ECB to Note Better Signs in Bank Lending Survey?

All and sundry wait as much for the what the ECB says tomorrow (Oct 17) than what it does (ie cut by another 25 bp). The consensus is that the Council will have to sound much more cautious about downside risks to both (its somewhat optimistic) growth outlook and its too pessimistic inflation picture. But amid acknowledgement of these risks, the ECB will be able to point to some brighter signs from its latest Bank Lending Survey (BLS). While still suggesting banks remain cautious about lending, the data suggested a clear improvement in the demand for loans (Figure 1) and very much reflecting an increasing perception that interest rates have started to fall and have further to go (Figure 2). On the consumer side, with households having built hefty savings afresh of late in reaction to higher interest rates, more signs of easing to come may start to unlock those savings and provide a much needed boost to demand – just as policy easing is supposed to do!

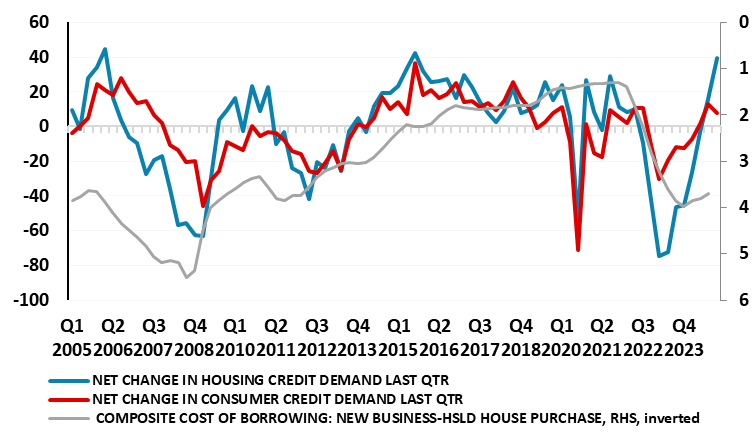

Figure 1: Household Loan Demand Recovering Strongly?

Source: ECB, net percentage balance in Bank Lending Survey. Note: Higher number equates to increase in demand

It seems puzzling to us that the ECB has started to note how its policy tightening may have acted to dampen the economy. In particular, the minutes to the (last) September Council meeting noted a marked rise in household savings, some that both consumer surveys and monetary data on deposits corroborates. The minutes suggested several factors that could be behind households’ increased caution and resulting savings. These included uncertainty about the geopolitical situation, fiscal policy, the economic impact of climate change and transition policies, demographic developments as well as the outcome of elections.

However, surely the main factor boosting the saving ratio is the high interest rate environment. While the elasticity of savings to interest rates was typically relatively low, the increase in interest rates since early 2022 had been very significant, coming after a long period of low or negative rates and where this tightening has been buttressed by unconventional policy moves too. Against this background, even a small elasticity implied a significant impact on consumption and savings. Given that surveys have been showing a gradual recovery in consumer confidence for some time (in step with lower inflation), this has occurred while perceived consumer uncertainty had been retreating. Therefore, the high saving rate was unlikely to be explained by mainly precautionary motives. It rather reflected ongoing monetary policy transmission, which could, however, be expected to gradually weaken over time, with deposit and loan rates starting to fall. although households that had not yet seen any increase in their mortgage payments would be confronted with a higher mortgage rate once their rate fixation period expired. This might be an additional factor encouraging a build-up of savings.

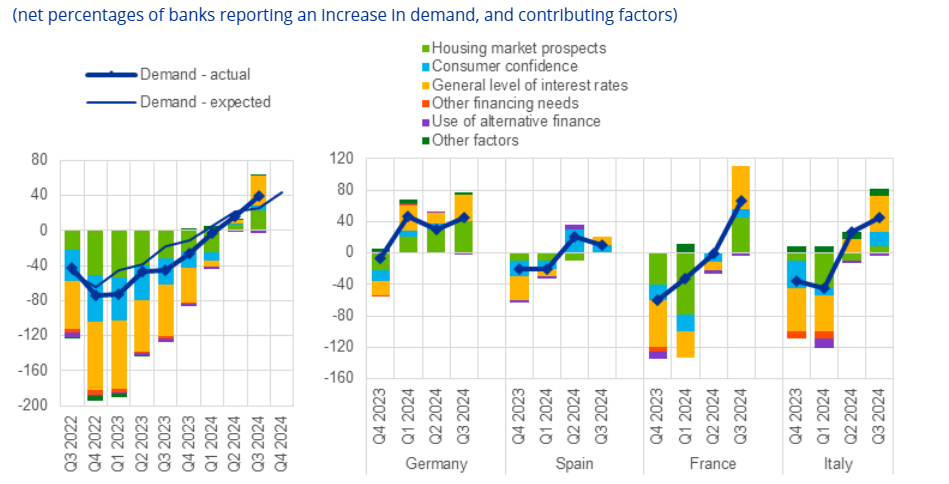

Figure 2: Household Loan Demand Reflecting Better Interest Outlook?

Source: ECB, Changes in demand for loans to households for house purchase, and contributing factors

But consumers may already be looking to brighter signs. The just-released October BLS noted that banks reported a strong net increase in the demand for housing loans, continuing the string and obviously inverse correlation between interest rates and credit demand. Indeed, net demand for housing loans increased further and more strongly than in the previous quarter, providing a further signal of the start of a recovery from the strong declines over the monetary policy tightening cycle. This was the highest net percentage increase since the second quarter of 2015 and was above banks’ expectations in the third quarter of 2024 (26%) and was broadly based across EZ countries. More notably it was riven primarily by a swing in interest rates sentiment (Figure 2). Importantly, the full imp act of recent tightening has yet to feed trough fully, but this does suggest that even the modest cuts to date and the prospect of more to come has started to have a tangible effect. Overall, risks to the economy continue to be biased to the downside, but some upside risks may now be emerging too!