USD, AUD, NZD, JPY, GBP flows: Risk positive moves overnight, JPY weak, GBP a focus today

NZD and AUD gain on RBNZ, higher Australian CPI and risk positive market tone. JPY weakness on the crosses looks overdone. GBP in focus ahead of UK Budget

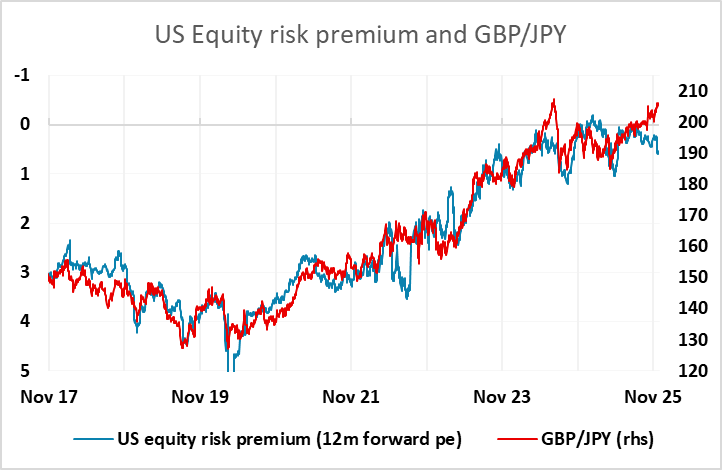

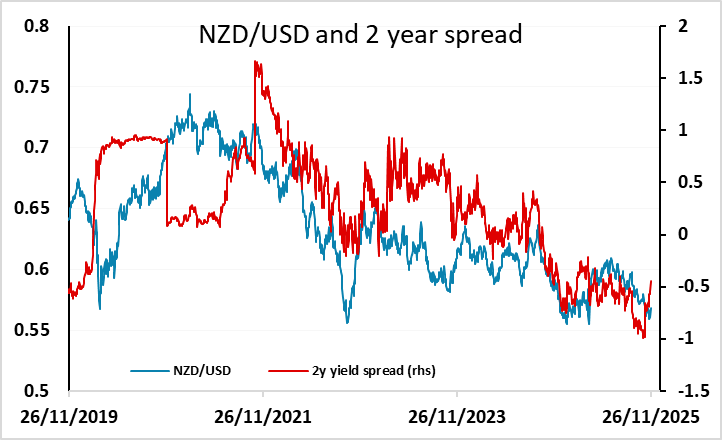

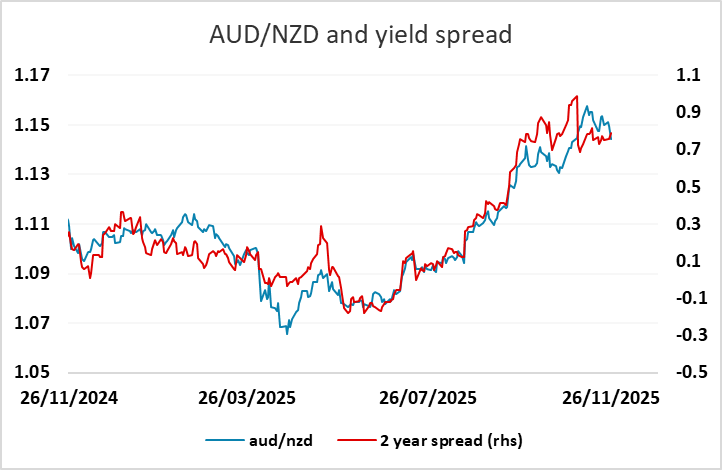

The risk positive tone seen in Asia is extending in early Europe, with the JPY continuing to fall on the crosses while the USD makes a slight recovery across the board after losses in Asia. The NZD was the best performer overnight as the RBNZ cut rates but indicated not further cuts were planned, triggering a sharp recovery in the NZD as front end yields popped higher in response. However, the AUD was also strong helped by higher than expected October CPI, and the USD generally fell back against the riskier currencies after softer retail sales and PPI data on Tuesday which increased expectations of Fed easing and helped equities rally. The JPY has underperformed in the risk positive environment in spite of rising expectations of a BoJ rate hike in December, but JPY weakness on the crosses looks overdone as lower US yields in the last week mean that implied risk premia have risen in the last week, despite some decline overnight.

The focus in Europe will be on the UK Budget, which is due at around 12:30 GMT. In truth there are unlikely to be many surprises after copious leaks in recent days. There will be tax rises on medium to high earners, including higher property taxes, which will be intended to fund the current £20-30bn hole in public finances as well as some new increases in welfare spending. A BoE rate cut in December is priced as an 87% chance, so there is unlikely to be a big GBP reaction to the expected contractionary Budget based on rate expectations. There may be some confidence effects on GBP depending on how robust and reliable the tax changes are seen to be, and how front loaded they are. We still see most of the GBP risks as being n the downside, but the EUR/GBP highs above 0.8865 from earlier this month are unlikely to be challenged unless the Budget fails to fill the perceived fiscal hole.