Indonesia CPI Review: Food Price Pressures Ease

Easing food inflation saw headline CPI decline to 2.12% yr/yr in August. Nonetheless, price pressures from a weakening IDR persist. Bank Indonesia will likely hold rates till Q4-2024.

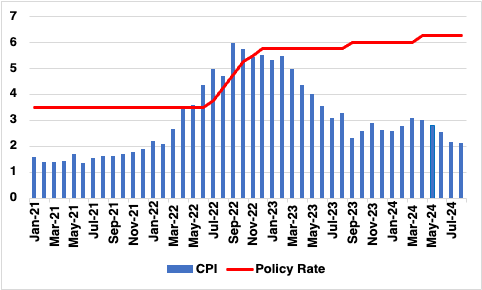

Figure 1: Indonesia Consumer Price Inflation and Main Policy Rate (%)

Source: Continuum Economics

Indonesia's consumer price index (CPI) eased to 2.12% yr/yr in August, down marginally from 2.13% in July, marking the lowest inflation rate since February 2022, according to data released by Statistics Indonesia (BPS). The figure remains comfortably within Bank Indonesia’s inflation target band of 2.5% ± 1%, underscoring the ongoing deflationary pressures within Southeast Asia's largest economy. On a monthly basis, consumer prices edged down 0.03% in August.

The slight slowdown in annual headline inflation was largely driven by a moderation in price growth for food, beverages, and tobacco, which saw inflation drop to 3.39% in August from 3.66% in July. Other categories contributing to the deceleration included health (1.72% vs. 1.77%), education (1.83% vs. 1.90%), and restaurants (2.24% vs. 2.28%). Out of 11 categories tracked by BPS, inflation slowed in four, remained unchanged in two, and accelerated in the remaining five.

Food prices remain the primary driver of inflation, contributing 0.96 percentage points to the overall headline figure, followed by personal care and restaurants, which added 0.37 and 0.23 percentage points, respectively. Lower food prices were the key factor behind the recent slowdown, with staple items such as rice, corn, and chilli seeing significant price declines due to a strong harvest season in July and August. This seasonal effect, coupled with falling production costs for some food items, has helped tame inflationary pressures.

The modest inflationary pressures and adherence to the central bank's target range provide Bank Indonesia with ample room to maintain its accommodative monetary policy stance, balancing the need to support economic growth while keeping price stability in check. A rate cut is expected only towards the end of the year, in our view; a 25bps rate cut in Q4.