Preview: Due April 30 - U.S. Q1 GDP - A modest decline, but less steep than trade data implies

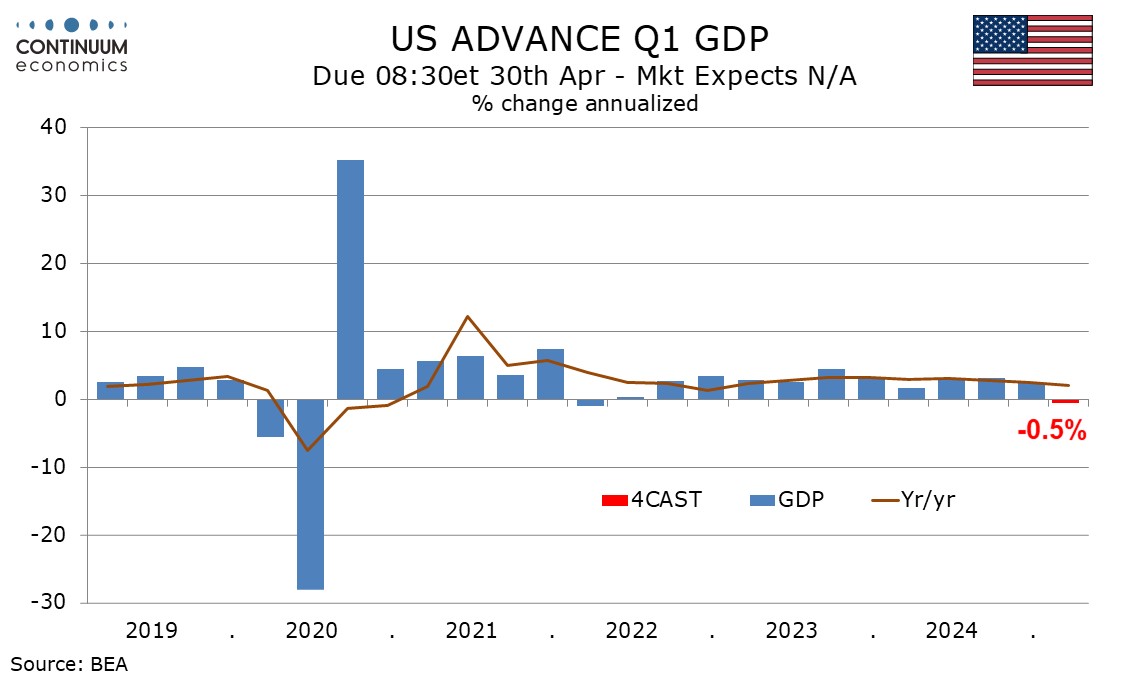

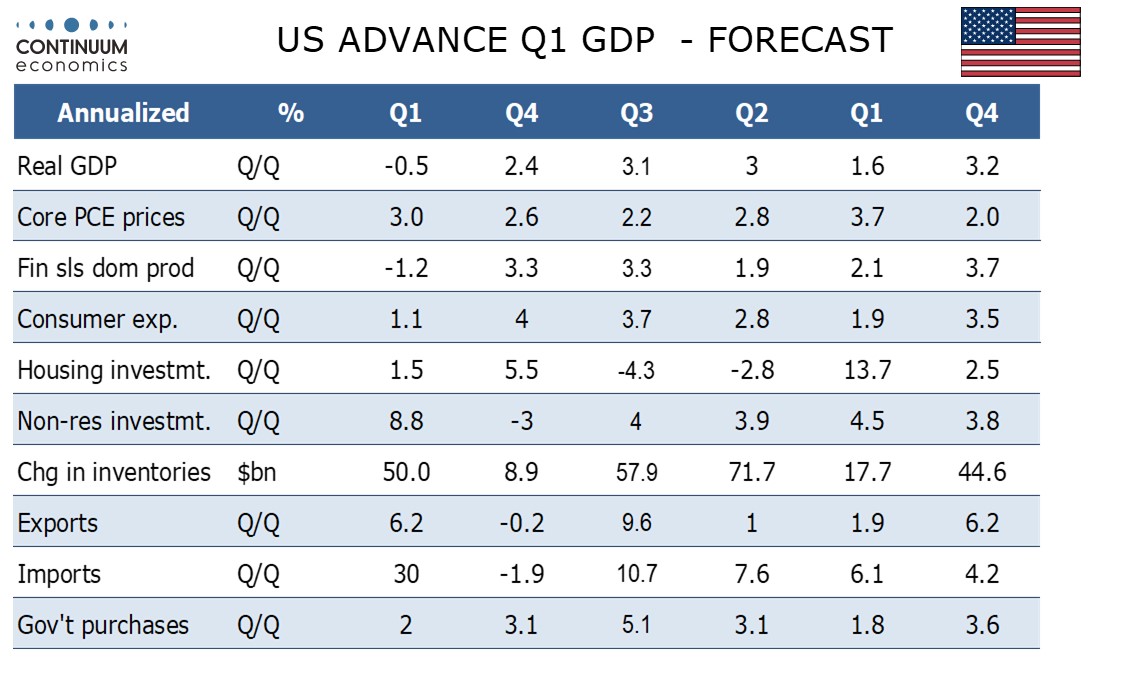

Q1 US GDP is subject to exceptional uncertainty with calculations based on the components suggesting a significant decline. The Atlanta Fed nowcast shows an annualized fall of 2.2% largely due to a surge in imports. However with non-farm payrolls showing a 0.5% rise in aggregate hours worked such a steep fall looks unlikely. We predict a modest GDP decline of 0.5%.

