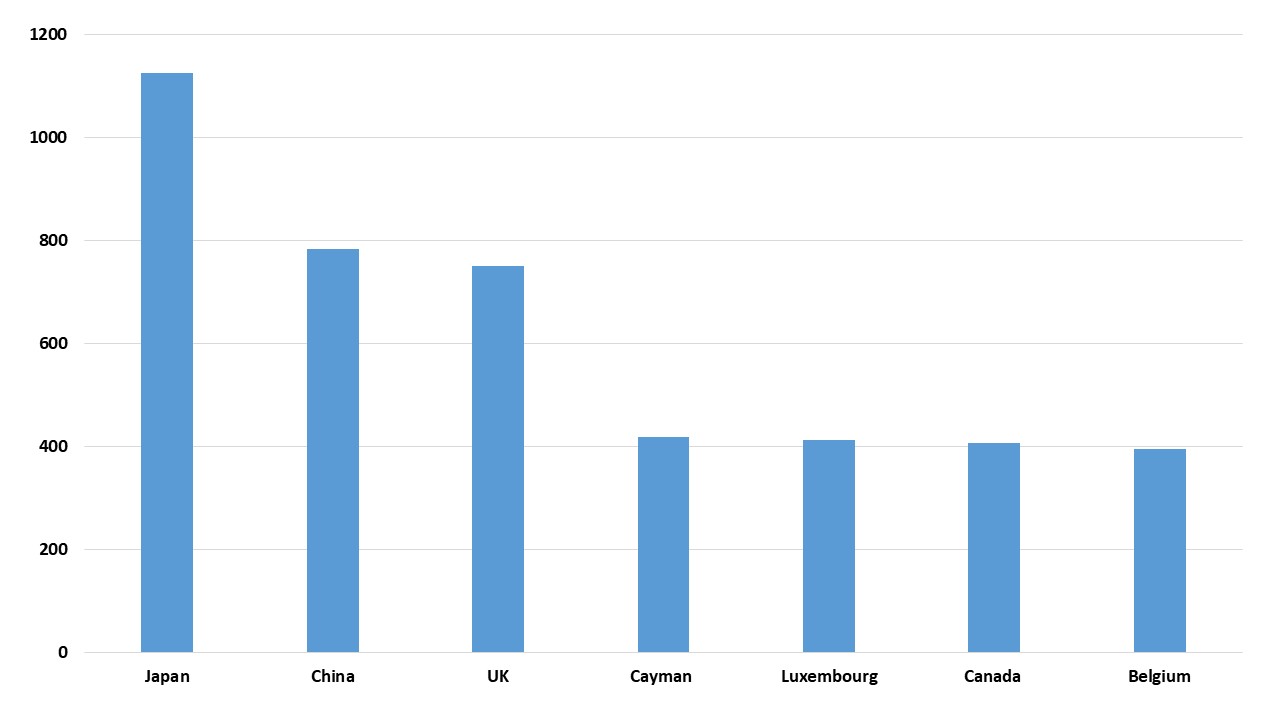

We have not revised down our baseline for 10yr yields (Figure 1) in 2025 and have pushed forecasts up 10bps in 2026. We are concerned that foreign investors will be less willing to buy extra U.S. Treasuries. Nevertheless, the economic slowdown, plus expectations that the CPI boost will be a temporary 2025 phenomena, will likely cap 10yr yields and a central band of 4.00-4.50% could be formed. If a recession is seen, that cyclical economic and Fed easing would dominate and we can see 10yr yields down to 3.25% in this scenario.

Figure 1: Fed and 2 and 10yr U.S. Treasury Yield Forecast (%)

Source: Continuum Economics

We have fine tuned our 2yr yield forecast lower by 10bps (Figure 1), despite only forecasting one 25bps cut in 2025 and a further 75bps in 2026. The risk of a recession in the U.S. is now higher than at the time of the March Outlook, as the average effective tariff under the Trump administration tariffs are set to be larger than we assumed. Though we expect a truce and reduction in current tariff rates with China, we look for 15% on average. Meanwhile, the erratic announcements, threats and partial U turn create policy uncertainty that is a further headwind to the economy. We now attach a 35% probability to a U.S. recession in the next 12 months.

Anecdotal reports suggest that a supply shock will likely hit U.S. production in the coming weeks, with a sharp fall in U.S./China trade due to the super high tariffs. Consumption will also be critical to watch, though the expectations is that importers will use inventories and this may mean that the hit to consumption comes through later in Q2. The April numbers released through May could be volatile, but we may have to also wait for the May data to get a better picture of the economic hit and the rise in CPI/PCE inflation. This leaves the Fed and market in limbo, with the first Fed cut not discounted until the July 30 meeting.

