Turkiye’s Inflation Hits 75.5% in May

Bottom Line: Turkish Statistical Institute (TUIK) announced on June 3 that Turkish CPI ticked up 75.5% annually and 3.4% monthly in May due to increases in education, housing, restaurant & hotel prices. We foresee favourable base effects, tightened monetary and fiscal policies, additional macro prudential measures, and relative Turkish Lira (TRY) stability will likely start relieving the pressure on the inflation, likely after June.

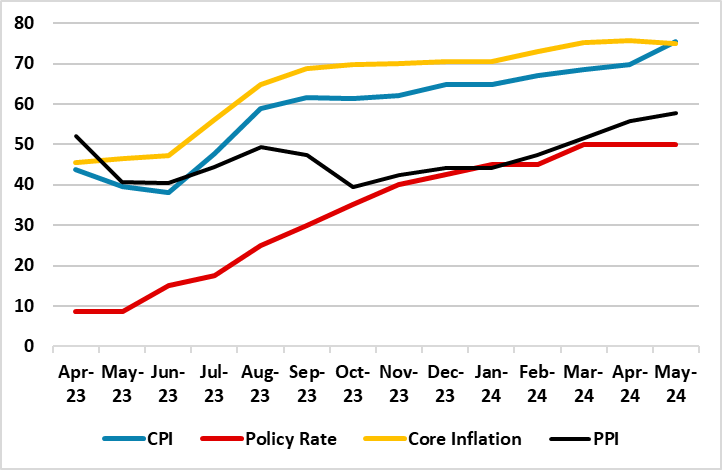

Figure 1: CPI, PPI, Core Inflation (YoY, % Change) and Policy Rate (%), April 2023 – May 2024

Source: Continuum Economics

When annual rate of changes (%) in the CPI’s main groups are examined in May, clothing and footwear with 50.9% was the main group with the lowest annual increase while education recorded the highest annual increase with 104.8%. It is worth mentioning that housing (93.2%), hotels, cafes and restaurants (92.9%) also recorded remarkable YoY increases.

Core inflation (CPI-C) recorded a strong 3.6% MoM increase, scaling up to 74.9% on an annual basis. 3.4% MoM surge in May was higher than in March and April, which both recorded 3.2% increase. The domestic PPI was up 2.0% MoM in May for an annual rise of 57.7%, the data showed.

Despite galloping inflation, Turkish policy makers remained positive in curbing inflation soon. Treasury and Finance Minister Mehmet Simsek said on June 3 that "The worst is over. The transition period in the fight against inflation is completed, we are entering the disinflation process." Central Bank of Republic of Turkiye (CBRT) Governor Karahan stated in May that the disinflation trend is expected to start in June, and CBRT would do whatever it takes to avoid any lasting deterioration in inflation as it maintains a tight monetary policy stance. (Note: According to CBRT’s second quarterly inflation report of the year which was released on May 9, CBRT increased its year-end inflation forecast to 38% from 36%. CBRT’s forecast for end-2025 remained unchanged at 14%, while inflation is seen falling to 9% by the end of 2026).

Despite inflation probably peaked in May before favourable base effects will help the inflation to plummet after June, as relative TRY stability after April also underpins the expected inflation relief. (Note: TRY lost around 9% of its value against U.S. Dollar in 2024).

In addition to this, CBRT’s return to traditional economic policies continue to draw interest from foreign investors as they are ramping up exposure to Turkish local bonds and credit default swaps. Turkish stocks rose by 30% in USD terms in 2024 and TRY bonds absorbed $6.5 billion of foreign capital in May. Additionally, CBRT’s net reserves are at the highest level since December 2023.

Despite mentioned positive developments, we still see upside risks to the inflation outlook due to geopolitical risks, possible minimum wage and pension hikes in July and updates to taxes. We also think buoyant domestic demand, stickiness in services inflation, deterioration in pricing behaviour, and strong inflation expectations continue to cause pressure on the general level of prices despite aggressive monetary tightening.