This would still be the first decline in GDP since Q1 2022, though Q2 2022 was also originally reported as a decline before being revised to a modest positive. Special factors, notably a pre-tariff surge in imports and bad weather will be behind the weakness in Q1 2025, though a rebound in Q2 is far from certain given the downside risks coming from tariffs.

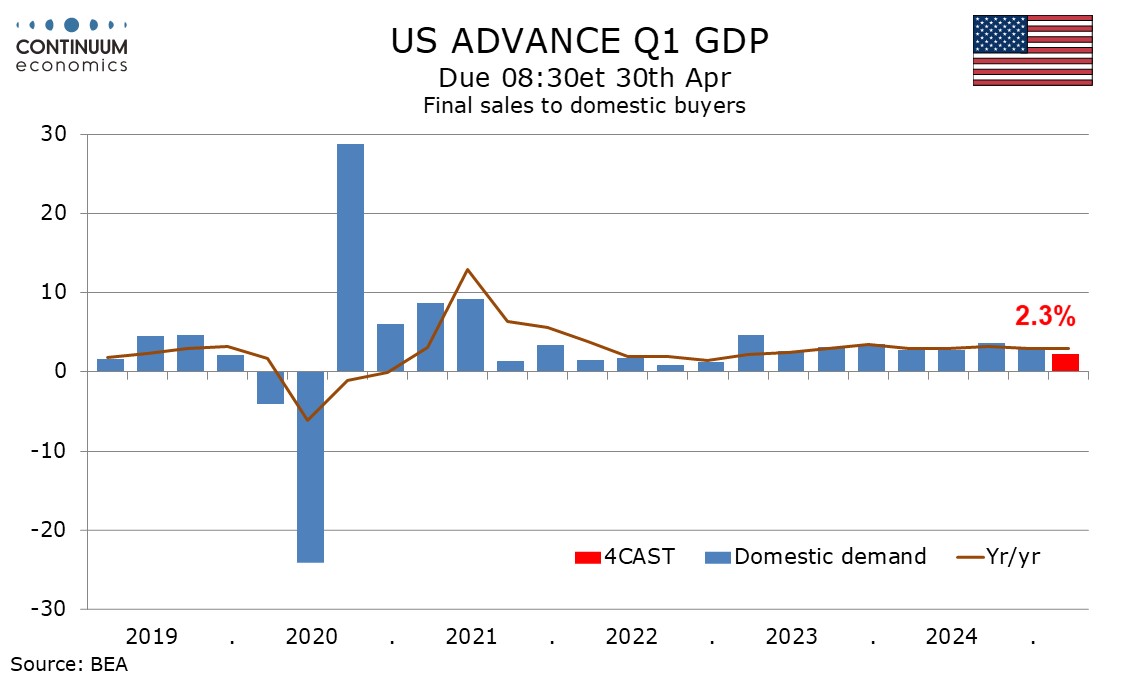

We expect final sales to domestic buyers (GDP less inventories and net exports) to rise by 2.3%, respectable if still the slowest since Q4 2022, but final sales (GDP less inventories) to fall by 1.2%. This would mean a steep negative of 3.5% from net exports but a modest positive contribution of 0.7% from inventories.