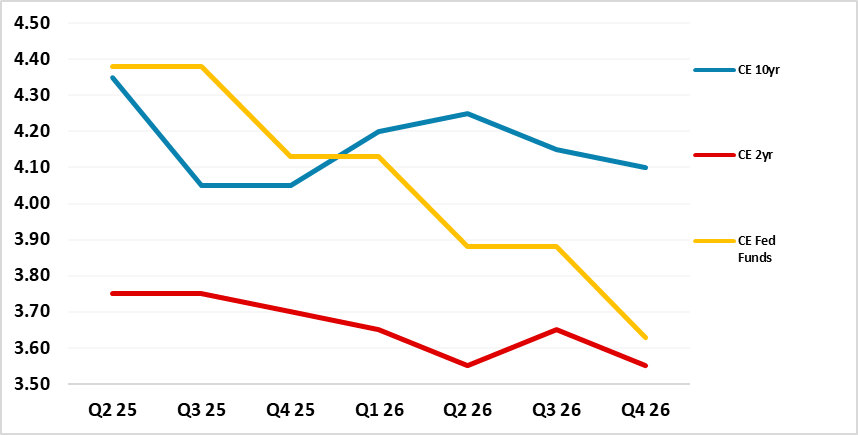

2yr yields will likely remain at a discount to the Fed Funds rate in 2025, but also now in 2026. We see congress only passing a 10yr budget bill that is neutral to mildly contractionary, due to deficit opposition from the GOP freedom caucus. If the U.S. monthly inflation jump eases in the inflation numbers for H2, then this can set up easing for 2026 and leave the market biased to easing towards a neutral policy rate. A recession would likely speed up Fed easing, as the market would expect a rapid move in the Fed Funds rate to the 2-3% area and this can keep a clear discount in the 2yr-Fed Funds rate (Figure 2).

Figure 2: 2yr U.S. Treasury to Fed Funds and Inverted Fed Funds (%)

Source: Datastream/Continuum Economics

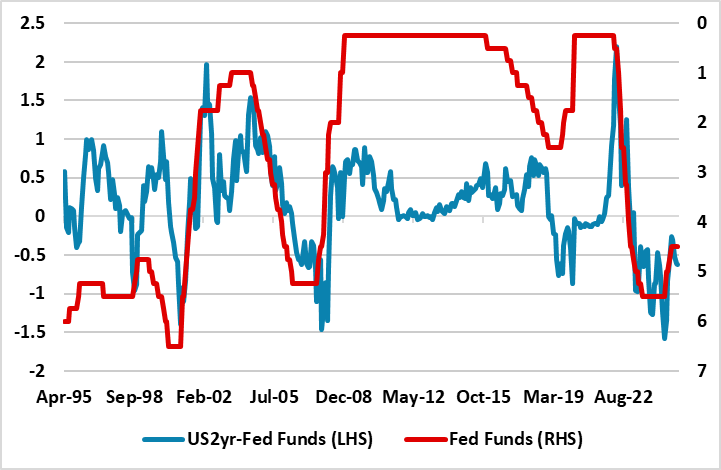

However, we have not revised down our baseline for 10yr yields (Figure 1) in 2025 and have pushed forecasts up 10bps in 2026. We are concerned that foreign investors will be less willing to buy extra U.S. Treasuries (here). This is a big issue, as the 12mth cumulative increase in the U.S. Treasury TICS data was USD817bln to Feb 2025. Country holdings are dominated by Japan and China (Figure 3), with Japan MOF data suggesting Japanese funds sold global debt market in the first half of April. The tariff war has created a stagflation shock to the U.S. Treasury market, but structurally foreign investors are also concerned with the adverse and erratic nature of trade policy. Additionally, Trump U turn on sacking Powell, does not stop discussion on when and how Trump will try to undermine Fed independence. This all argues for an extra risk premium for foreign investors in terms of U.S. real yields or a lower USD (we look for 1.20 on EUR/USD by end 2025) and also less net inflows.

Figure 3: Foreign Countries Holdings of U.S. Treasuries (USD Blns)

Source: BEA Tics (Feb 2025 release)

Nevertheless, the economic slowdown, plus expectations that the CPI boost will be a temporary 2025 phenomena, will likely cap 10yr yields and a central band of 4.00-4.50% could be formed. If a recession is seen, that cyclical economic and Fed easing would dominate an we can see 10yr yields down to 3.25% in this scenario. However, long-term foreign holders could use this an opportunity to reduce the stock of U.S. debt being held, unless the Trump administration does a major U turn on remaining reciprocal and product tariffs across all countries.