Bank Indonesia Retains Rate Prioritises Rupiah

Bank Indonesia held its key interest rate at 6% to stabilise the rupiah and attract FX inflows, while maintaining interventions in the FX and bond markets. Inflation remains within target, and GDP growth forecasts are steady. Future rate cuts depend on US Federal Reserve actions. A 25bps cut is expected in Q1-2025.

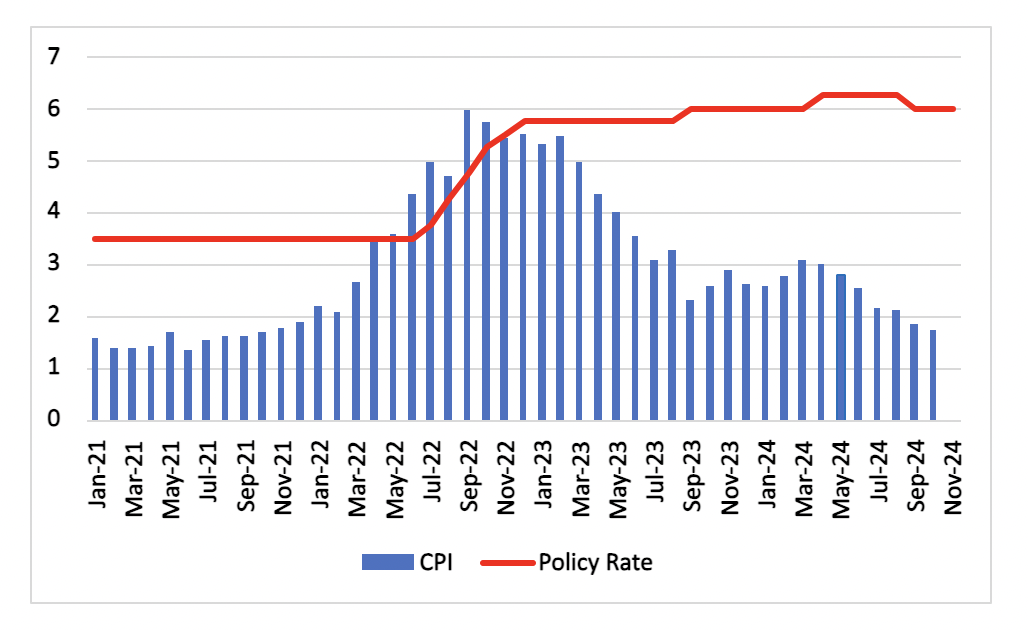

Figure 1: Indonesia Consumer Price Inflation and Policy Rate (%)

Source: Continuum Economics

Bank Indonesia kept its benchmark seven-day reverse repo rate steady at 6.00% in its November meeting, prioritising stability in the rupiah amid renewed pressures on emerging-market currencies. This marks the second consecutive meeting the central bank has opted to pause its rate-cutting cycle, despite easing inflation and slowing domestic growth. The decision was anticipated, especially given evolving geopolitics. The Indonesian central bank cited heightened geopolitical uncertainty and U.S. political developments, including Donald Trump’s election victory, as factors contributing to dollar strength and foreign portfolio outflows. The rupiah has lost nearly 5% against the dollar since mid-September, a decline that underscores Bank Indonesia’s sensitivity to external pressures.

Indonesia’s economic growth is projected at 4.7%-5.5% for 2024, with the central bank expecting an acceleration in 2025. Inflation, which has been steadily cooling, remains within target, offering some room for future easing. However, external headwinds have limited the central bank’s ability to act. BI Governor Perry Warjiyo’s acknowledgment of shifting global dynamics, including a narrowing window for U.S. Federal Reserve rate cuts, has further tempered expectations for near-term monetary easing.

Our expectation is that Bank Indonesia will resume rate cuts only when the rupiah stabilises, potentially delaying action until Q1 2025. With external uncertainties dominating the landscape, Bank Indonesia appears poised to adopt a cautious, wait-and-see stance before resuming its monetary easing cycle. We expect the next cut to come in Q1 2025, albeit a small 25bps cut only.