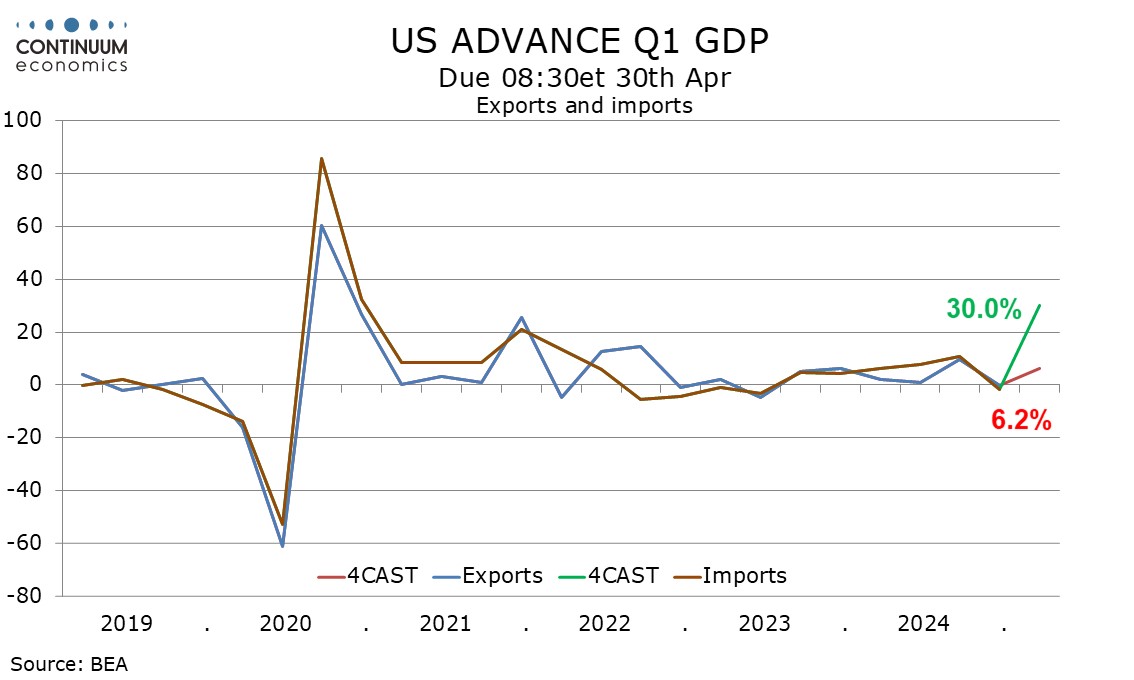

We expect a solid 6.2% rise in exports to be comfortably outweighed by a 30.0% surge in imports, though trade data suggests the imports surge could be at least twice as strong as that. Around half of the import surge came from finished metal shapes and nonmonetary gold which may not be reflected in GDP, though imports have clearly surged in an attempt to beat threatened tariffs and are likely to reverse sharply in Q2.

Usually a surge in imports, a negative in GDP arithmetic, is offset by gains elsewhere. Inventories are the most obvious source, but while inventories have picked up from a weak Q4 the inventory gain looks unlikely to be close to the negative coming from increased imports.

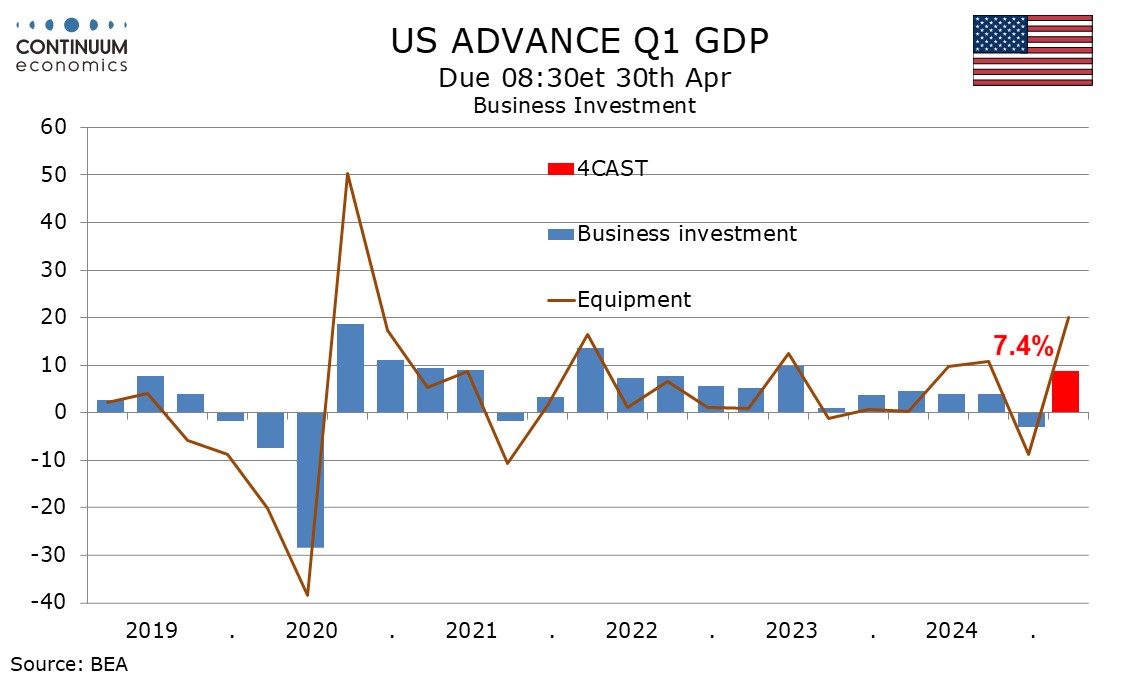

Business investment in equipment looks set to pick up sharply, and details of the imports surge suggests investment goods have been particularly strong. We expect investment in equipment to rise by 20.0% after a fall of 8.7% in Q4, that was depressed in part by a strike at Boeing. We expect overall business investment to rise by 8.8% after a 3.0% Q4 decline, with intellectual property up by 2.5% after a 0.5% Q4 decline but non-residential structures slowing to a 2.2% rise from 2.9%.

Construction spending looks mostly subdued in Q1, with housing investment, to 1.5% from 5.5%, and government, to 2.0% from 3.1%, also likely to see some slowing alongside private non-residential structures. The government slowing will be largely on state and local spending. DOGE cuts will impact only a small proportion of Federal spending.

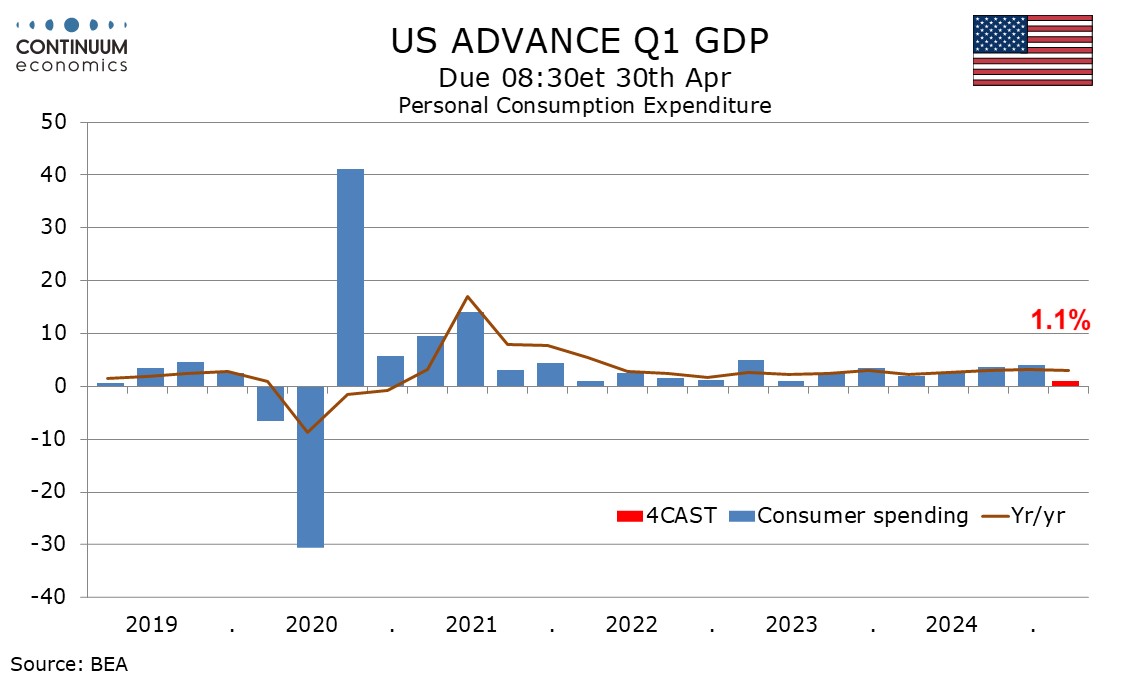

Consumer spending looks set to see a subdued quarter, rising by only 1.1%, with a dip in durables after a strong Q4 and only modest growth in non-durable goods and services. The weakness will be largely from weakness in January and to some extent February due to bad weather, with March set to see quite a strong month. The consumer spending gain will underperform what we expect will be a 3.2% increase in real disposable income, though the latter was flattered by temporary gains in government benefits, and looks unlikely to be repeated in Q2.

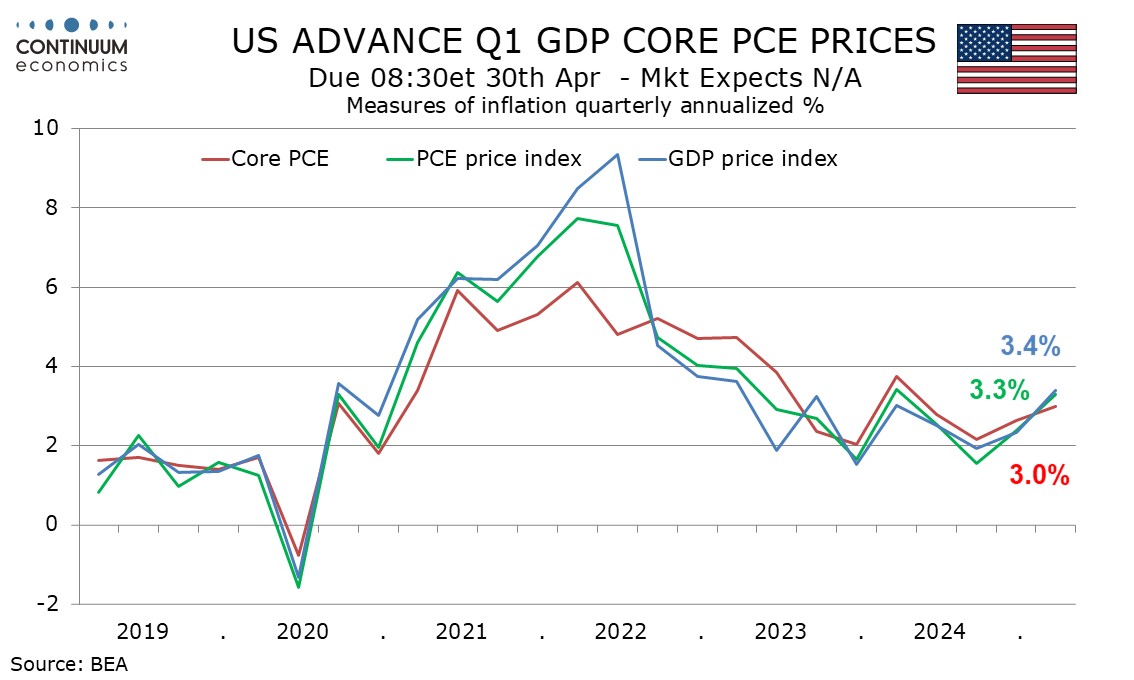

Price data will look quite firm, with a 3.0% rise in core PCE prices, a 3.3% rise in overall PCE prices and a 3.4% rise in the GDP price index, the latter supported by firmer export as well as consumer prices. Tariffs are an upside risk to prices in Q2, and that will be a downside risk for the economy.